Trending Assets

Top investors this month

Trending Assets

Top investors this month

Q1 2023 Portfolio Update

Dear followers,

The below is a summary of the performance of our portfolio for Q1 2023.

The composition of our portfolio is the outcome of the research we conduct under the StockOpine’s Newsletter, which we share with our subscribers through our in-depth reports.

- lululemon Athletica Inc. - It’s all about branding

- From Wood to Composite: Trex's Growth and Success in the Decking Industry

- Skyline Champion Corporation – A Compelling Investment Opportunity

- Beyond the Ecommerce Behemoth: Examining Amazon's Diverse Business Ventures

- Walmart Inc. – Harnessing the Power of Omnichannel Retailing

If you wish to support our work, consider subscribing to our newsletter -> StockOpine’s Newsletter

---------------------------------------------------------------------------------------------------------------------------------------------------------

1.A note on the economy

While we do not claim to be economists, we wanted to share some of our thoughts for the upcoming year.

With the rising interest rates to compact inflation, the ongoing layoffs, the geopolitical tensions and the financial industry turbulence, we anticipate another challenging year rather than a healthy macro environment for 2023. Thankfully, recession is not here yet and a soft-landing scenario appears more possible.

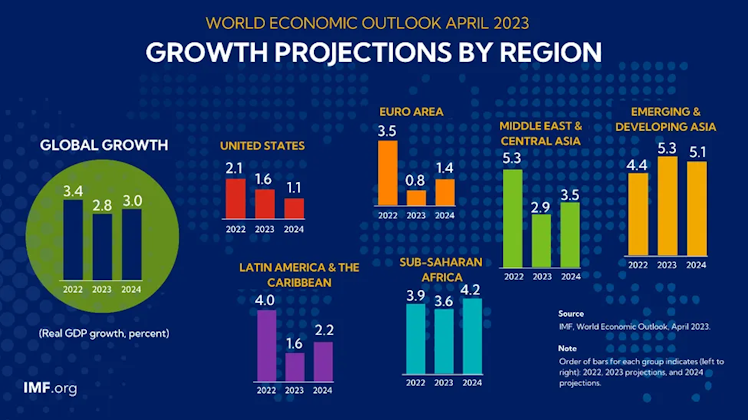

As shown in the screenshot below, the International Monetary Fund ("IMF") projects a more prominent slowdown in advanced economies like the US and the Euro Area.

Source: IMF, April 2023 World Economic Outlook

If you are interested to read more about the global economic outlook here is the link to the Overview of IMF, April 2023 World Economic Outlook report. Do spend 10 minutes to read the Foreword and the Executive Summary.

Although the macro environment is crucial and can impact our forecasts or even the timing of opening a position, our investment strategy is long term oriented. We strive to select stocks with resilient business models that can sustain economic cycles.

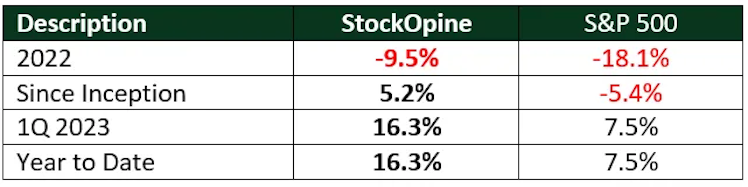

2.Performance

Our Q1 2023 and Year to Date (“YTD”) total return as of 31 Mar 2023 was 16.3% compared to 7.5% of S&P 500. As a result of the Q1 2023 performance, our return since inception (28 January 2022) turned positive to 5.2% compared to a negative 5.4% of the S&P 500 over the same period.

Source: S&P Dow Jones Indices, Broker, StockOpine analysis

--END OF FREE PREVIEW--

📝 The post can be found here.

📢 Hope you enjoyed this extract! If you did, consider signing-up and/or share it with friends. Your support will be appreciated.

🤝 As a reminder, students with an .edu email can benefit from a 50% discount (if you face any issues or you are a student without an .edu email but wish to subscribe to the paid tier contact us).

---------------------------------------------------------------------------------------------------------------------------------------------------------

Disclaimer: The content of our newsletter is not a trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient. The information provided should not be considered as a specific advice on the merits of any investment decision.

stockopine.substack.com

Subscribe to StockOpine’s Newsletter

We focus on quality companies, providing high-quality fundamental research and stock ideas. Click to read StockOpine’s Newsletter, a Substack publication with thousands of subscribers.

Already have an account?