Trending Assets

Top investors this month

Trending Assets

Top investors this month

SoFi: GAAP Profitability Incoming

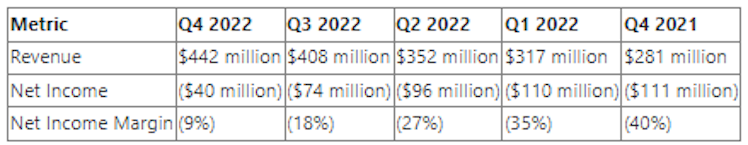

$SOFI reported earnings on Monday, and I wanted to go back and highlight the company's rapidly improving GAAP net income margins over the last five quarters.

Generally speaking, a stock with a -9% net income (loss?) margin doesn't catch my attention. But in SoFi's case, it may be worth a look from most of us. Consider its last five quarters of GAAP profit margin improvements:

Cue the NFL broadcaster joke that if they keep this rate up, they'll have net income margins of 100% in a few years.

Regardless, glancing at the chart above, it may be no surprise that Founder and CEO Anthony Noto expects true GAAP profitability by Q4 2023 -- a remarkable feat for a stock that just grew net revenue by 60% YoY for FY 2022.

Here's a quick SWOT analysis for SoFi's Q4 2022 earnings and what makes it an attractive stock to consider:

- Strength - We already highlighted this with the GAAP net income margin improving and profitability on its way in Q4, hopefully. However, SoFi's bank charter designation is also worth noting, as it has grown deposits in its financial services segment from less than $1B at the end of 2021 to $7.3B as of Q4 2022. These deposits provide immense capital to continue funding its lending segment.

- Weakness - In its lending segment, student loans and home loans are more or less AWOL due to the macroeconomic environment they face. Weirdly, this makes SoFi's results -- both revenue growth and better margins -- all the more impressive, considering it is doing it with one hand tied behind its back.

- Opportunity - Already with Galileo, and now acquiring Technisys, SoFi's technology platform is positioned to become rather important to the digital banking industry. As Noto puts it, they intend to become the AWS of digital finance, which is an interesting but apt comparison, in my opinion. What was noteworthy from the earnings call was that of Galileo's 11 new clients from Q4, nine already had an existing base of customers -- demonstrating that it is drawing the attention of larger, more mature banking partners and not just young neobanks.

- Threat - The existential threat for SoFi will probably always be its lending unit -- particularly its line of personal loans. This market admittedly could go sour quickly, but it is worth noting that the weighted-average FICO score for its personal loan customers was a robust 747. So it would take a pretty strong shock to the consumer finance environment to harm SoFi irreparably.

Altogether SoFi's member count grew by 51% in Q4, added 24% more lending products YoY (even with student and home loans struggling), and increased its financial service products usage by 60%.

At just 4.1 times sales, SoFi's 58% net revenue growth in Q4 and potential incoming GAAP profits in 2023 make it well worth a spot in my portfolio.

What do you all think of SoFi? Anything you are worried about, or like?

Which has better odds by the end of 2025?

28%SoFi still trading below $10

71%SoFi being up 100% or more

21 VotesPoll ended on: 2/5/2023

Already have an account?