Trending Assets

Top investors this month

Trending Assets

Top investors this month

📈 Optimum Mix target allocations--weekly update

$UPRO reached its buy indicator and momentum for $NFLX and $WMT continued to be stronger than $PYPL as of November 14, 2022, when the most recent issue of the Leveraged Momentum Update newsletter was sent, so the Optimum Mix target allocations changed to the following based on a $10,000 total balance:

cash: $10,000 x 34% = $3,400

$UPRO: $10,000 x 16% = $1,600

$NFLX: $10,000 x 25% = $2,500

$PYPL: $10,000 x 6.25% = $625

$WMT: $10,000 x 18.75% = $1,875

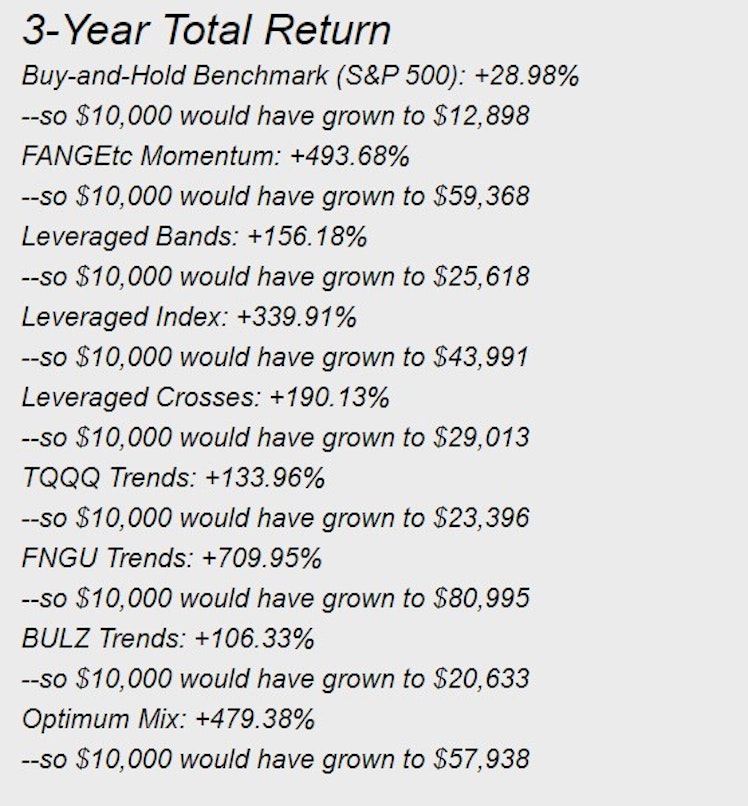

The 3-year total return for the Optimum Mix was 479.38% as of that date.

Click image to see larger image of complete list of strategies with their 3-year total return rates.

The next Leveraged Momentum newsletter/trading is tomorrow so click here today to subscribe to the FREE newsletter.

Any questions or feedback?

leveragedmomentum.com

Leveraged Momentum | Helping investors beat the market long term

Already have an account?