Trending Assets

Top investors this month

Trending Assets

Top investors this month

Studying the Invitae Saga

I love that Jon highlighted a point about building a community of people that want to understand specific companies better. In that example the company was Tesla, and the community was everyday people who were motivated to research, learn, and share because they felt like Tesla was doing something meaningful in the world.

Being exposed to that community and engaging yourself affords the opportunity to financially participate if you personally are convinced the company will do well.

Right now I'm doing something similar with Invitae. I think there's a possibility that $NVTA has a shot at materially improving the way we diagnose and treat diseases such as cancer (and many other diseases).

The purpose of forming a community like this is not to pump a stock and then move on to the next one, but to study, discuss, and validate your thesis on a company. As my knowledge grows, I invest more or less depending on what I learn over time.

Where I'm at in the Invitae journey now: I'm listening to every Invitae earnings call starting from the beginning and progressing to the present; kind of like how you would go back and read a series of novels in a saga. I'm immersing myself in the 'world of Invitae' similar to how you would delve into the world of Lord of the Rings or Harry Potter 😅.

This is helping me pick out the plot points in Invitae's life thus far. And thus, I have a question for the CommonStock community today about one thing I noticed:

In Invitae's Q4 2016 Earnings Call, CEO Sean George laid out this goal for 2018:

"No longer a concept story, we now focus on swift execution as we pursue both our long-term growth strategy and positive cash flow in the fourth quarter of 2018."

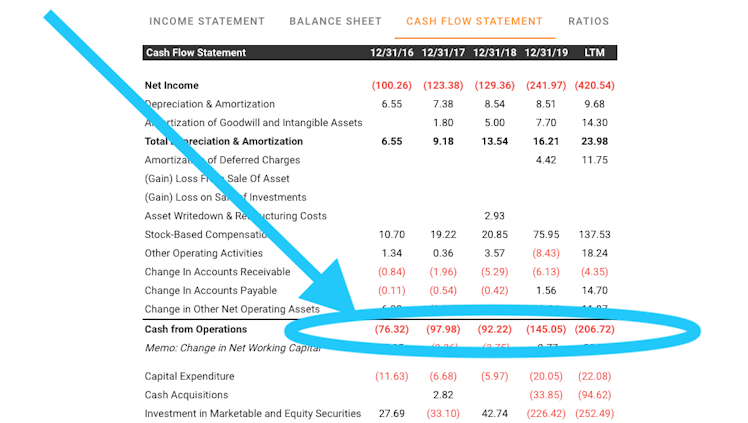

Invitae did not hit this goal of becoming cash flow positive by the end of 2018. In fact, their cash flow has only become more and more negative:

Why am I focusing on this? Because I think it brings up some interesting questions for the group:

- How important is management's character to you when you are investing in a company?

- When management states a goal and then doesn't hit it, does that matter?

And I would start off by saying it depends on whether the goal was a key driver of the investment narrative. If not, then investors will mostly shrug it off.

For example, in Invitae's case, the investment thesis is that the cost of sequencing a human genome will continue to fall so fast, that genomics testing will become a mainstream part of medical care in the next decade. By setting themselves up as a leader in the space now, Invitae will profit in the future.

Invitae's stock is much higher than it was in 2016 because having positive cash flow by 2018 wasn't the thing that would decide whether Invitae would be successful on their long-term mission or not.

Would being cash flow positive be nice? Of course. But thats not why anyone invested in the company (although, it might be why some institutional investors did, but perhaps that's why Sean George felt like he had to make that a goal in the first place even though it wasn't that important. And its also why we retail investors can make calculated bets that can increase our chances of beating institutions)

This memo is getting too long, but I'd love to ask this question of the community: You can't be cash flow negative forever. How long are you willing to invest in a company that is cash flow negative?

YouTube

Chamath Palihapitiya: Freedom, Bitcoin, and First Principles | The Knowledge Project #94

Check out my New York Times Bestselling book, Clear Thinking. It's packed with proven frameworks and practical strategies that will give you a roadmap to nav...

Already have an account?