Trending Assets

Top investors this month

Trending Assets

Top investors this month

$IOT - An IoT monopoly in hypergrowth mode and a long runway

$IOT - Samsara is an IoT monopoly with rapid innovation, product cadence, and customer feedback loops coupled with a strong strategy and moat making Samsara a truly exceptional business

What does Samsara do and What are Samsara's Products?

Samsara has created the Connected Operations Cloud, which allows businesses that depend on physical operations to harness the Internet of Things (IoT) data to develop actionable business insights and improve their operations.

Samsara is solving the problem of opaque operations and disconnected systems. By harnessing recent advancements in IoT connectivity, artificial intelligence (AI), cloud computing, and video imagery, Samsara is enabling the digital transformation of physical operations.

The main applications in their platform are:

- Video-Based Safety

- Vehicle Telematics

- Apps and Driver Workflows

- Equipment Monitoring

- Site Visibility

The following image gives more details of their products and features

How does Samsara make money?

Samsara generates 98% of revenue from subscriptions to their Connected Operations Cloud, which today includes Applications for video-based safety, vehicle telematics, apps and driver workflows, equipment monitoring, and site visibility.

What is Samsara’s customer value proposition?

Samsara:

- Provides a Single Pane of Glass for all IoT Data

- Improves Safety and Reduces Costs of Physical operations

- Increases Operational Efficiency of Physical operations

- Enhances Sustainability of Physical operations

What is Samsara’s Market Opportunity?

Samsara's total addressable market opportunity is approximately $54.6 billion by the end of 2021, growing at a three-year overall compound annual growth rate of approximately 21.0% to $96.9 billion by the end of 2024.

What is Samsara’s Mission?

Samsara's mission: to increase the safety, efficiency, and sustainability of the operations that power our economy.

Samsara has a mission to improve and analyze every aspect of physical operations.

This is a powerful mission statement with a sense of purpose/inspiration. It's also simple and allows room for Samsara to innovate and keep adding adjacencies to their business.

What are Samsara’s People and Culture like?

Samsara has a Differentiated Company Culture in which they innovate quickly in partnership with customers, focus on durable and long-term solutions.

While doing this they work together as a collaborative team and are very entrepreneurial.

What do Samsara’s current Financials look like?

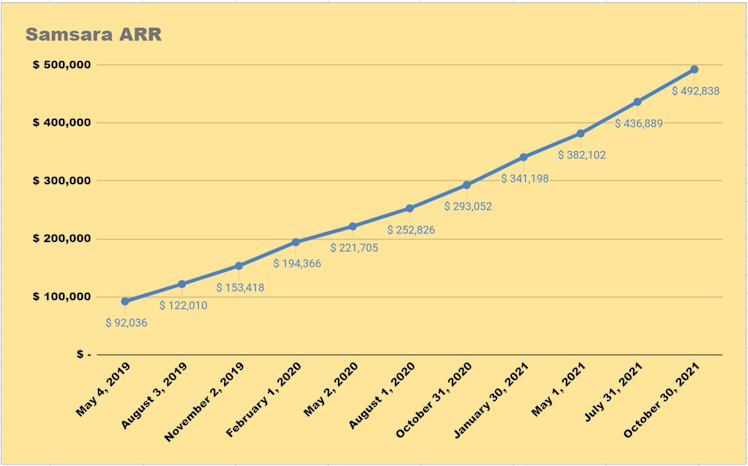

- Revenue - $493M Q3 2021 ARR

- Revenue Growth - 68% Q3 2021, I expect this to decelerate

- Gross Margin - 72% Q3 2021(up from 69% last year, love to see the margin expansion)

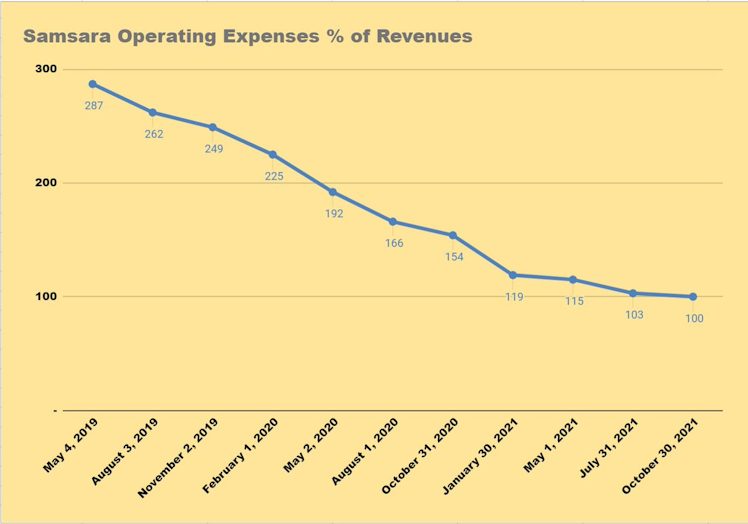

- Earnings Margin - negative 33% Q3 2021, Losses reduced from negative 100% from the previous year. We can see tremendous operating leverage here.

- Net Cash - $805M raised from IPO and $267M from Q3 2021, kinda crazy

- EV - $9.2B (Assuming $8B market cap, $1.4B total debt, and $0.267B cash, the debt is over-estimated[includes preferred equity], we will get better numbers from the upcoming quarter results)

- EV/ARR - 18.6x(much cheaper after we account for IPO cash and updated debt numbers, we will see them soon after this quarter's results)

- Dollar Based Net Retention Ratio - 115% overall and 125% for customers spending more than $100K

- LTV: CAC - 8x, incredible for a company so early in its life

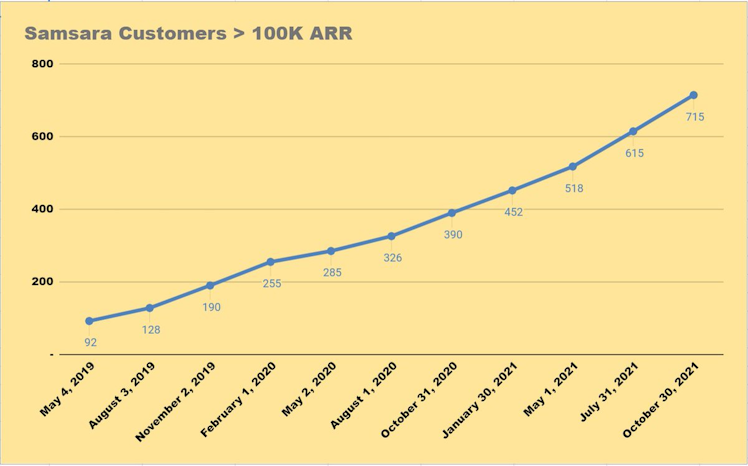

- Customers - 25K overall, 13k+ more than $5K ARR, 700+ customers > $100K ARR

From the below image, we can see that they have done this while significantly decreasing their operating expenses. As they scale further we should see a further decline in this and correspondingly increasing operational leverage.

Meanwhile, we see them growing their ARR consistently (Below image). They have grown 5 times in 2.5 years, crazy

And increase the number of large customers(Below image). They have grown 7.7 times in 2.5 years, crazy

What are my final thoughts on Samsara?

Samsara is a special place with a truly differentiated platform, culture, and strategy. They have a massive opportunity to capture and they are showing no signs of slowing down.

They are a true partner of their customers and their rapid innovation, product cadence, and customer feedback loops coupled with a strong strategy and moat make Samsara a truly exceptional business!

If you like my summary about $IOT check out my deep dive at moderngrowthinvesting.com/samsara/

I saw on the asset page that you and @florent.xhani are the only two on Commonstock that have bought Samsara in the last year. @florent.xhani - what was your thesis in investing here? Did their differentials draw your attention like they did for @growthinvesting?

Already have an account?