Trending Assets

Top investors this month

Trending Assets

Top investors this month

My "buy the dip" pick is Stanley Black & Decker $SWK

When people hear the name "Stanley Black & Decker", people commonly associate it with power drills and other hand tools. But for those that love dividend aristocrats, dividend champions, and dividend kings, Stanley Black & Decker is a stock you might be interested in.

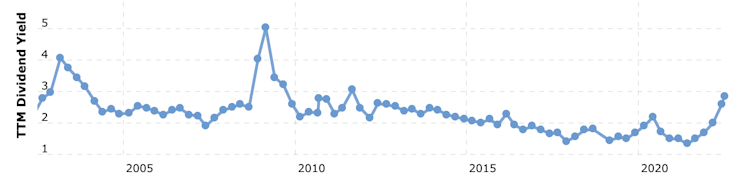

$SWK has raised its dividend for 54 consecutive years. Its current dividend (at the time of writing) is 2.91% and its PE ratio is 13. For perspective, this dividend yield is much higher than what the stock normally offered investors in the stock market for many years.

Source: macrotrends

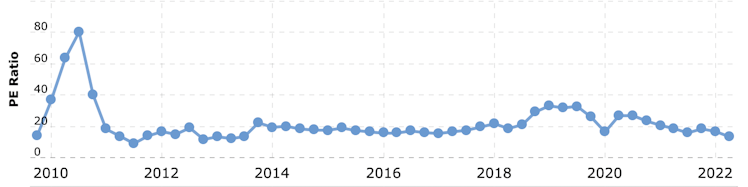

Meanwhile, its PE ratio is near a historic low.

Source: macrotrends

Stanley Black & Decker's business is both B2B and B2C. Their primary products are power tools. For this memo, we will be focusing more on the B2B aspect of the business since that's where the company will be sourcing most of its growth from. Outside of that, they sell outdoor power equipment and industrial equipment, and fasteners (aka bolts). Since the majority of its revenues are from the US, for this memo, we will focus on the economic conditions of the US.

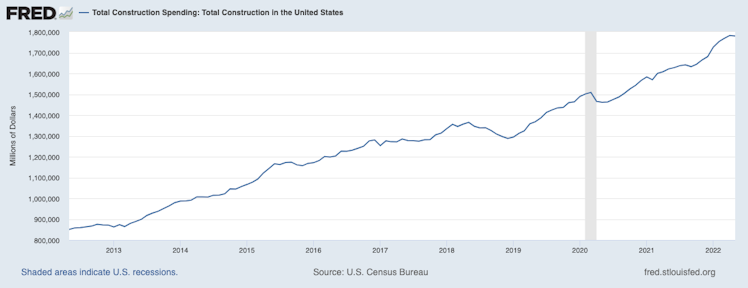

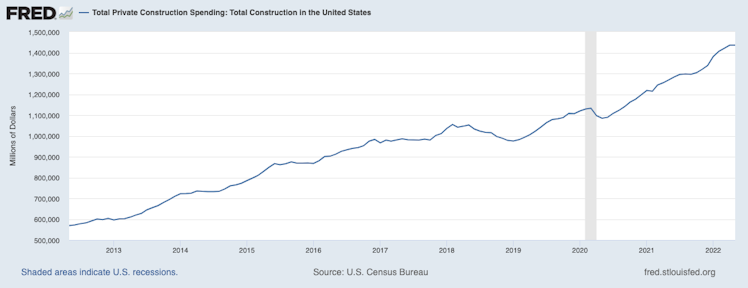

The business is closely tied with the construction industry. With more construction spending, there are more construction projects and thus more demand for power drills. According to FRED, construction spending as a whole in the US continues to grow year over year.

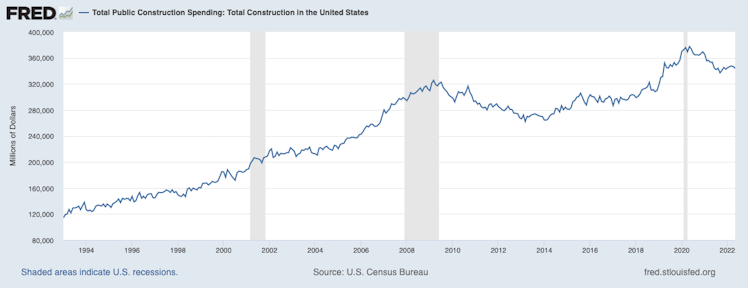

Some of the rise in construction spending can be attributed to inflation and the extra costs that came with supply chain issues. Importantly, most of the growth isn't driven by public construction spending, but rather, private construction spending.

Regarding public construction spending, since the start of COVID, the US government has been spending less on construction because they had to allocate more resources towards unemployment and economic stimulus. As we've gotten past COVID, the government is looking to boost infrastructure spending to sustain economic growth.

As for private construction spending, despite COVID, spending has continued to soar. This is good because it shows that the private sector has optimism about the future. At the same time, this is bad because if a recession does happen, then construction spending from the private sector would plunge.

Overall, with growth in construction spending, Stanley Black & Decker is expected to continue seeing demand for its power tools grow throughout this year.

Outside of Stanley Black & Decker's main business, the company has other growth catalysts.

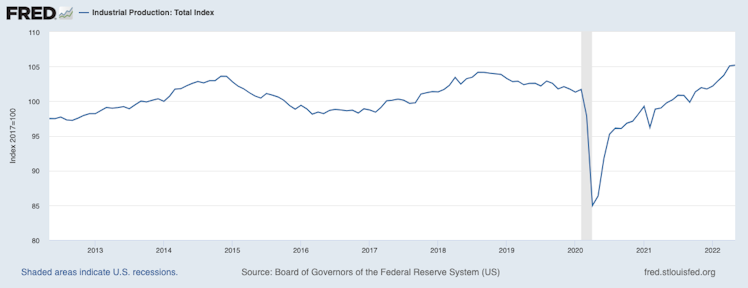

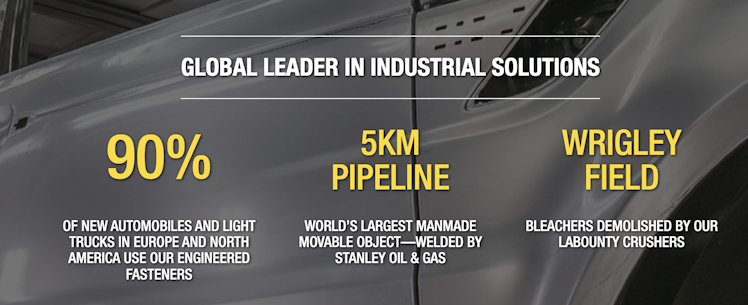

One of the biggest growth catalysts that Stanley Black & Decker has is the rapid rebound of its industrial business. This business division sells tools, equipment, and fasteners to factories. Looking at the industrial production levels in the US, the months of April and May have seen record industrial production for the US and with that, it's assumed that the trend will continue.

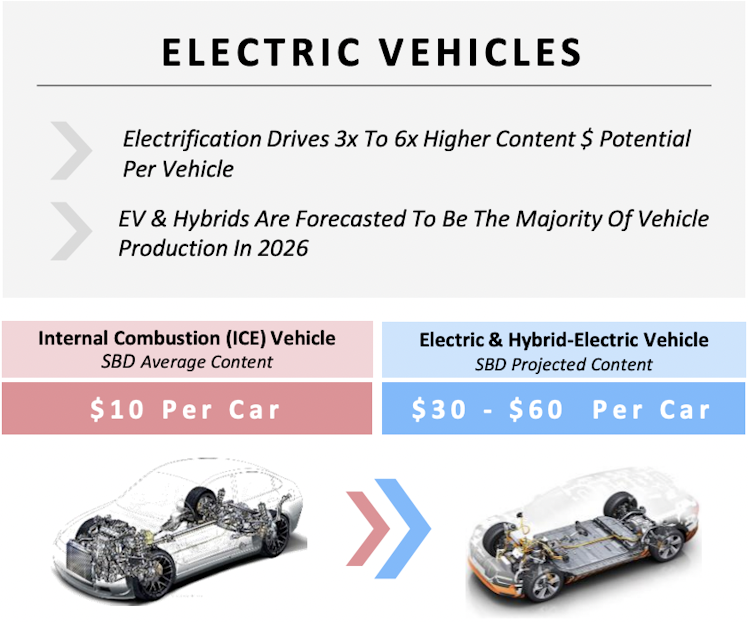

Stanley Black & Decker benefits from the growing demand for vehicles. With a massive car shortage (that's starting to look like its ending) and the immense demand for electric and hybrid vehicles, Stanley Black & Decker will see its income from its industrial business grow.

According to their recent investor presentation:

Stanley Black & Decker makes money on nearly every car produced globally through the sale of its fasteners. For those that are wondering what a fastener is, here's a screenshot of what they are (credit: Google)

In short, fasteners bring immense recurring sales for Stanley Black & Decker. As more cars are produced, Stanley Black & Decker is producing and selling more fasteners to them. This can also be applied to many other items that are produced in factories like washing machines, furniture, etc. $SWK directly benefits from a rise in industrial production.

And speaking of growing demand for electric and hybrid vehicles, according to their investor presentation, Stanley Black & Decker sees their profits from each vehicle produced to double to even sextuple! The reason being is that electric and hybrid vehicles require more fasteners than traditional ICE vehicles, even though ICE vehicles come with more moving parts.

Credit: investor presentation

For the ESG crowd, Stanley Black & Decker is a fantastic ESG stock pick. There's more to the business that looks ESG friendly than the fact that they provide fasteners to electric and hybrid vehicles.

Being in the outdoor power equipment market, Stanley Black & Decker is benefiting from the growing demand for electric lawnmowers and leaf blowers. If every state does choose to enact the ban on the use of gas-powered lawnmowers and leaf blowers, Stanley Black & Decker will see immense demand for their outdoor power equipment. But for now, it looks like policymakers will focus on banning the sale of gas-powered outdoor power equipment. California made a law that would ban the sale of gas-powered lawnmowers and leaf blowers after 2024. More states could follow California as the emissions that come with gas-powered outdoor power equipment are immense.

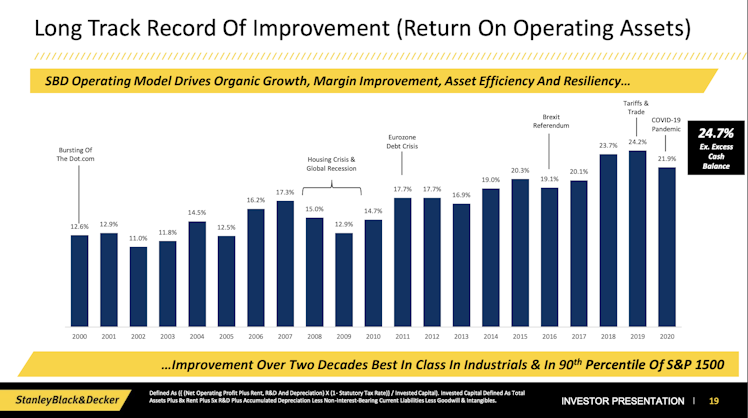

With all the uncertainty looming around in investors' minds over issues with food, energy, war, supply chains, inflation, etc. investors during these times want to put their money on management teams that they can depend on to guide them through the gas and make them money. Stanley Black & Decker has demonstrated that quite well over the past several years.

From their investor presentation, management has shown that despite hard times, they have been able to maintain or even increase their Return on Operating Assets. Over the years, management has been able to boost the efficiency of the use of their assets.

And don't forget that despite the macroeconomic issues that management had to go through, they've continued to raise their dividends. Revenues may have dropped in some years, but those drops were temporary.

When looking at the changes in Stanley Black & Decker's executive team, sure, the company has undergone a couple of changes throughout those years, and despite having different management teams, the business has shown its resilience. The business has been able to improve its efficiency despite the adversity of the macro environment.

Another thing to note is that during this year, Stanley Black & Decker has sold two non-core businesses. For their security business, they sold it for $3.2 billion. As for their automatic doors business, they sold it for $900 million. By selling these businesses, Stanley Black & Decker will be seeing immense growth in their cash balances once the sale of these businesses gets completed. At the same time, selling these businesses makes management more focused on their core businesses, which is something investors love.

In sum, I believe that sooner or later, the market will see Stanley Black & Decker favorably because the business has directly benefited from the growth in construction spending as well as industrial production. Also, since the majority of the company's sales are in the US, investors will feel better about investing in Stanley Black & Decker compared to a business that sources most of its sales from the international markets because the economic situation in the US is much better compared to the economic situation in Europe and elsewhere.

And finally, $SWK directly benefits from the world's push towards reducing emissions. Its newest products will appeal to both regulators (who want to reduce emissions) as well as consumers (who want to be able to comply with the regulations while also getting a better tool). At the same time, many of the innovations that other companies are making that relate to promoting the environment (like automakers and electric/hybrid vehicles) will be needing more fasteners from Stanley Black & Decker.

www.prnewswire.com

Stanley Black & Decker to Sell Access Technologies Business for $900 Million in Cash to Allegion

/PRNewswire/ -- Stanley Black & Decker (NYSE: SWK) today announced it has signed a definitive agreement for the sale of its automatic doors business, Access...

Already have an account?