Trending Assets

Top investors this month

Trending Assets

Top investors this month

Planet Labs $PL - A Microthesis For Shoebox Sized Satellites

Planet Labs ($PL) is a publicly traded satellite company that sells geospatial data through its own software and various APIs etc. They do it cheaply and efficiently, enabling completely new buyers of geospatial data to actually access it without paying for it with extremely expensive licenses. That opens up new government use cases, agriculture, forestry, disaster response, and more... see some customer stories on their website here.

Their last big customer win was the German government, which bought data for about 400 federal locations and access points to monitor a variety of things from space, daily.

So, satellites you say?

Yeah, about 200+ and counting proprietary satellites in orbit right now that provide high-frequency imagery of the earth every day, beamed down to their central repository of data, which is then sold to customers via third-party platforms, APIs, and their own software. As you might've figured, one image can be sold multiple times. So data and $$$ revenues are scalable as long as # customers scale. That is inherently gross margin expansionary as costs for taking new images are incrementally small once a satellite is in space. That said, Planet Labs is still investing in launching more sats of varying capabilities offering a stronger network coverage and value proposition to customers.

The edge?

While their satellites vary in complexity, many of their satellites are actually the size of shoeboxes, weighing about 5kg a piece. When launching objects into space is extremely expensive, weight and size matter a ridiculous amount. The company is led by an ex-NASA guy, a chap who happened to do his PhD at Oxford under Roger Penrose, and he has seemingly put together an all-star team. The unit economics on satellites seem to work, and they've been showing a steady trend toward a high-gross margin business. From my research, no competitor has got their tech/cash/team balance right for exponential growth. I analyzed BlackSky, Satellogic, and Maxar, among other established geospatial players like Airbus and software-only platforms like Orbital-Insights. I was also particularly impressed with Planet's own software product providing an all-in-one solution that's not just data, but a piece of interactive UX design too:

Source: Investor Presentation

It's not quite a Bloomberg Terminal yet, but more like a cheaper dashboard like Koyfin. I had free access to the Beta and checked out satellite shots of a snowy landscape I crossed through in April 2022, when I was on a trek at the Annapurna Sanctuary in Nepal. It was very impressive.

Pair that product quality, vertical integration, and unit economic strength with a good salesforce. The ex-go-to-market head of Autodesk is the main sales lead, and recent sales momentum is showing. In addition, the company has a healthy enough balance sheet with years of cash funded, and the pieces of the puzzle have come together for a potentially exponential pure growth company.

The Numbers

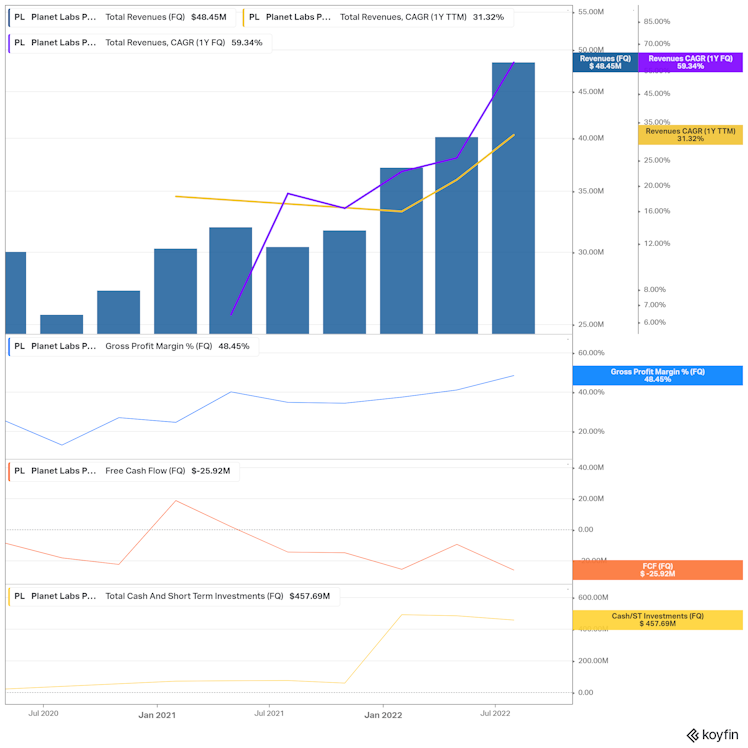

The following charts show revenue, revenue growth trends, gross profits, free cash flow, and balance sheet cash across the past few quarters.

Revenues have accelerated marking 59% YoY last Q, Free Cash Flow burn is completely under control considering the balance sheet of $450m in liquidity, and as I said, the gross margin is expanding. Apparently, the 3-4 year target is aimed at 70%+ or so. That'll enter into software-like margin territory.

On the downside, revenues are dependent on big contract wins. It's not a pure subscriber-based SaaS, due to the complexity of the product and varying data stacks or features that are needed by customers. So they have varying sales models and are relatively hush about prices. This is understandable when dealing with governments and policy-like corporations. Other downsides include cash burn, which of course, meant a valuation rerating downward this last year considering interest rates. Competition seems covered but can always be a negative factor in the near future considering the pace of innovation in the geospatial satellite industry.

Valuation

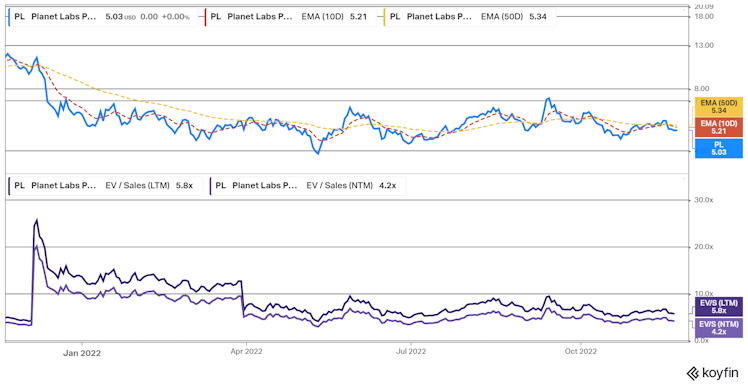

Alright, so 4.2x on the Next Twelve Months' EV/Sales is not the cheapest ask for a cash-burning, tech company in today's environment. I think the differentiator for me was entirely the competitive analysis where Planet seemed to be the best positioned across product quality, unit economics, financials, management, and more. And with that, the geospatial data market is expanding rapidly, thanks to a massively declining cost curve on satellite launch costs (thanks to daddy Musk, RocketLab, and other launchers). The declining satellite launch costs help make this new data avenue available to far more use cases than before due to previously prohibitive licensing costs.

Planet Labs seems to be leading the charge in this new part of the opportunity as geospatial data moves towards that mid-market. The tech isn't the highest or most sophisticated, but it is exceptionally innovative on the baby satellite front that "does the job". The company's mission is to democratize earth data after all, and that starts with costs. The team is quality all around and is targeting the right part of the market at the right time, offering the right product.

I am factoring in a high probability of multi-year 40%+ CAGR on sales, and a pathway to 65-70% gross margins in coming years. By 2025, FCF generation is entirely possible. It's not bad now, and there's enough runway to expand even in this environment. Importantly, Planet was extremely lucky to raise capital at the right time during the market euphoria of 2020-2021.

Conclusion

So high risk, high reward. Many unknowns, specifically the exact cost advantage vs competitors and revenue predictability. But this small company is my bet for the entire geospatial data space, which is surprisingly crowded. Here's a summary of my bullish points:

- Widening moat, the scale here expands the moat further

- Innovative product-market fit thanks to baby low-cost satellites

- Financials are in check, unlike many ex-SPAC competitors; bigger competitors don't have the nimble tech yet

- Margin expansionary

- They "get" sales, led by the guy who did Autodesk's go-to-market before

- Sales acceleration, margin expansion, general business momentum

- Clients are in relatively less macro-cyclical sectors: governments, forestry, and agriculture that don't depend on consumer trends so much

I'm long $PL. Very cool company, somewhat punished by markets, but is more than holding ground in this environment. In fact, it's one of the rare businesses delivering better-than-expected performance compared to its original SPAC ambitions. I think it's a compelling opportunity in small-cap tech. About <$1B in enterprise value about now. Potential 5x in 5 years in my view if things go well.

Planet

Customer Stories | Planet

As a leading provider of geospatial data globally, Planet equips customers across markets and around the world with the information they need to make the decisions that matter.

Lots of potential in this name. Got a lot of good things going and a great founder team

Already have an account?