Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - Looming FOMC and Retail Data

Stocks are slightly higher Wednesday as investors await the conclusion of the FOMC meeting later today. All three major averages are up at least .4% and both the S&P 500 and DJIA are looking to break five-day losing streaks. Markets are projecting a 95% chance of a 75 basis point hike today, which would be the biggest increase since 1994.

Looking at economic data today, retail sales fell 0.3% in May, shy of the 0.1% gain expected. It was the first drop in 5 months. The control group of retail sales, which most closely resembles consumer spending, was unchanged for the month.

U.S. import prices rose 0.6% in May and were up 11.7% over the past year, down from 12.5% the previous month. Excluding fuel and food, import prices fell 0.3% for the month and are up 5.5% over the past year. Export prices rose 2.8% in May and 18.9% over the past year, the largest gain since September 1984.

In housing news, the NAHB Home Builders Index fell for the 6th straight month to a reading of 67 in June. It is the lowest reading since June 2020. All 3 components fell (current sales, sales expectations, and buyer traffic) with buyer traffic falling into negative territory for the first time since June 2020. Elsewhere, MBA mortgage applications rose 6.6% despite the average interest rate of a 30-year conforming mortgage increasing 25 basis points to 5.65%.

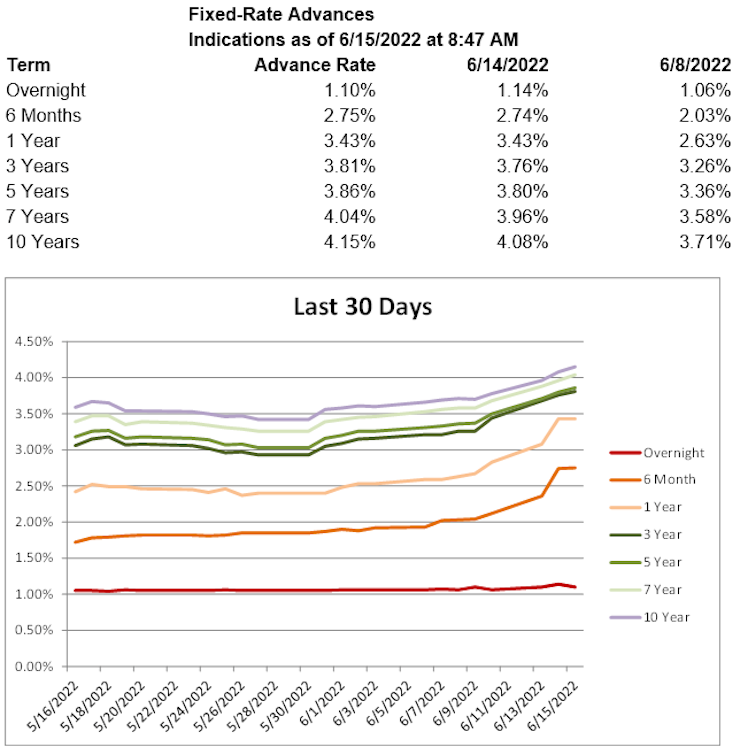

U.S. Treasury yields are lower, with the 2-year Treasury yield down 8.7 basis points to 3.35%, the 5-year Treasury yield down 9.6 basis points to 3.50%, and the 10-year Treasury yield down 8.3 basis points to 3.40%. Advance rates are mostly lower today.

Already have an account?