Trending Assets

Top investors this month

Trending Assets

Top investors this month

Finding Gems

Been kicked twice trying to write this up, so here’s a short summary and some pics. I wanted to explain why I bought $WSM this week. Before a 20% bounce after earnings. Finding quality undervalued businesses is not difficult.

Coming from Graham & Buffet, quality and stability are most important to me. This protect me from downside, and still offers more upside than most investments demonstrate.

1) Unprofitable companies are automatically eliminated. If I’m supposed to be buying future earnings, I’m going to need to see some earnings before I pony up. I’m a man of science, not faith.

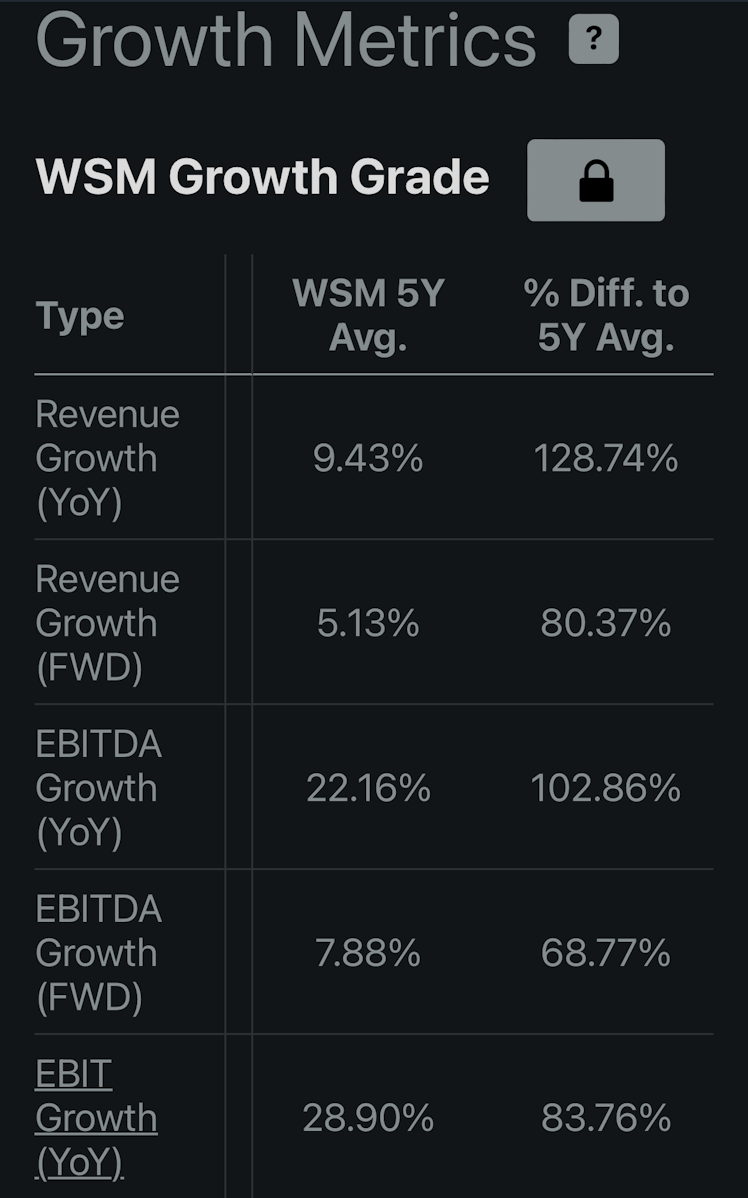

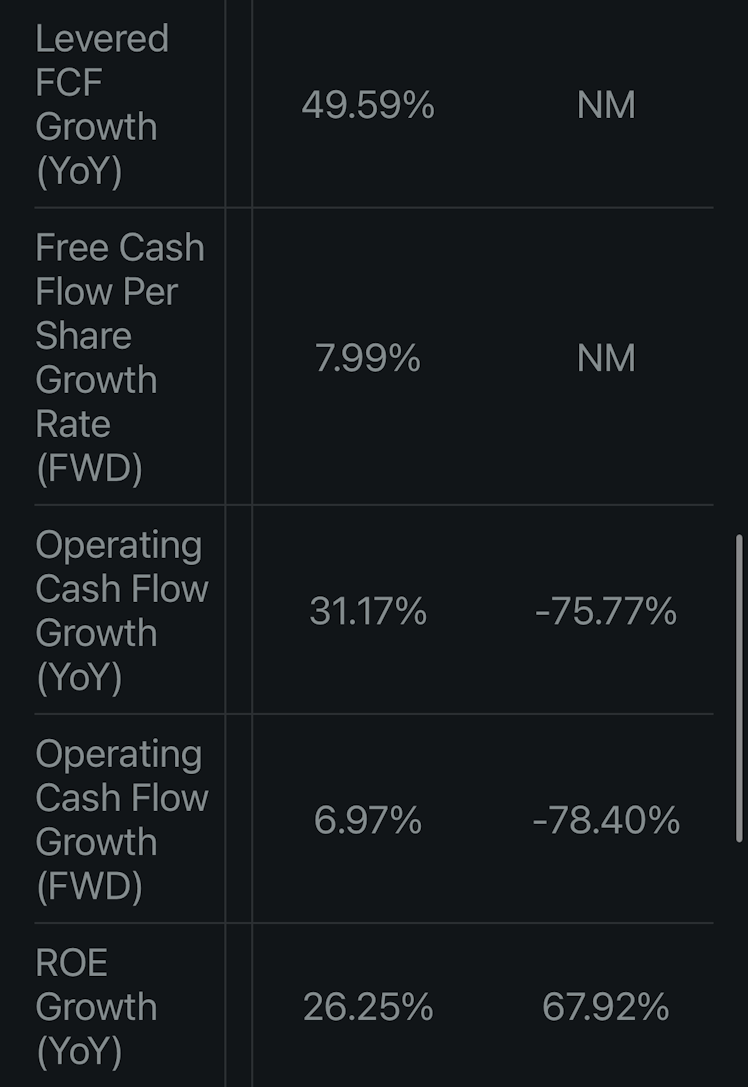

2) Negative growth rates. I’m okay with 5%-10% growth, if profitability & valuation are exceptional, but I prefer a sustainable 10%-30% growth in earnings, revenue, income, cash flow, etc., relative to peers.

3) I will not buy the most expensive (valuation, not price) stock in a sector. $AMD & $MA are perfect examples. Everything looks great, but their valuation is limiting my returns. I did add $NVDA, which clearly breaks this rule, but more as an experiment and just small positions in my kids’ portfolios.

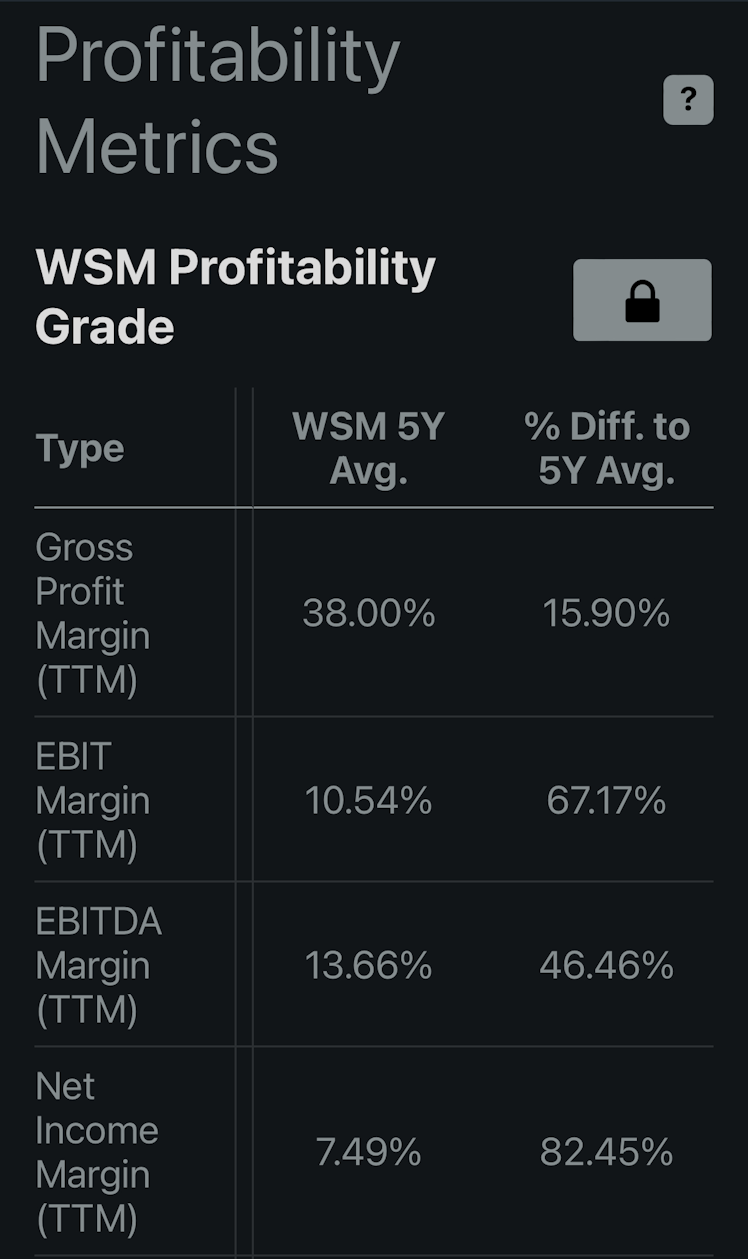

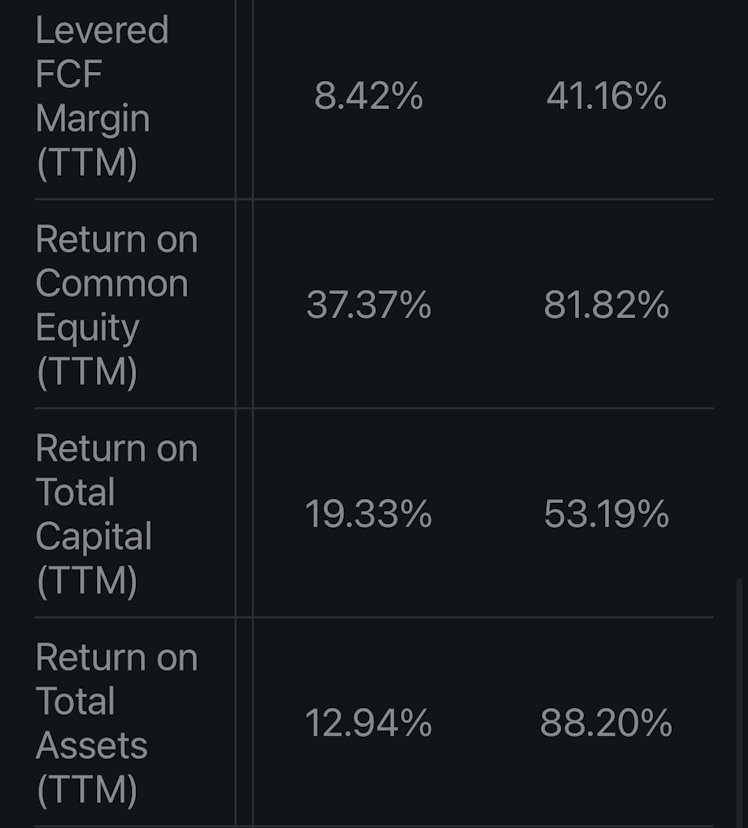

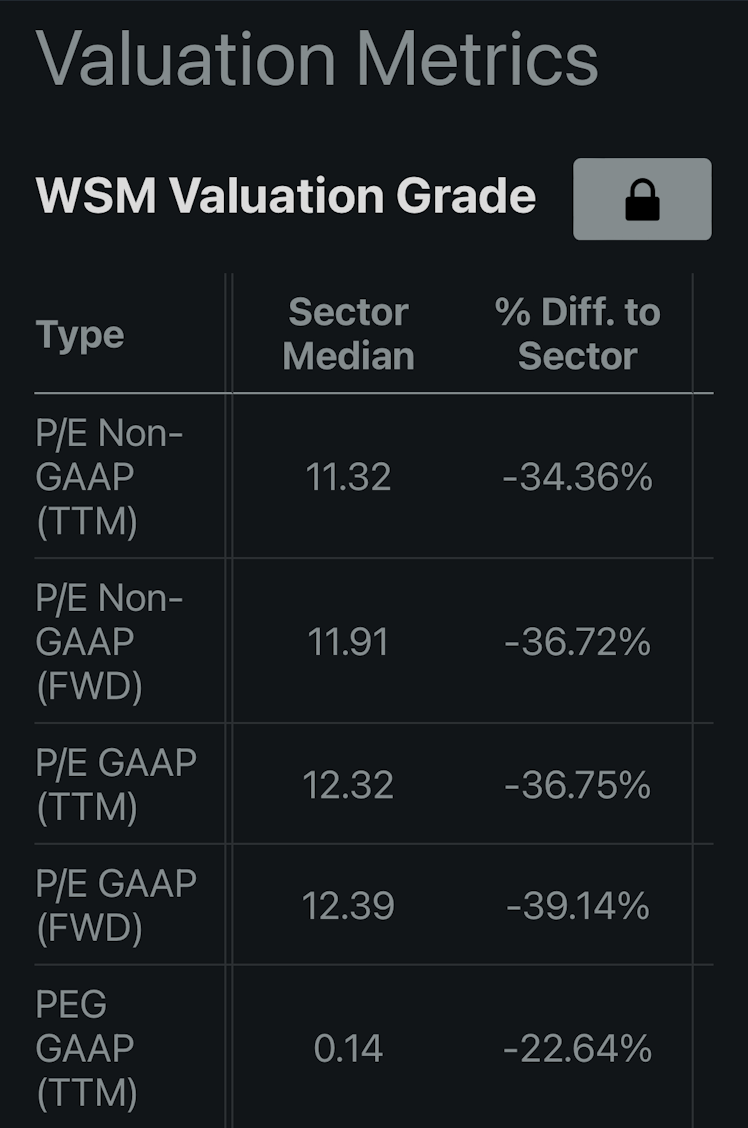

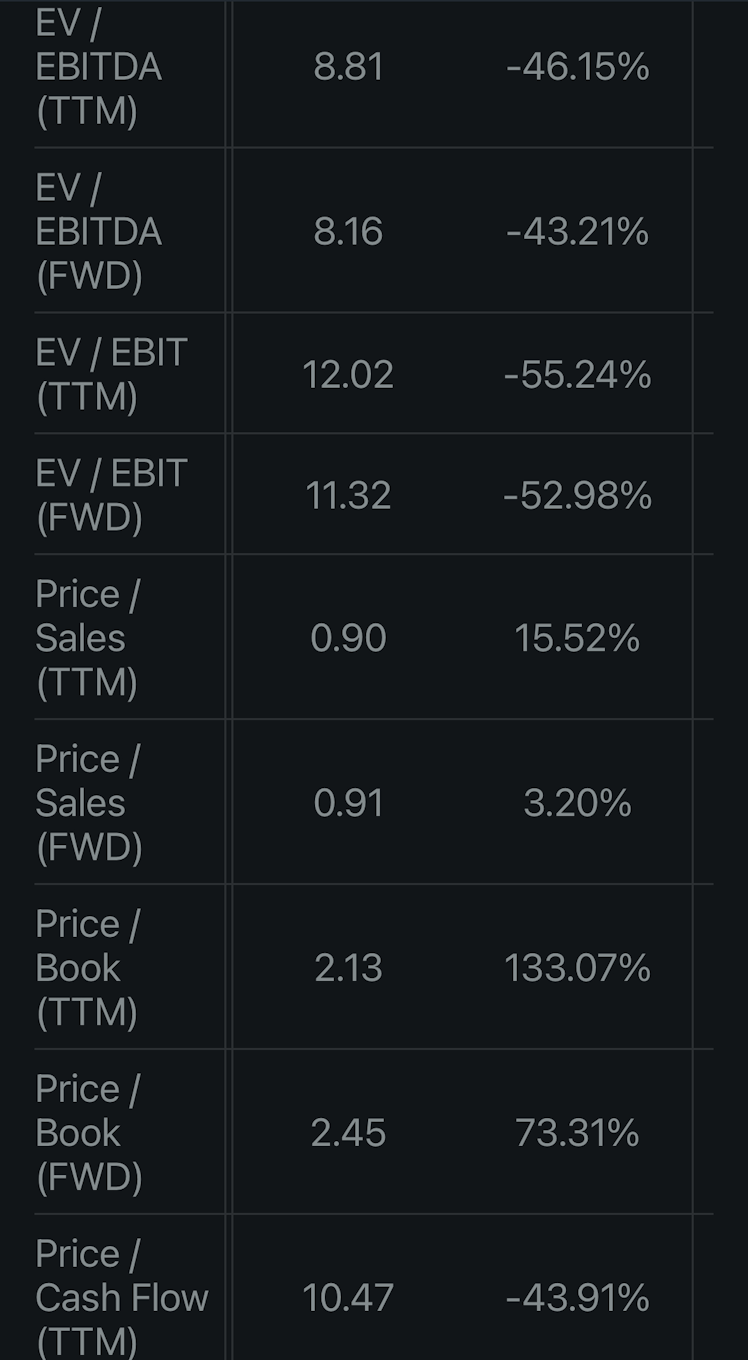

Here is some data I look at to determine performance relative to peers:

These are 5 year averages relative to peers, for profitability & growth and current comps for valuation metrics, because current valuation is what matters. They are significantly outperforming industry averages while being significantly cheaper than industry average. Analysis done🤙

Source: Seeking Alpha

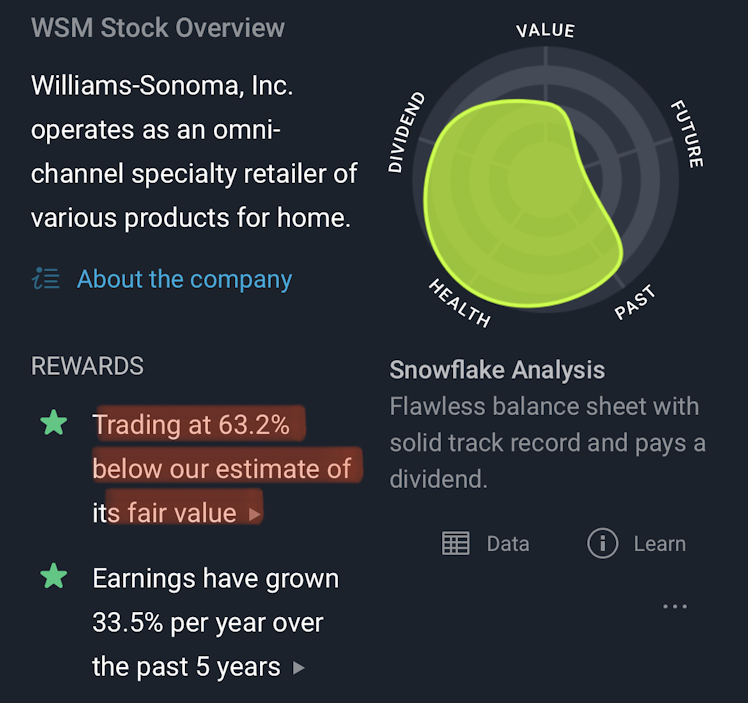

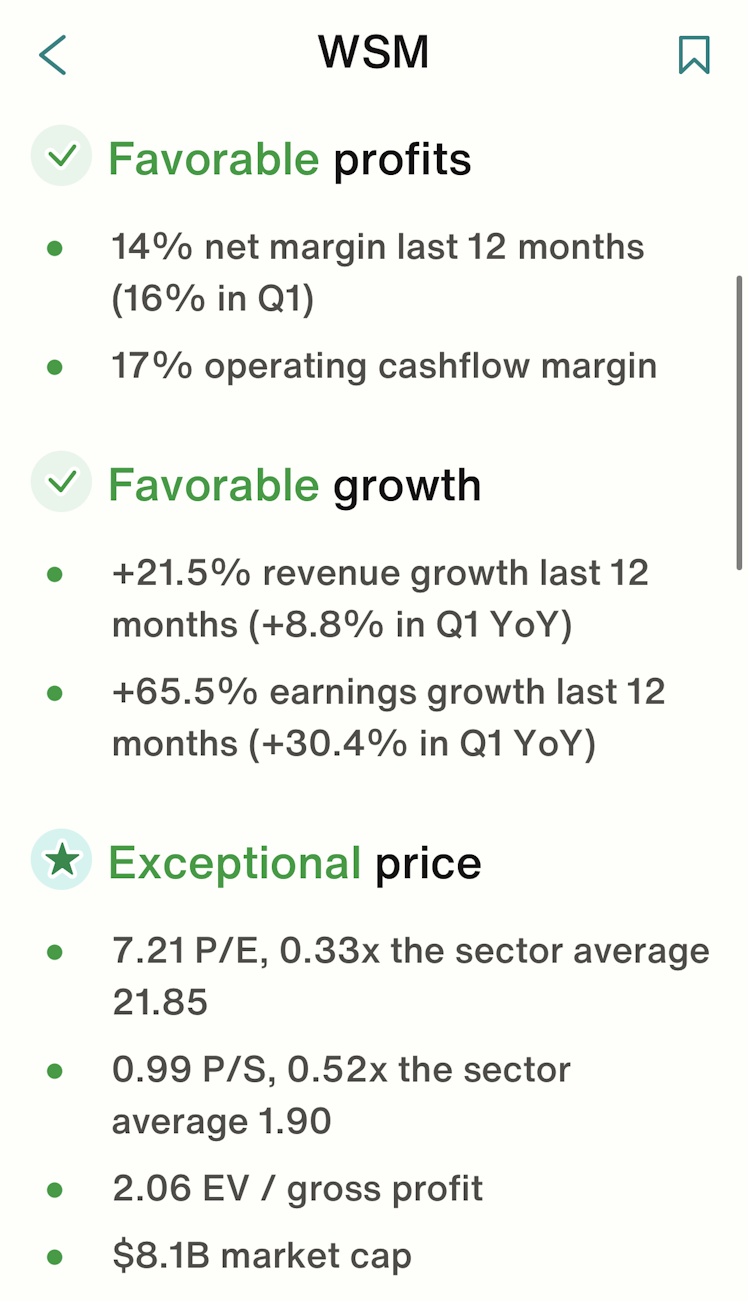

After my analysis of this and other data, I will go get a few opinions from trusted second sources that have similar investment philosophy.

Source: Jitta

Source: Simply Wall Street

Source: Bloom

This is just basically to see if everyone else agrees there IS a margin of safety, and to find any red flags I may have missed, which all three sources are excellent tools for.

Finding no red flags, excellent long term performance, undervalued in every way you can measure, is a buy all day every day in my world. I don’t care if they’re selling crack, popsicles, or teddy bears. Okay, maybe avoid the former, but the point is, performance is performance, and valuation is valuation, all the other noise is irrelevant.

Keep it simple🤙

Looks like a great company and I know my wife and I certainly have tons of their product! Great pick!

Already have an account?