Trending Assets

Top investors this month

Trending Assets

Top investors this month

Beware of the decline in the Dow Transports

According to Dow Theory, the decline in Dow Transports is followed by the decline in industrials. Currently, the Dow Transports index hasn't been doing too well and data from the transportation industry shows why:

High diesel prices make truckers less profitable and pickier on what routes they take. Higher employee turnover is making trucking firms less profitable as they have to dish out more money in recruiting and keeping drivers. Overall, these factors make trucking costs immensely high.

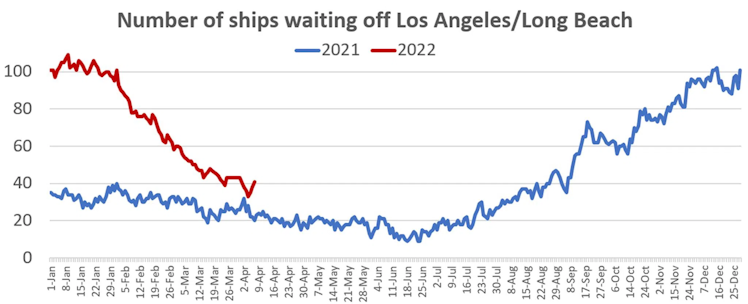

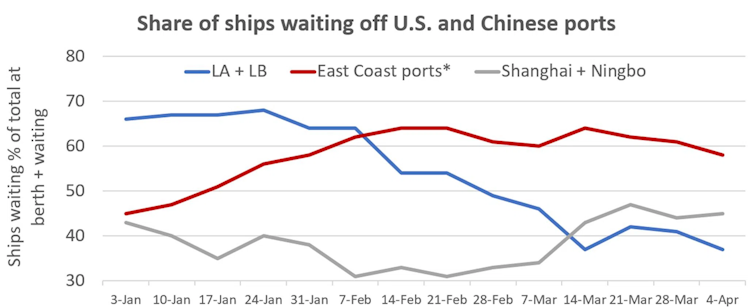

As for the cargo vessels, the lockdowns in Shanghai helped ease congestion in the LA and Long Beach ports. However, the ports on the East Coast are currently more congested than the ports on the West Coast.

Here are some charts to convey what's going on. All charts come from the Freightwaves blog.

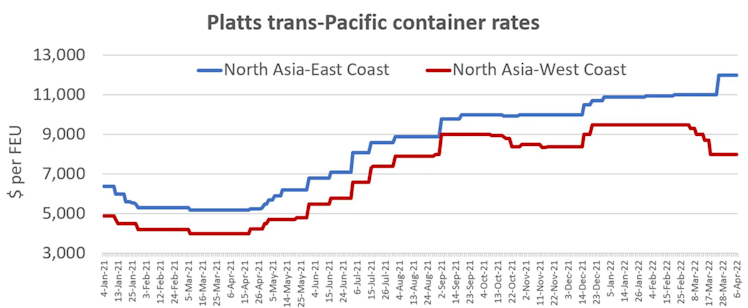

$RH CEO mentioned in his earnings call on how ocean charter prices have more than doubled and that the time it takes to offload cargo off ships has increased. However, according to the charts above, there are mixed signals when it comes to the shipping sector. Most likely, Restoration Hardware is receiving most of its goods from the East Coast.

Once the Shanghai lockdowns get lifted, the Port of LA and Long Beach are expecting huge numbers of ships coming as many firms want to get as much inventory in as soon as possible before another lockdown happens in China.

When the economy is doing well, there's high demand for transportation services. Once the economy starts slowing down, transportation services decline as the industrial companies order less inventory. This could be what we're currently seeing.

At the same time, with cruise companies and airlines receiving some of the busiest booking seasons of their operating lives, we could be seeing a massive fundamental shift in the economy from being mostly based on physical goods to services.

...we could be seeing a massive fundamental shift in the economy from being mostly based on physical goods to services.

Yep, services and experiences also. This seems to match spending patterns of Millennials and Gen Zers. I think this shift had been well underway but when COVID shut everything down the trend was halted for a bit.

Already have an account?