Trending Assets

Top investors this month

Trending Assets

Top investors this month

"Buy The Dip" July Idea Competition: $LULU multi-year compounder with clear path to continued growth and high profitability.

We are very happy to participate to the @commonstock July Idea Competition which is a real challenge given the current environment and the short time given to publish a qualitative write-up.

Our “best idea” is Lululemon $LULU which is consistent with our core Quality-Growth investment philosophy. We are looking to invest in companies with competitive advantage, structural growth perspective, led by the right management team with capital allocation skills and running a financially strong business.

Given the current volatile market fueled by inflation, recession fears and geopolitical tensions, we are more than ever interested in companies that set clear long-term goals and have an history of achieving those goals. It seems obvious, but few companies do it, and LULU

is one rare example. While many companies are reducing their growth targets in the face of a possible recession, LULU is pursuing its growth strategy with continued focus and defying the macro outlook.

Thesis:

- Each LULU product is focused on quality and innovation by taking a differentiating approach to competitors.

- Focus on building strong community resulting to lower customer acquisition costs.

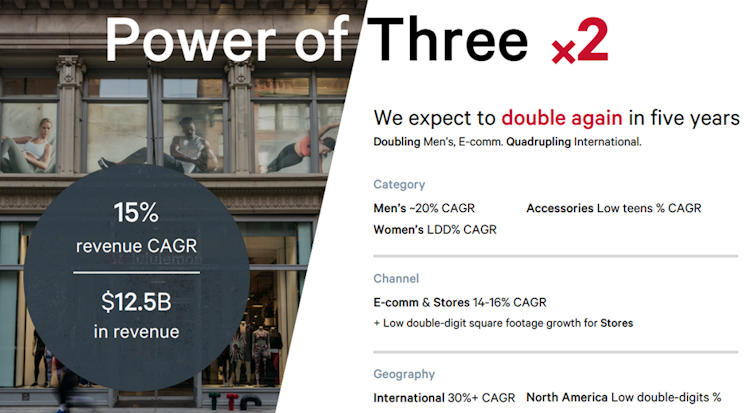

- Power of Three x2: After meeting its previous targets two years ahead of the schedule, LULU is challenging itself by setting another aspirational long-term goal (detailed later). By doubling down on its strategy, LULU is confirming the large market opportunity that lies ahead of it, and its confidence in its strategy.

- Strong balance sheet with high financial flexibility. FCF growing at +30% CAGR. Slightly upward slopping margin levels, well above athleisure peers. Strong multi-year compounder.

- Management making long-term decision with purpose. Smart capital allocators.

- Attractive valuation compared to historical multiples.

Competitive Moat

- Innovation is in LULU’s DNA.

One of the key factors that differentiates the company’s product design is its commitment to and investment in innovation, whether in new fabrics, categories, fits, or collaboration with the result that the company continuously releases new offerings that improve functionality or deliver new wearing options for consumer’s wardrobe. LULU’s keen focus on finding function in fabrics is a main element of its success that should continue to fuel sales gains as for-performance design and fabrics with sustained innovation can find buyers beyond the core yoga-wear community. The company’s product innovation is centered around meeting customer’s unmet needs by utilizing and creating new fabrics and close collaboration with vendors. LULU has shown the ability to build franchises that start as one product and it should be able to use this playbook for its core and new categories. The company continues to have a product innovation pipeline that focusses on the long-term as they identify long-term trends in consumer tastes, ESG, and new markets giving them an edge.

The four-year investment to develop new women’s footwear collection launched this year is the perfect example of this drive to innovate and it offers LULU potential to gain share in a fragmented market for women’s performance-sports footwear, given legacy athletic-shoe brands don’t have as big a headstart in making sneakers designed specifically for women.

LULU is debuting a footwear line that’s designed to meet women’s unmet needs first, leveraging the company’s history, research and category experience from its

apparel offerings.

For LULU the innovation pipeline is a cycle of continuous improvement over time. During the pandemic many retailers were forced to shift into defense mode at the expense of future innovation but LULU made the latter a priority to forge forward with product design, performance technologies and new category launches (tennis, golf, women’s footwear). This

focus on increasing share of wardrobe with flexible product for multiple wearing purposes (sport, lifestyle, OTC) continues to drive growth in the women’s business and give them the possibility to rapidly expend men’s and international’s current levels. The company is uniquely positioned with its core products now bolstered by its expansion categories.

- Community and experimental advertising to build awareness and lower customer acquisition costs (CAC).

Community is another company’s differentiating factor in the industry. In its early stage of growth, LULU’s primary source of advertising was community building. The company has chosen to do grassroots advertising, ambassadorships and guest relationships are the main vehicles for brand engagement and fostering loyalty. LULU’s entrenchment in communities

allows it to build deeper connections, while also providing access to new audience. The company has hosted thousands of global events, including flagships experiences such as Sweatlife festivals in Europe and 10K runs in America. Sponsoring Team Canada for last Beijing Olympics also boosted global awareness.

Looking ahead, the creation and launch of first ever membership program will create an ecosystem that increases the potential size of the customer base while at the same time strengthening its connections with guests. The program will be two-tiered:

- The essential free membership will offer guests early access to product drops and exclusive items.

- Lululemon Studio, a monthly subscription ($39/month to replace MIRROR) will give users access to an additional 800 hours of workout content and provide customers with a stronger community experience and interaction.

Management expects c.80% of guests to be part of one of the membership programs within five years allowing for investment efficiencies driving lower marketing spend, lower CAC compared to MIRROR and higher spend among guests.

Another key driver of LULU’s effort to increase its community and customer base is its seasonal store strategy as it creates unique guest experiences and provides an opportunity to test new markets post-pandemic before making longer-term commitment. 30% of all guests visiting seasonal stores are new, enabling faster customer acquisition in a lower-cost and flexible format.

LULU is evolving in a competitive industry with fierce competitors like Nike or Adidas, but we believe that thanks to its differentiating approach, LULU can grow and gain market share in the future. The conclude we highlighted below some extracts of an Adrienne Yih (Barclays Managing Director) interview about LULU’s pricing and brand power.

- “Yeah, they have extreme pricing power. The pants run anywhere between $118 up to $128. And so that is, that is an extraordinarily high price for arguably a legging […]And there really isn't any price elasticity. So if there is going to be a price increase, we think absolutely, they'll be able to pass it through certainly on their proven apparel items”

- "Yes. So if you get into the mind of the female, and they certainly are doing this with the male as well, brands that are scarce, that give you a particular look and feel, and when you put it on, you feel like Superwoman, right, or Superman in Lulu. That little omega sign that sits on the back of, you know, of a bra or on the pants, it is a symbol of kind of strength, wellness, health, like you're doing something good for yourself. The best thing that a retailer can do, as you know, Brian, is to make that person, when they put on that piece of apparel or that footwear, to change their psyche, right, to change their mental confidence. And that's what Lulu does. It's a confidence builder, not just an apparel item.”

Sustainable Growth

The company’s management outlined during the last investors day long-term financial targets of doubling total revenue to $12.5B (Power of Three x2) equating to a 15%+ revenue CAGR, with modest operating margin expansion annually translating into EPS growth exceeding operating income growth. Management sees the model growing at a 15% CAGR multi-year providing ample ability to chase upside and consistent with 19%/24% CAGR seen pre- and during pandemic. LULU has just 1% market share of the $650B global premium activewear market. The company shows investors in the past that it has the ability to meet guidance and even outpaced it with higher growth rates and targets reached years in advance.

Let’s now delve a bit deeper into the long term growth drivers:

- North America (84.7% of revenue): Expected to grow at a low-double-digit revenue CAGR by 2026 to around $9B by continued product innovation and expansion, increasing unaided brand awareness (only 25% in the US today, with men at just 11% and women at 38%), and omni-channel growth. The latter is driven, in part, by the already mentioned pop-up (seasonal) stores.

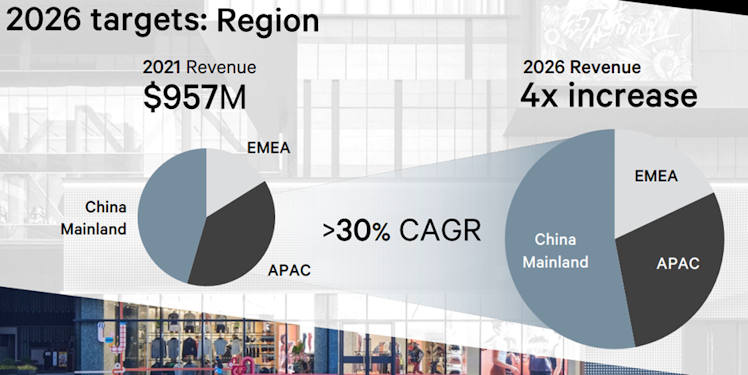

- International (15.3% of revenue): LULU’s opportunity to boost its international presence remains key to delivering on its upcoming long term plan. Guided international set to quadruple by 2026 (30%+ CAGR). International market remains unpenetrated with low brand awareness compared other brands in the space and it offers LULU plenty of room to grow. Key region will be China, the company expects China to represent more than 50% of international sales in 2026 and to be the second market globally. The sportswear market in Mainland China is expected to expand at a 12.3% CAGR over the next five years, reaching $101B in 2026 as per Euromonitor forecast. LULU has gained market share in the region recently but currently only holds 1.1% of the market.

- Women (66.7% of revenue): Also guided to a low-double-digit revenue CAGR by 2026 to around $7B driven by continued innovation in core products and new categories, especially footwear. As mentioned above, LULU has the potential to gain share in a fragmentated market for women’s performance footwear. Historically, performance shoes were designed for men and adapted for women in different color schemes but without factoring for specific needs. The Blissfeel running shoe was well received with early sold out online in many colors and sizes.

- Men (24.5% of revenue): Men revenue is expected to double by 2026 to $3**.1B** (c.20% CAGR). Momentum should continue in the coming years, and help the company to gain market share. The brand has already doubled its men’s business ahead of its 2023 target. However though effort will be needed to compete with men’s sportwear brands like Nike or UA but we believe LULU branding itself as a lifestyle name, especially with “office, travel, commute” OTC products will support this segment revenue growth, echoing the return-to-office trend.

- Corporate-owned Stores (45.1% of revenue): Gross square footage increased to 2,125K from 1,262K over the last five years with currently 574 stores worldwide. LULU may continue to focus on accelerating store productivity in 2022, expanding its omni-channel offerings, MIRROR shop-in-shops and store footprint. A goal to make about 10% of the total store fleet experimental by 2023 may drive deeper connections with shoppers and boost traffic and sales. Store experiences are key elements of LULU’s omni operating model, which builds seamless online/offline experience for customers. Store productivity in 1Q 2022 was tracking above pre-pandemic levels, fueling annual top line growth above 20%.

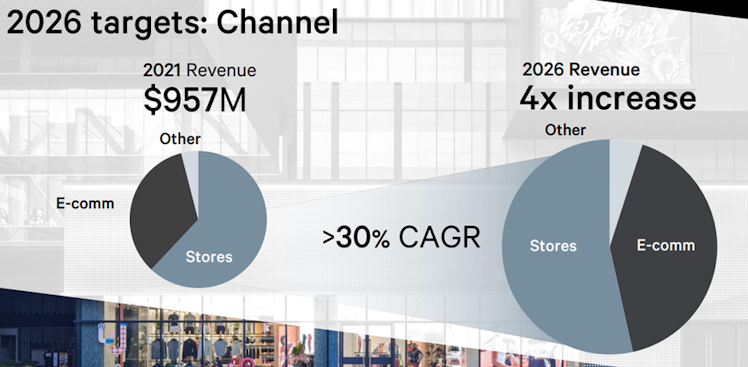

- e-Commerce (44.4% of revenue): guided to double revenue to $5.6B by 2026. Online sales growth has soared on the back of the company’s digital-site investments during the pandemic. The addition of buy online and pick up in store across all locations enhanced the profitability of internet sales. Investment across its digital platform to boost traffic and conversion reason core to LULU’s e-commerce strategy. It will provide additional focus on seamless checkout experience, improving inventory accuracy, product comparison and enhanced storytelling.

Financials

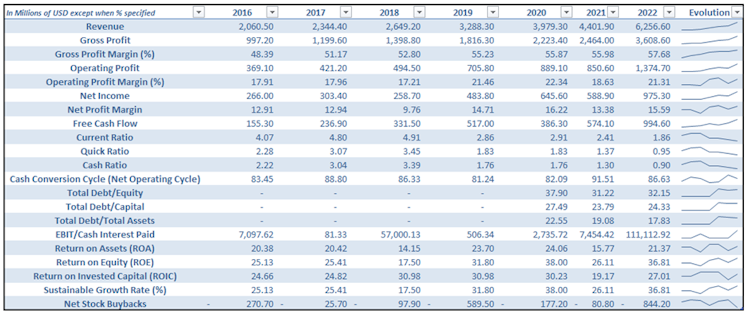

Revenue topped $6.3B in 2022 (reporting on FY in Jan) representing an outstanding more than 20% CAGR since 2016. Gross margin grew even faster as the business grew and gained bargaining power with suppliers, gross profit margin improved from 48% to 58% in 2022.

Operating profit and Net Income grew in line with Gross Profit as operating expenses (as a % of revenue) remained stable. The company returned a constant long-term ROA around 20%. ROE improved significantly and can be easily explained by a combination of higher profits, introduction of debt in the balance sheet and shares count reduction.

From a liquidity point of view, the company’s balance sheet is pretty strong. However, it is important to notice that the liquidity level gradually declined over the period to 1.86 from 4.07 (current ratio). From our perspective, a current ratio above 1.5 is a satisfying liquidity level. The

lower liquidity can be explained by strategic acquisition but mainly by share repurchases program which benefits shareholders.

From a solvability point of view, LULU introduced debt into its balance sheet in 2020. Indebtedness levels remain reasonable and debt as source of capital, given the recent very low cost of debt, can be seen as a sensible decision. Solvability ratios improved years after years since 2020. To conclude, and if the above was not enough to reassure an investor, the company generated in 2022 an EBIT equivalent to more than 111K times the cash interest paid which provides further good signals regarding LULU solvability.

The company generated a FCF shy of $1B in 2022. Importantly, the latter grew 36% CAGR over the period and in line with Net Income. Main use of cash was the acquisition of fixed prod assets and shares repurchase.

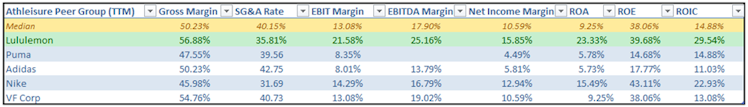

- Quick comparison with the athleisure peer group in terms of profitability:

The above table shows the unique profitability of the company within its group. The only ratio where LULU is close to the median is ROE, however it fails to account for LULU’s significantly lower debt levels than peers (i.e. 24.33% total debt/total assets vs. group median of 44.52%).

Management Checklist and ESG considerations

- Management

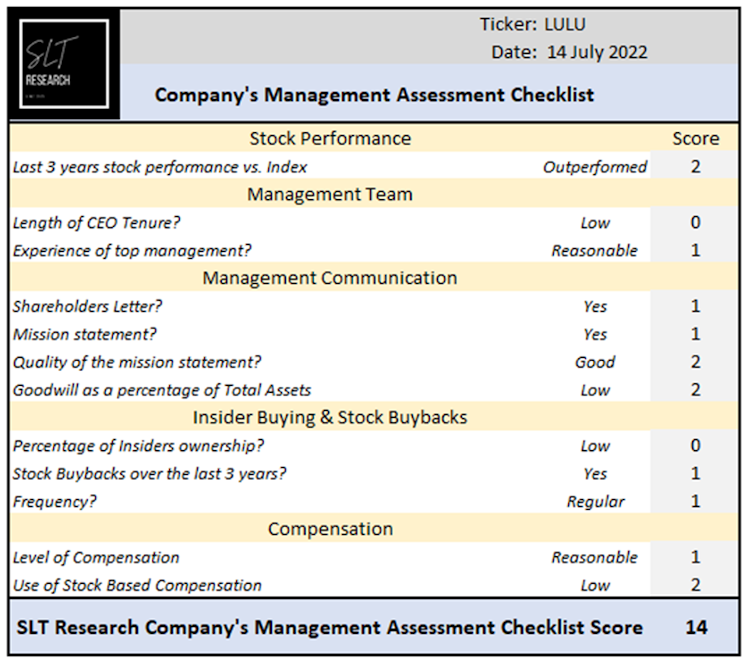

LULU has a good score using our Management Assessment Checklist, we particularly like management’s communication and capital allocation skills.

Through its mission statement, the company makes it clear that the popularity of its products does not precede the experiences that it desires its customers to enjoy. The use of strong terms in this statement is an indication of how passionate LULU is when it comes to initiating long-lasting behavioral changes in everyone it comes in contact with especially those that use its technical clothes for athletics. The mission statement comprises of these components: improving lives, improving health, exceeding expectations.

Management is smart in terms of asset allocation and methodical when executing long-term plan which clearly adds shareholders value. The company is the most profitable within its peer group with lower use of leverage. FCF yield is attractive and in addition, the company only used M&A at the margin, and has been mainly focused on reinvesting FCF into its fast and constantly growing business. The company does not pay dividends and given the positive spread between its ROIC and WACC, we believe it is the best decision.

- ESG

Driving a sustainable pipeline of products through raw-materials innovation could help LULU entice customers that prefer brands that resonate more closely with their personal views for more sustainability especially among Millennials and Gen Z. PwC 2021 consumer survey revealed that the latter two groups are more likely to think about sustainability during shopping. The company is seeking to significantly change the way it sources and manufactures products across all its key raw materials.

LULU also announced the expansion of its first trade-in and resale program. The company leaps into the more than $30B resale market, estimated to surpass $75B in 2025 based on the Global Data estimates. Built on a circular economy model, it will allow the company to reach more value-focused shopper and sustainable-minded consumers. Customers can receive credits ranging from $5-25 for trade-in products that are being resold through the company’s own stores or website. This ESG friendly initiative aims also to increase store and online traffic, driving customer acquisition. LULU is leading versus peers and above median

regarding Environmental and Governance scores according to Bloomberg ESG metrics.

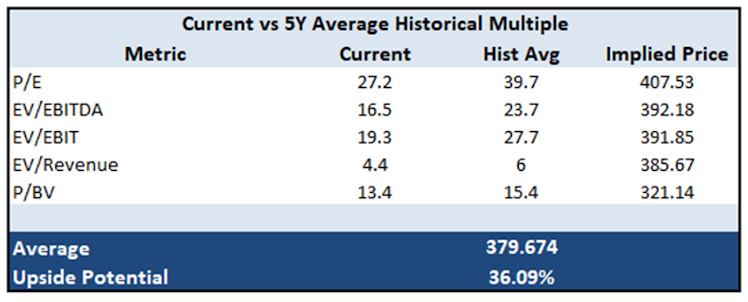

Valuation

The company is currently trading well below its five year historical multiples. The current economic and geopolitical environment needs to be accounted to reflect inflationary environment and incremental freight and supply chain costs. However, we believe valuation also needs to recognize LULU pricing power, consistent sales trends, product innovation, category expansion, and historical experience of meeting targets. We computed a 12M price target of $380, representing a potential 36% upside.

- Main risks include more difficult than expected capture of further market share from competitors and freight and supply-chain headwinds pressuring margins with bigger magnitude than expected. We believe the latter can be partially mitigated with LULU flexible inventory model that minimizes risk and maximizes profitability.

We hope you've enjoyed the post and we'd love to hear your thoughts in the comments. Make sure to follow us on CS and to upvote our analysis.

Disclaimer: The information provided in this post is for information only and solely on the basis that you will make your own investment decisions after having performed appropriate due diligence.

Already have an account?