Trending Assets

Top investors this month

Trending Assets

Top investors this month

"A Freight Recession is Imminent" says Freightwaves

Amid the supply chain crisis, transportation companies have been firing on all cylinders. With a flood of orders, transportation companies have been able to charge more for their services.

For the railroad companies like $UNP and $CNI, they've been able to charge clients storage fees since they didn't have enough space in their trains to transport all the goods that needed to be shipped.

As for the cargo ship companies, they were able to charge a lot more for contracts. $RH CEO was notable for talking about it in his earnings call about inflation.

And for the truckers, it's a mixed situation. With a tight labor market, they have more negotiating power than ever. However, with higher fuel prices, more routes are becoming unprofitable for truckers and companies are either stepping up and offering more pay for truckers or are choosing to wait out for a possible freight recession.

Freightwaves, a notable blog that covers the transportation sector, has a great track record of predicting the future movements of the sector. They're predicting another freight recession coming soon. Here are a couple of quotes that explain their thesis:

"The typical trucking cycle is three years and usually what kills it is oversupply – too many trucks chasing high-paying spot freight and high load volumes."

"The problem is that capacity expansion always continues well past the peak and can even continue for a time after the market has entered a recession."

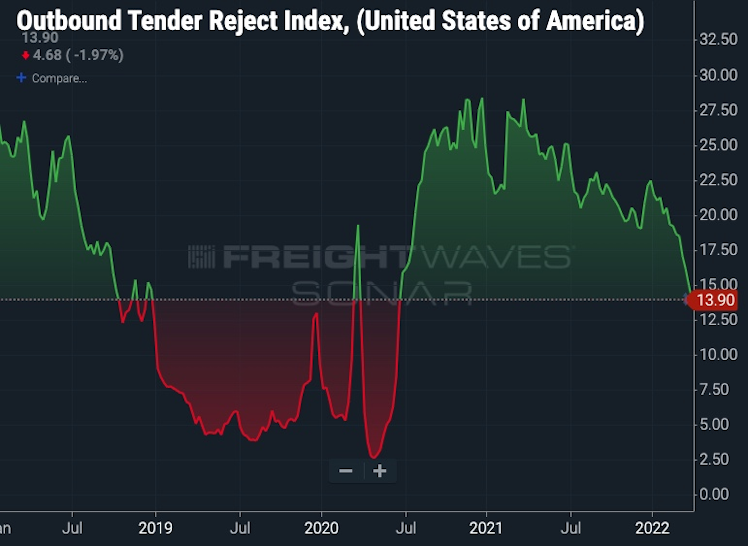

The core of Freightwave's recession call is the tender rejection rates. This measures the willingness of truckers to accept or reject a load. If the rejection rate declined, it means that capacity is loosening.

This is the chart that Freightwaves posted. it looks like truckers are receiving less business now and could see themselves enduring conditions similar to that of the pre-pandemic and early COVID economy.

It's important to note that March is usually the time when truckers receive the most business. This March however hasn't been too hot. Retail stores seem to be less serious about stocking up their shelves for the summer. A weak March implies a weak economy for the rest of the year. That's how important March's data was.

To conclude, it's possible that we could be seeing a freight recession in the near future. Trucking companies are going to be the most impacted. Cargo ships continue to have pricing power as ports continue to deal with the massive line of ships and trains will be seeing less revenue from storage fees.

FreightWaves

Why I believe a freight recession is imminent

FreightWaves Founder and CEO Craig Fuller provides further analysis regarding the decline in the freight market.

Already have an account?