Trending Assets

Top investors this month

Trending Assets

Top investors this month

Braze $BRZE - Customer Engagement SaaS

One stock that I haven't seen talked about much is Braze. They went public a few months ago, and have the rare combination of recording 50%+ sales growth, as well as Free Cash Flow generation. Braze is a customer engagement software platform consisting of multiple apps that

The company recorded strong earnings results yesterday. Beat and raise on the FY guide. Very impressive if you ask me - especially when their business is tied to selling B2C companies that are getting hit by the macro.

Here are a few metrics:

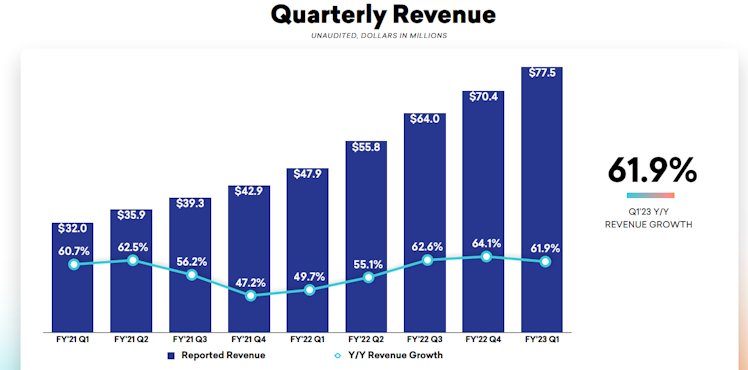

- $310m annual run rate based on a $77.5m rev this Q1

- 62% YoY sales growth

- 127% Dollar Net Retention

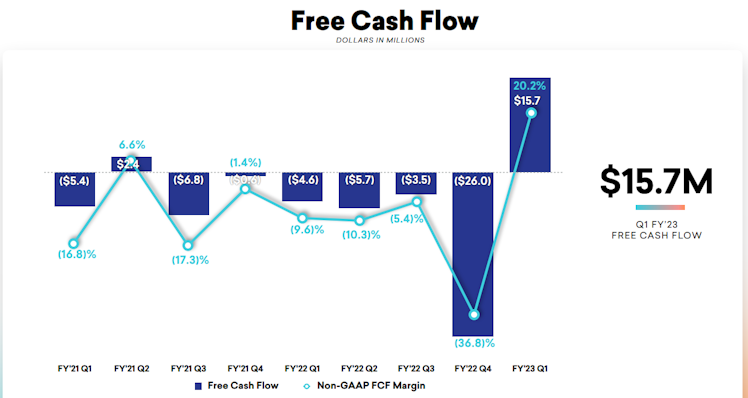

- GAAP negative at -$40m but FCF positive at $16m as of last quarter

The customer engagement space is littered with a lot of businesses. Competitors include big ones like Salesforce and Adobe, perhaps more direct large stocks like Hubspot, and then some emerging private market businesses.

The category is characterised by a more human-centred granular marketing software that drives tangible results in customer engagement, marketing, and retention for B2C companies.

Case studies from Braze and other emerging platforms show that this works with serious ROI. Quality and reviews by users have been stellar on G2 Crowd and Gartner. It is Founder and CEO led by an MIT grad who's been building the business for over 12 years.

While there's no way to know how the private market competitors are doing on cash, it's worth noting that Braze got lucky going public before a lot of this mess. With substantial cash on that balance sheet and with very disciplined growth/profit metrics, it's very compelling. Importantly, this moderate FCF generation or burn gives them a strategic advantage against younger competitors. Competition definitely exists, making things a little murky, given this player is very young in a young and expanding market opportunity. But that comes with a long growth runway to go here.

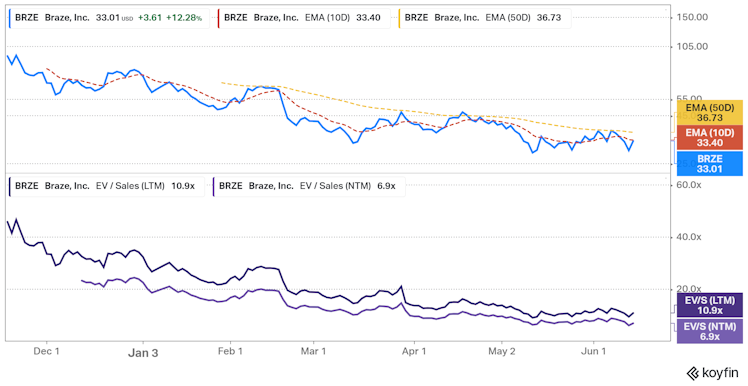

I've been long two quarters and plan to stay long due to the confidence expressed by the team on the durability and value add of the software for their customers. It's looking like a resilient business, one that's more than equipped to handle a recession. Trading at 6.9x NTM EV/S.

Source: Q1 Investor Presentation here: https://s28.q4cdn.com/756779097/files/doc_financials/2023/q1/Q1'23-Earnings-Presentation.pdf

The Q4 FCF was marked by several big costs, including many seasonal one-offs.

Source: Koyfin

Worth a look!

Disclosure: I'm long BRZE.

Already have an account?