Trending Assets

Top investors this month

Trending Assets

Top investors this month

HubSpot taking on Salesforce: David vs Goliath?

Salesforce ($CRM) has been the singular fortress and gatekeeper of the Customer Relationship Management industry for over a decade. Through the years they've broadened their product portfolio with an ecosystem comprising every sales and marketing app and use case imaginable relating to software. M&A has pushed the business beyond its core competence to encompass apps like Slack (workflow communication) and Tableau (analytics and visualization).

There is however an argument to be made against the now $150B market cap giant. We've seen time and again that nimbler solutions that were designed from the ground up every few years provide a value proposition that can justify switching costs for even mid-large enterprises. It's hard to keep the innovation alive at scale and thus M&A helps entangle customers and build dependence when a company can't quite re-design its software as the latest best practices flourish.

HubSpot ($HUBS), by most market share metrics, is the #2 CRM Platform now and is doing extremely well. By the company's own metrics, a team of 50 may incur an estimated cost of $75,000 a year with Hubspot vs. an equivalent $236,800 from Salesforce for equivalent services. Take it with some salt, but when cost cutting is on the horizon, such a difference for enterprises not requiring advanced Salesforce functionality makes switching extremely attractive.

HubSpot began as a marketing automation platform and has since evolved by branching out into Sales and CRM use cases. With a "land and expand" model, they last recorded 41% YoY growth on a constant currency basis, growing their customer count by 25% YoY. Not hyper-growth by any means, but commendable business execution.

To add, they're scoring Free Cash Flow generation, which is a strategic advantage. When younger competitors in specific use-case domains have to fire off employees, while reducing their S&M spending, HubSpot doesn't have to do the same and can continue on its current trajectory. This theoretically, should leave financially unsound innovators in the dust amidst this tricky macro.

In summary, HubSpot appears to be at a fortunate size along its S-curve cycle. Innovative enough to drive serious growth through product expansion, and profitable enough to not be bothered by cash-flow consequences in a delirious macro environment. As a result, it's worth investigating further.

To contextualize:

- Salesforce recorded $7.7B in sales last quarter with 22% YoY growth, and a 3.7% FCF Yield.

- HubSpot recorded $420m in sales last quarter growing 36% (41% cc) YoY and has a 1.5% FCF Yield.

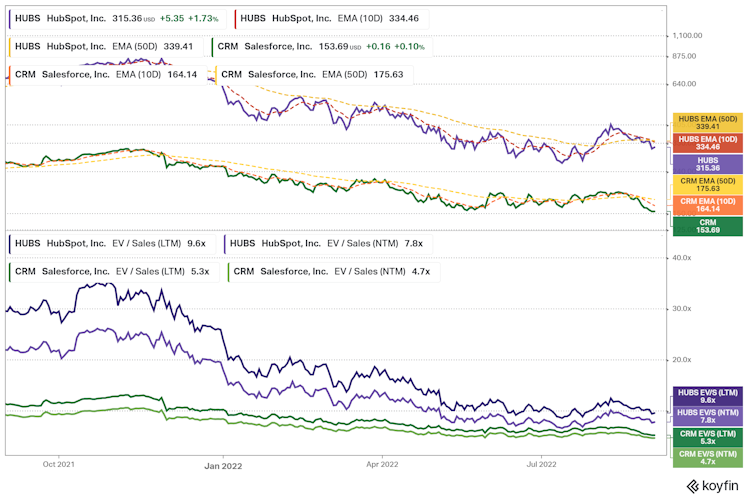

If one finds high-quality and best-of-breed solutions in Hubspot, there's a long runway to go with broad revenue drivers against a massive market opportunity in the $30B+ range. One will also have to pay a premium on EV/S valuations but that should be worth it considering the runway ahead.

At an NTM EV/S of 7.8x, HUBS is not priced like a value stock, nor should it be. But it is cheap enough for investors with a long-term horizon to dig in and consider it as a potential investment in the rather macro-resilient software space.

Under investigation for my portfolio. No position yet.

www.hubspot.com

Salesforce Sales Cloud vs HubSpot | Why HubSpot is the Best Alternative

Compare two of the top-rated CRM platforms – HubSpot and Salesforce – to help you decide which CRM and sales software is right for your business.

Already have an account?