Trending Assets

Top investors this month

Trending Assets

Top investors this month

Dividend Portfolio Update

As you may know, I write many updates, economic analysis, and opinion pieces on my website, you can ready my most recent full portfolio update here. However, it's been a while since I've shared an update on Commonstock so let's do one!

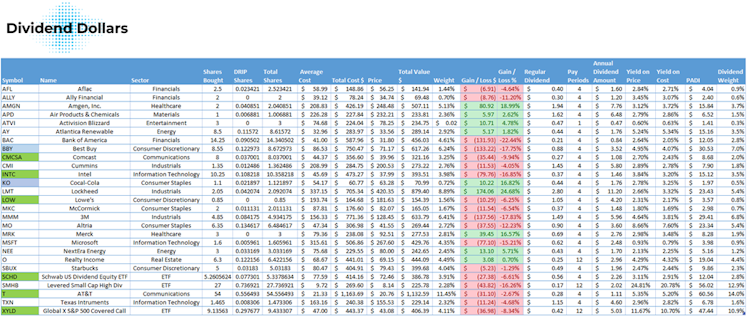

To date, I have invested $10,110 into the account (WOOT WOOT WE PASSED 10K), the total value of all positions plus any cash on hand is $9,887.69. That’s a total loss of 2.20%. The account is up $142.95 for the week which is a 1.47% gain.

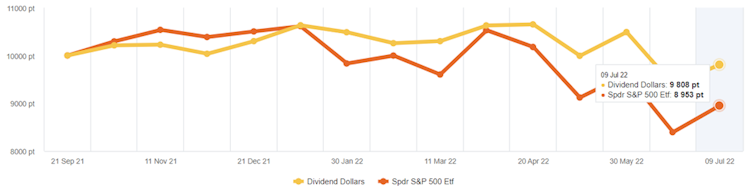

We started building this portfolio on 9/24/2021 and when compared to the S&P 500 we are outperforming the market so far! Within that same timeframe, the S&P 500 is down -12.48% whereas our portfolio is down -2.20%! I love tracking my portfolio against a benchmark like the S&P. The above chart comes from Sharesight which makes portfolio and dividend management a breeze!

We added $120 in cash to the account this week. The trades made this week will be broken out below.

Below is a table of everything we are invested in so far. There you can see my number of shares, shares bought through dividend reinvestments, average cost, gains, and more. The tickers in green are positions that I bought shares in this week and the blue ones are positions that I reinvested dividends into. The positions that we added to increased our annual dividend income by $9 at a yield of 4.42%.

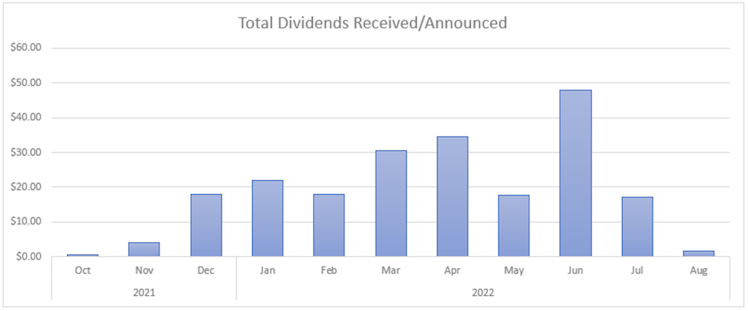

This week we received $6.72 from two dividends: $0.49 from Coca-Cola ($KO), $6.23 from Best Buy ($BBY).

In my portfolio, all positions have dividend reinvestment enabled. I don’t hold onto the dividend, I don’t try to time the reinvestment, I just let my broker do it automatically. The Coca-Cola dividend was actually received last Friday, but got reinvested on the following trading day.

Dividends received for 2022: $179.42

Portfolio’s Lifetime Dividends: $202.34

Below is a breakdown of my trades this week!

July 5th

- Best Buy ($BBY) – dividend reinvested

- Coca-Cola ($KO) – dividend reinvested

- Comcast ($CMCSA) – 0.5 shares bought at $39.26

- Lowe’s ($LOW) – added 0.125 shares at $175.84

July 6th

- $SCHD – added 0.1399 shares at $71.48 (recurring investment)

- $XYLD – added 0.233198 shares at $42.88 (recurring investment)

July 8th

We also bought some $SSSS and sold it the next day for a ~5% gain. This is not something I do often so I won't provide the dates and prices for those orders.

This was sort of a slow week on top of an already shortened week. It was a pretty positive week driving by the tech and consumer discretionary sectors as discussed in my weekly market review, therefore there wasn’t too many amazing opportunities to buy down. I mainly just took this week to add a little bit into some of my favorite down positions and positions on ex-dates.

Next week I plan on keeping my eyes on Lowe’s, Cummins, and Altria for the reasons below:

- Lowe’s ($LOW) for its ex-date coming up on July 19th.

- I’ll also be looking to add to Cummins ($CMI) which I’m down 4% on right now. Their yield is 2.89% which is slightly above their 5-year average and their P/E is at 10.8 which is about 20% underneath the 5-year average. They have a 29-year dividend streak with 16 years of consecutive growth. I’m anticipating a dividend increase on their Q3 payout and thus would like to add earlier now while down.

- I’ll also be watching Altria ($MO) to add to next week. I’m currently down 12.3% on this stock. Its yield is juicy right now at 8.67%, roughly 2% higher than its 5-year average. This company has great financials and the JUUL headlines don’t concern me too much due to the company’s limited stake in it. Similar to $CMI, I’m expecting their next announced dividend to be increased and I want to add early while down now.

Sharesight

Sharesight for Dividend Dollars followers

Dividend Dollars followers: Save 4 months on an annual premium Sharesight plan.

Already have an account?