Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - Trade Deficit and Mortgage Data

Stocks are higher today as markets look to break a 3-week losing streak. The Nasdaq is also looking to end a 7-day losing streak, the longest streak since 2016. Stock futures were lower initially as investors are now anticipating the Fed will hike interest rates by 75 basis points at the September meeting.

For economic data today, the U.S. trade deficit narrowed by 12.6% in July to -$70.6 billion, the 4th consecutive decrease. Exports increased 0.2% for the month, while imports fell by 2.9%. Imports reached the lowest level in 5 months.

MBA mortgage applications fell 0.8%, the 4th straight weekly decline. Both refinance and purchase activity were slightly lower. The report also showed that the average interest rate of a 30-year mortgage increased 14 basis points to 5.94%.

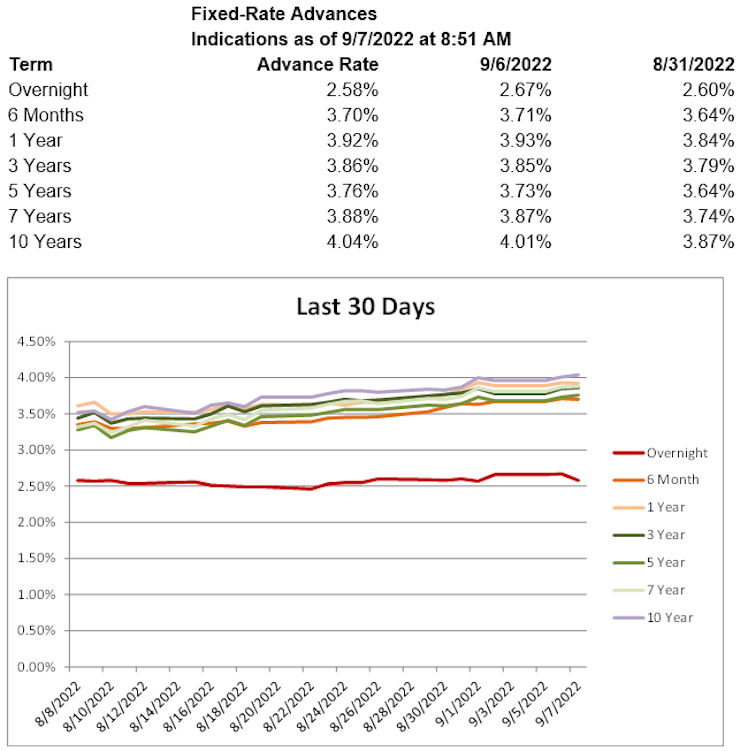

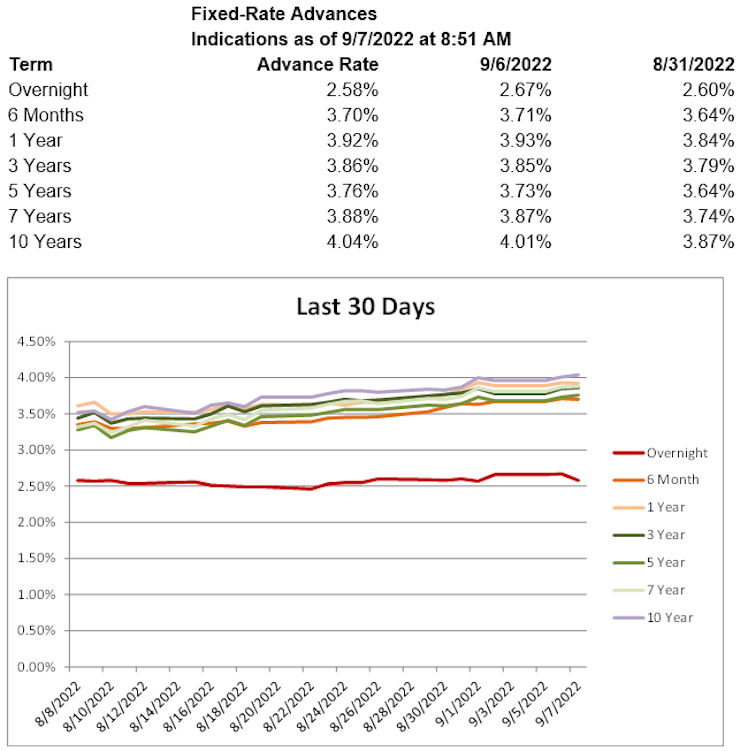

Treasury yields are lower, with the 2-year T yield down 2.5 basis points to 3.48%, the 5-year T yield down 4.7 basis points to 3.40%, and the 10-year T yield down 4.8 basis points to 3.29%. Advance rates are lower throughout much of the curve today.

Already have an account?