Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update

Stocks are mixed today as investors await the FOMC meeting. It is expected that the Fed will raise rates by 25 basis points, so investors will be looking for any clues about the future path of rates. Investors are also digesting corporate earnings and a labor report that showed a surge in private payrolls. All 3 major averages fell at least 1% on Tuesday.

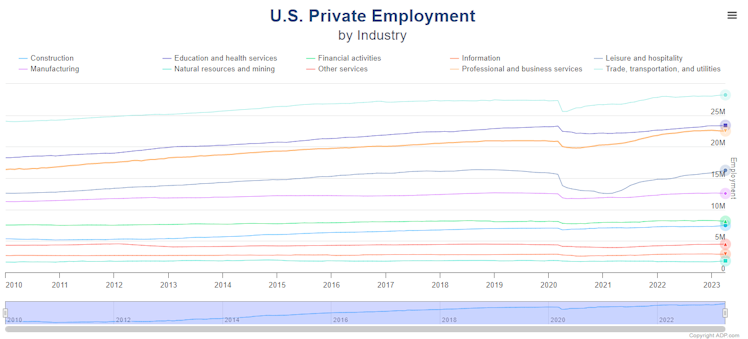

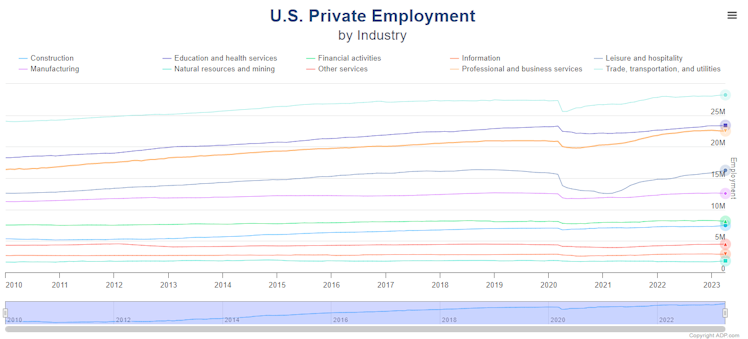

For economic data today, the ADP Employment Report showed private payrolls jumped 296,000 in April, up from 142,000 last month and well above expectations of 133,000. It was also the biggest monthly increase since July 2022. Leisure and hospitality saw the biggest gain with 154,000 jobs added.

Elsewhere, the ISM Services Index rose to a reading of 51.9 in April, just below expectations. Business activity and employment were lower, while new orders were higher.

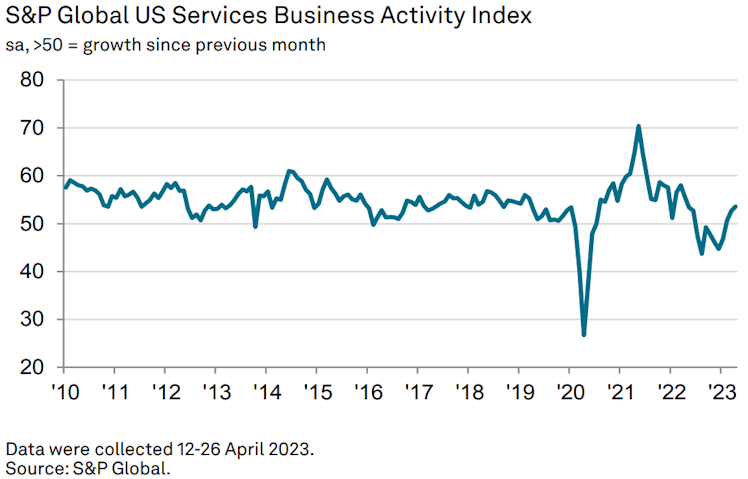

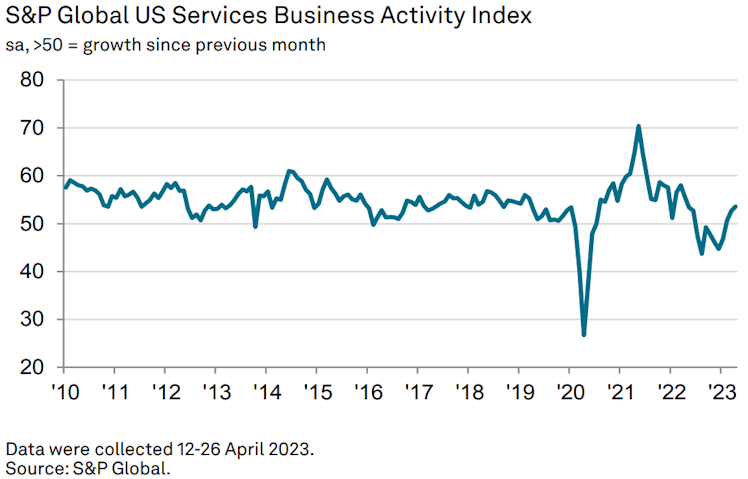

Lastly, the S&P Global Services PMI came in at a final reading of 53.6 for April, down from 53.7 in the preliminary reading. Business activity is picking up while rising input costs and output charge inflation. Chief Business Economist at S&P said, “there are indications that resurgent demand for services is reigniting inflationary pressures.”

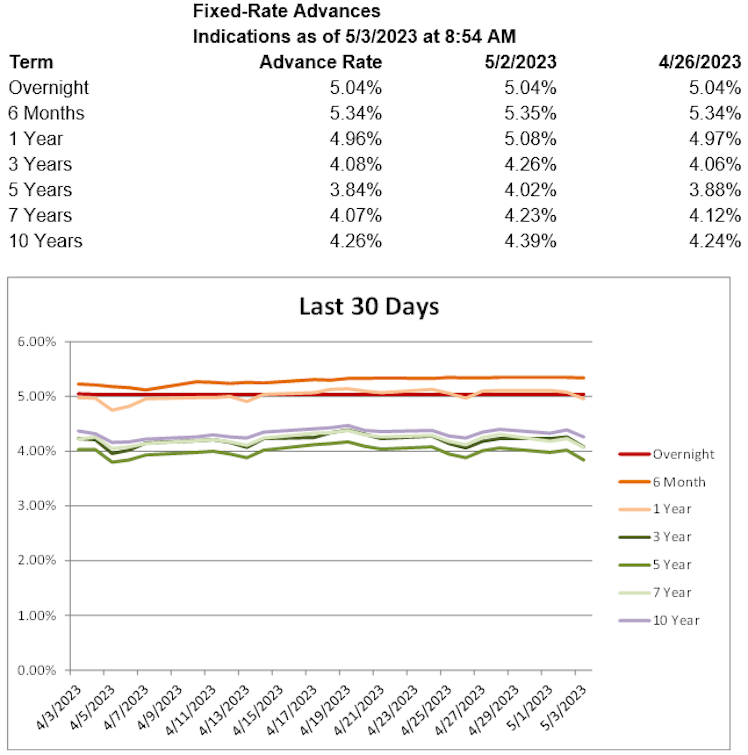

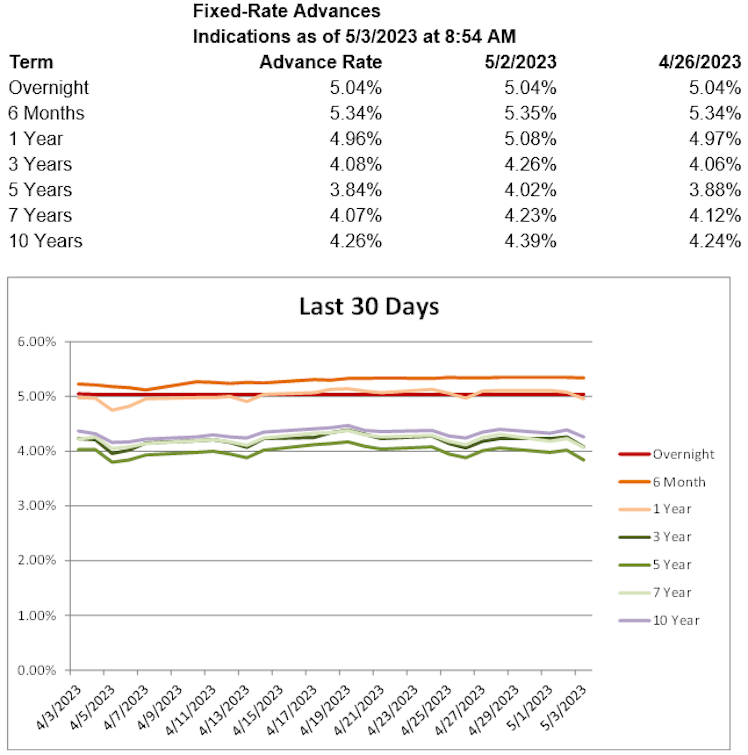

Treasury yields are lower, with the 2-year T yield down 5.2 basis points to 3.93%, the 5-year T yield down 7.1 basis points to 3.40%, and the 10-year T yield down 5.8 basis points to 3.38%. Advance rates are mostly lower today.

Already have an account?