Trending Assets

Top investors this month

Trending Assets

Top investors this month

Investing in Modern Golf

For my buy the dip contest stock pick, I am rolling with $ELY. Contrary to popular belief, this is a lot more than a golf club and golf ball company. Chip Brewer, the CEO, constantly refers to their vision for the company as Modern Golf and I am going to explain why I think they are executing this.

TL:DR - Callaway is making golf cool again and the company is executing

Callaway Golf

Share Price $20.74 (41% off 52 week highs)

Market Cap $3.83B

Mission) Merging traditional golf business and entertainment businesses to create Modern Golf

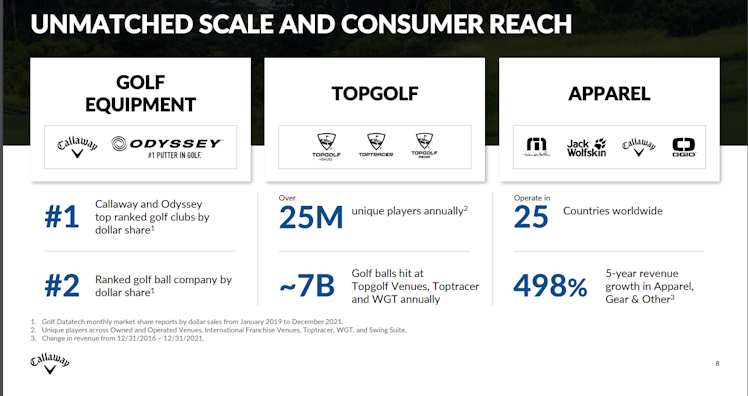

The Brands and their dominance)

Callaway, Odyssey, Ogio, TravisMathew, Jack Wolfskin, and Top Golf

Fundamentals)

From a fundamental standpoint, the company is clicking on all cylinders. On the Q1 Earnings call, they mentioned every product was up YoY. As Casey Alexander from Compass Point said on the last earnings call, "Never have we seen the fundamental performance of the company so strong at the same time the stock has performed so poorly." Most importantly for this contest, they raised guidance for the remainder of the year. Some highlights from that call and moving forward:

-Rev grew 31% compared to Q1 of last year. $1.02B vs $795M

last year

-EBITDA grew 31% as well with $170M vs $130M last year

-Raised rev guidance to $3.935-$3.970B for FY22

-Raised EBITDA guidance to $535-$555M for FY22

-Per investor day presentation, expecting 25% CAGR in EBITDA

through '25 to $800M+

Stock Buybacks and Insider Buys)

While many brands in the Consumer Discretionary sector are suspending buy backs, Callaway's board authorized it to repurchase up to $100M of it's shares on May 26th. This came shortly after doing a $50M buyback in December of 2021. In addition to the company buying, the CEO and CFO bought up $670,000 worth of shares. While this isn't the end all be all, it is nice to know the Executive team has skin in the game and is willing to put their money where their mouth is

Growth of Golf)

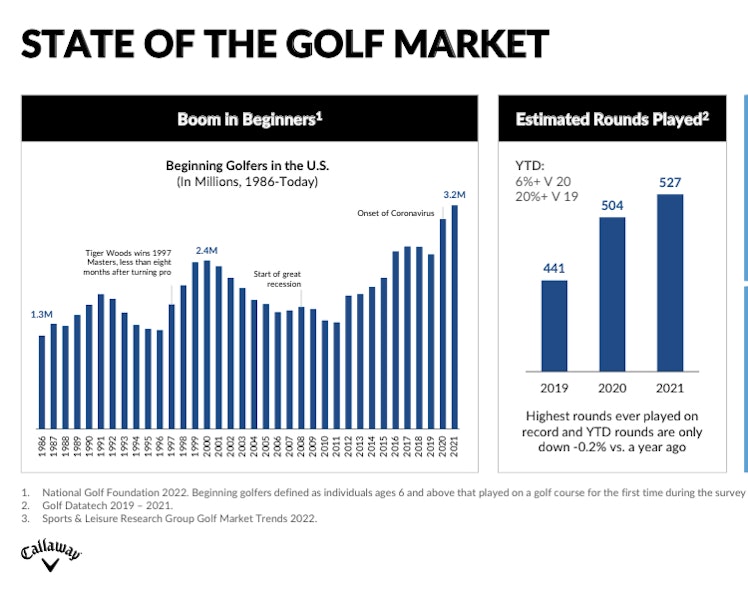

A big part of this thesis has to do with the growth of golf. While Covid acted as a tailwind for golf as a whole, Chip has continued to insist the demand is still there and this chart confirms that. As an avid golfer myself, I can confirm people are still playing a ton of golf in Florida and I have never seen courses so busy in my life

I am expecting golf as whole to get another boost from the documentary that Netflix is currently shooting that is similar to Drive to Survive. If you aren't familiar with Drive to Survive and the impact it has had on F1, here are some stats below that show it has revitalized the sport. Netflix couldn't have picked a better season to shoot than this year with the chaos of the LIV Tour, as several guys they are following have jumped ship (Dustin Johnson, Brooks Koepka, Abraham Ancer, Kevin Na, and Sergio Garcia). The Executive Producer, Chad Mumm, has already stated on Twitter that the PGA Tour doesn't have final cut rights and you can expect lots of drama. Plus, they are 3 for 3 following major champions this year with Justin Thomas, Scottie Scheffler, and Matt Fitzpatrick all winning and being a part of the show. I think this is going to be a huge hit and fully expect it to have a positive impact on golf/Callaway.

Making Golf Cool)

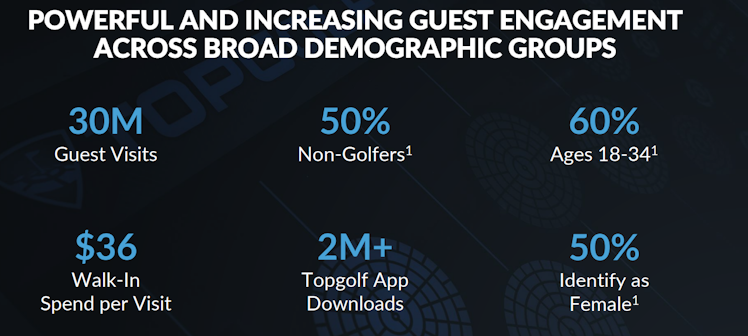

Another huge part of this thesis is the fact that Callaway is making golf cool again through Top Golf. If you search "Top Golf" on Tik Tok, you will see thousands of viral videos of people having a blast. While searching Top Golf on Twitter one time, I was shocked by the amount of girls that were tweeting they want to go on a date to Top Golf. Top Golf has managed to draw in lots of young people and make it a cool hang out spot. Top Golf mentioned this in the slide below. In addition to 50% of attendees being non-golfers, 75% of those said they are more likely to play on a course now. This is a huge cross sell opportunity with Callaway clubs.

The other important note for Top Golf is it is an extremely repeatable business model. They are adding 11 venues this year getting the owned and operated venue count to 81 with the plan to get it to 114 by '25.

Risks)

-Covid outbreak - If we get another outbreak, that could slow Top Golf bookings since they are currently forecasting high single digit growth for same venue sales over '19

-Inflation negatively impacting consumer spending on all brands

-This one is silly but I think the ticker sucks. Very few people recognize the $ELY ticker

Final Thought)

I strongly believe that Callaway is set up well for the future. They have strong brands in Callaway, Top Golf, TravisMathew, and Top Tracer that are executing and experiencing tremendous growth. Golf has been seeing a nice boom in popularity and I don't see that slowing any time soon, which should be great for Callaway.

Already have an account?