Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - Hot Inflation, PPI, and Mortgage Data

Stocks opened higher, dipped lower shortly, and are continuing to trend upwards. All 3 major indexes posted their biggest one-day drop since June 2020, all fell at least 4%. After the hot inflation reading yesterday, some projections were calling for the Fed to hike by a full percentage point at the FOMC meeting next week, stoking investor fears.

The Producer Price Index fell 0.1% in Aug, matching expectations, and prices were up 8.7% YoY, down over 1% from last month & the lowest reading since Aug 2021. Core prices, which exclude food, energy, and trade, were up 0.2% for the month, just below expectations, and 5.6% YoY, the lowest reading since June 2021.

Elsewhere, MBA mortgage applications fell 1.2% last week as refinance applications fell by 4.2% to the lowest level since 1999. The purchase index edged 0.2% higher for the week. The report also showed that the average interest rate of a conforming 30-year mortgage rose to 6.01%, the highest level since November 2008.

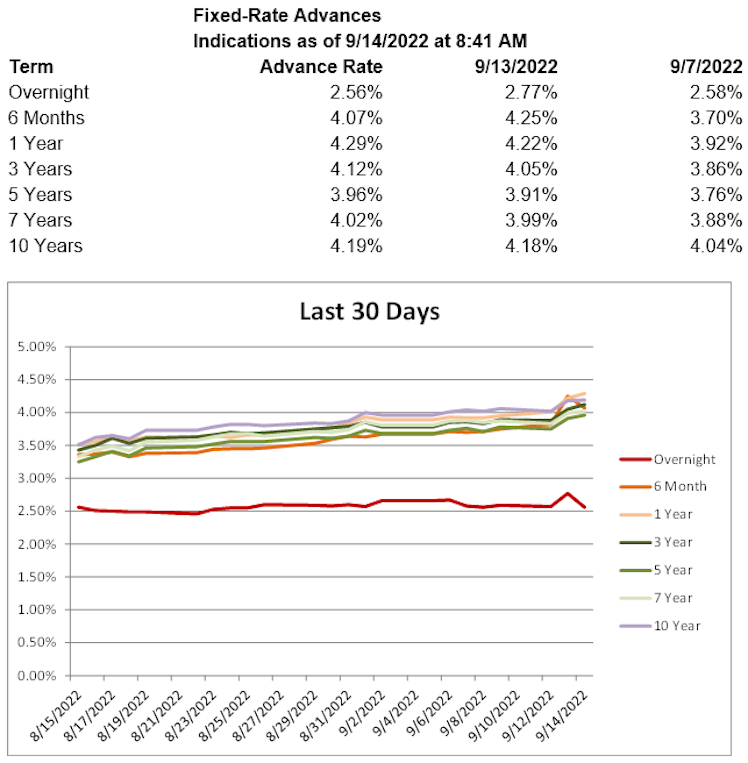

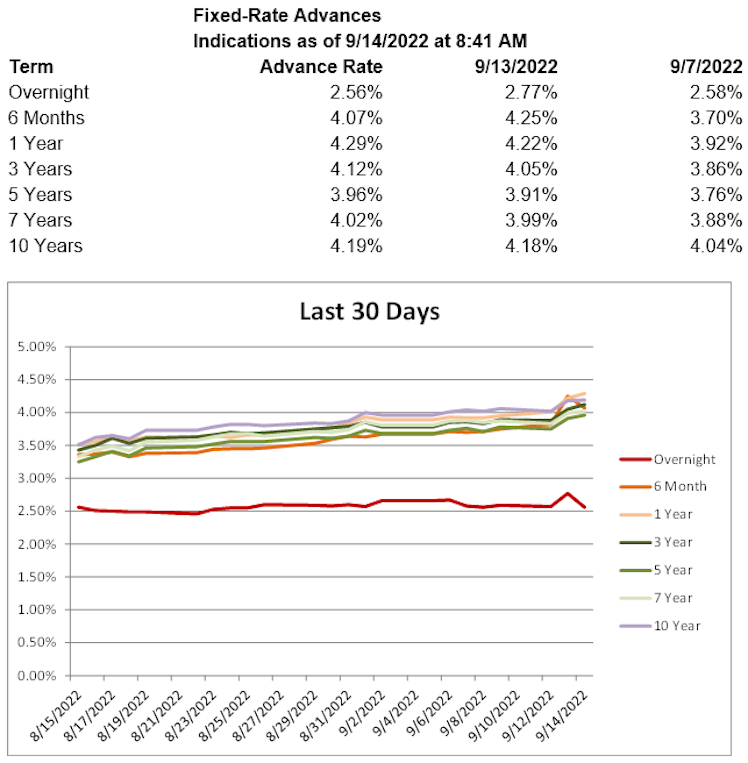

Treasury yields are higher this morning, with the 2-year T yield up 3.6 basis points to 3.79%, the 5-year T yield up 1.4 basis points to 3.61%, and the 10-year T yield up 0.1 basis points to 3.42%. Advance rates are lower for terms under 1-year, higher on longer terms.

Already have an account?