Trending Assets

Top investors this month

Trending Assets

Top investors this month

24th May 2022 - Trading Journal

I have decided to move my Daily Trading Journal from DayOneApp to Commonstock. I hope that this may be useful to others in both it's format and the content. Writing a trading journal is a very good habit to get into and enables the writer to reflect on their thoughts, mood and bias. I will attempt to post this journal each day that I trade or study the markets in real time.

I have only just begun looking to trade actively again after a hiatus due to market conditions. I have spent all of this time studying styles that I hope will suit me. Mainly along the lines of Minervini, Weinstein & O'Neill. I have consumed a huge amount of information in the past few months and feel confident in my ability to weather this storm and be well equipped when the market eventually sees sunshine again. This is a generational moment in the markets and I want to be one of the bubble class of 2020 left standing.

- Situational awareness:

Situational awareness represents my feelings and awareness of the bias of the market going into the day. Clearly today that bias was bearish. We are in a strong bear trend, the SNAP results last night seemed to kick off a reverse to the downside. I suppose this was a bellwether or possibly some leveraged whale just blew up! Who knows...

- Pre Market Work:

I am in no rush to place trades and I have no intention of placing new trades each day. I will be selective especially in these conditions. I spent the morning doing the same routine I have for the past few days. Looking through charts on longer time frames and highlighting anything that came up that looked like it was ready. The only sectors primed for moves are Aerospace/Defence, Shipping/Transport & Commodities (Oil, Gas, Coal). I am reluctant to dive heavy into commodities as the trade is a bit long in the tooth and everyone and their auntie is trying to trade them. Once participation reaches peak then the trades will begin to fail. That said there are setups and they are worth considering with tight stops.

Mainly, I would like to spend my time identifying the stocks in Stage 1 that may move to Stage 2 as the market turns. Tech is still being decimated but there are a couple of very early signs of bottoming in $ZM also interesting bottoming forming on weekly charts in $AMPL & $JOBY. These could just as easily leg down again, only time will tell.

- Trading Day:

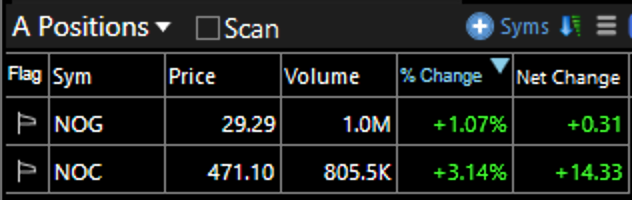

Once the market opened I used my sector lists to indentify what was holding up. $NOC was a clear RS name today and was already on my focus list with a nice VCP (Minverini) setup. My entry was more anticipation than breakout but I like the setup and the solidity in the name and sector. Also the Moving averages all converged suggest a strong setup in my favour. With a minimum 2.5:1 Risk:Reward I opened a 5% position which is quite small but I am starting slowly.

- End of day Thoughts:

I am still trying to structure my watchlists better at the moment they are a bit messy apart from the focus lists. I need to work on these. Also I have updated my TraderSync so that it is cleaner with better tags and settings. Long overdue.

I had several Shorts on watch today $COIN, $NET, $CELH all of which look like absolute manure and IMO will probably half from here but as volatility gets more crazy I am reluctant to press shorts too much and am uncomfortable holding them multiday and don't want to day trade much.

- Notes & Open Trades:

$NOG - June 17th Call $30

$NOC - 5% Stock Position : Entry $464.50, Stop $455.50

TraderSync

Track your trading performance and become a better trader

The only trade journal with AI inbuilt to help you find your edge. Available on web, ios, and android app.

Already have an account?