Trending Assets

Top investors this month

Trending Assets

Top investors this month

Commodity Super-cycle's Temporary Setback

Commodities have suffered a brutal smackdown the past few weeks, leaving many feeling a little lost and confused. No doubt commodity investors recognized the impact a potential recession could have on demand, but the speed of the descent in equity pricing caught most off guard. It's one of the biggest clichés in markets:

“Stocks take an escalator up, and an elevator down”.

Cliché or not, it's the truth - and a truth that was difficult to take for believers in the 'Case for the Copper Bull'.

I enjoy being a commodity investor because every single day I am aware of the role they play in my daily life. One of my favourite Twitter accounts is Neil Ringdahl's, a mining engineer/executive in Honduras. Neil frequently posts images of mining activity and he has some interesting stories he shares, including one regarding the Alphamin Resources tin mine in the DRC. Neil knew the helicopter pilot initially scouting the mine who faced ground fire while doing so. Many of the goods we rely on everyday were sourced from dangerous places, the result of child labour, poor working conditions, or environmentally unfriendly practices.

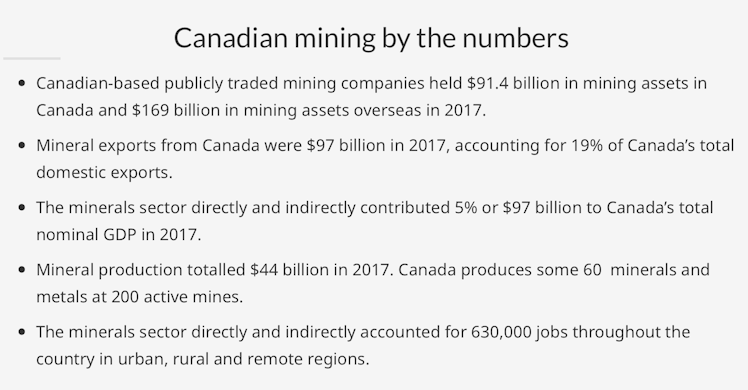

One of the things I hope to accomplish through my posts here on Commonstock is increasing awareness and appreciation of how much energy and metals have done to raise our standard of living. Other countries aren't so fortunate and the Western world should work to make energy poverty a thing of the past, not only in North America & Europe but across the world. North American mining and energy regulations are world-class and something to be celebrated. Unfortunately, with a lack of investment here, we may face increasing shortages resulting in higher prices for consumers, and an increasing level of energy poverty ourselves.

Though I am choosing to discuss copper equities in this post, I hope you will take a minute and watch this video. You may think differently next time you fire up your gas stove, fuel up your vehicle, or reach for a bottle of water:

This morning the Chinese government announced a potential $220B stimulus plan to spur infrastructure investment in the country and the price of copper rose ~4%. Let's just say I am glad I bought the dip and didn't sell any of my conviction picks, despite the panic I felt watching the share prices tank. There may be some bumps in the road, but my initial post on May 3rd regarding "The Case for the Copper Bull" continues to play out, and Jeff Currie of Goldman Sachs agrees:

From today's edition of the Globe & Mail:

Scotia Capital analyst Orest Wowkodaw thinks “the risk-reward proposition for the mining equities remains reasonably attractive.”

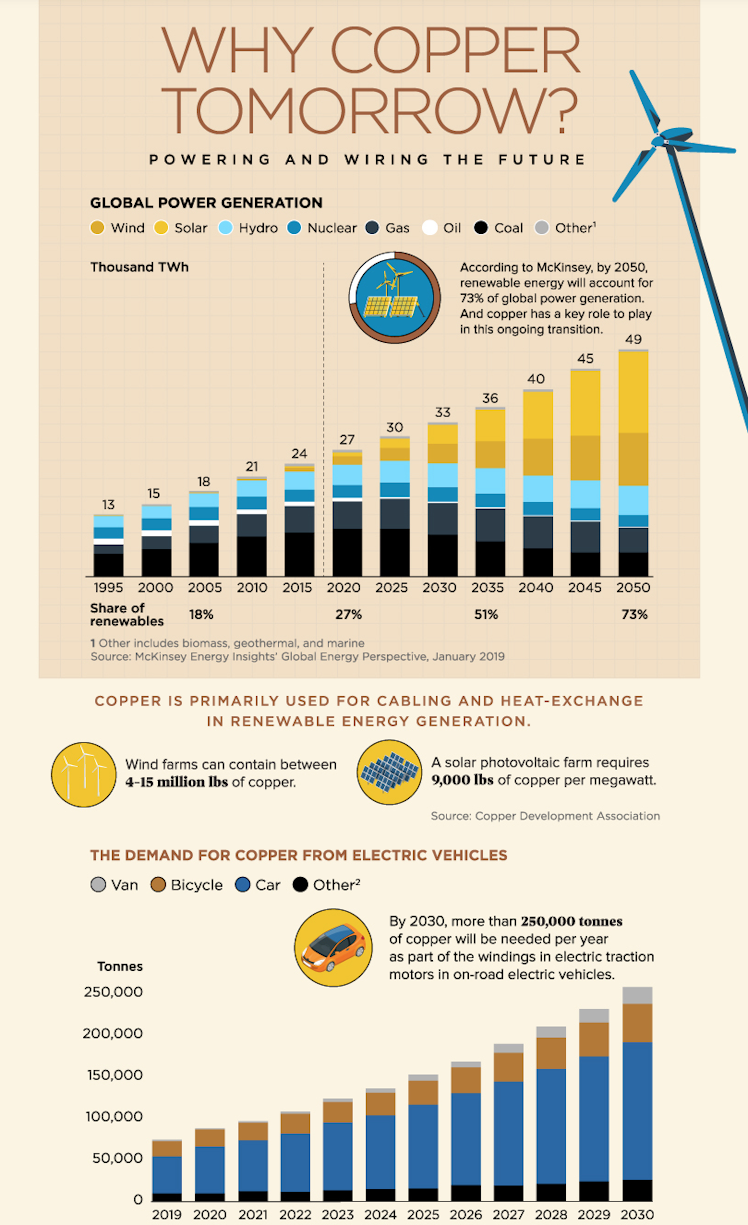

“Escalating global macroeconomic concerns from ongoing pandemic lockdowns in China and the impact of rising interest rates and higher energy prices in ex-China markets (which are stoking recession fears), have placed significant downside pressure on most commodity prices,” he said. “Due to weaker demand expectations, we now see most major commodity markets shifting towards a near-term balance or a modest surplus position which is likely to weigh on prices. Despite this uncertainty, we do not anticipate a complete collapse in near-term commodity prices given that visible inventories are low and are projected to remain at reasonable levels until large structural market shortages arrive. Moreover, the supply side also remains under considerable pressure. In the medium to long term, we continue to anticipate the emergence of a new commodities super cycle driven by growing demand from global decarbonization efforts to address climate change amplified by the impact of severe underinvestment in new production capacity.”

“Among the base metals, we continue to prefer copper exposure given low inventories and our forecast of a reasonably tight near-term market, before transitioning to a large medium-term structural deficit due to supply erosion,” said Mr. Wowkodaw. “We also anticipate copper to be among the biggest beneficiaries of global decarbonization efforts."

$TECK.B remains Scotiabank's top pick and one of my copper holdings.

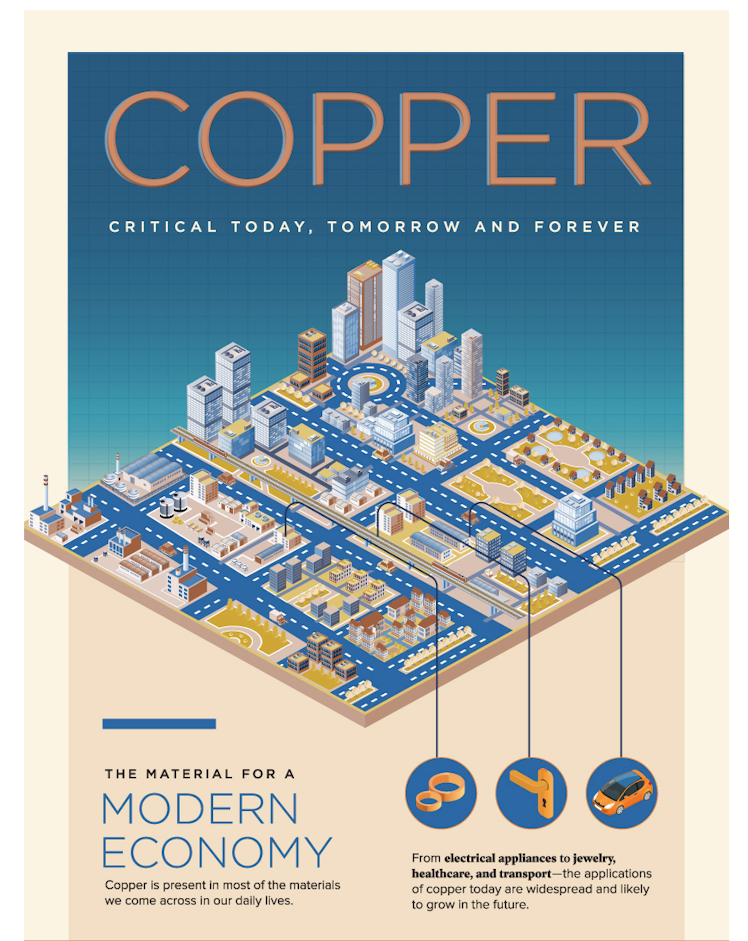

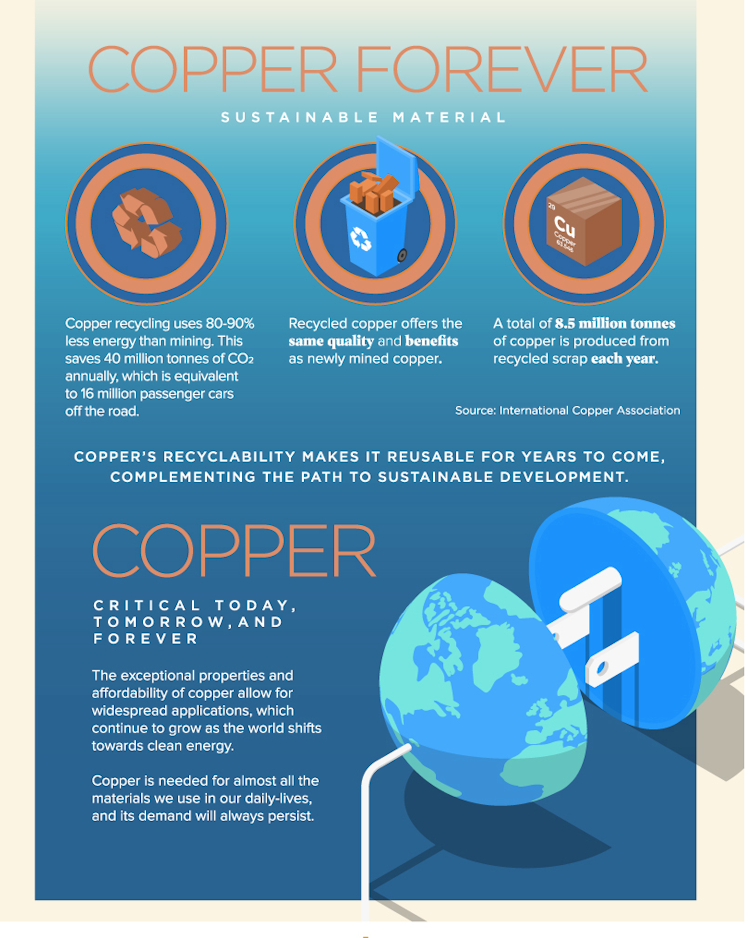

Copper: Critical Today, Tomorrow, and Forever

-The Visual Capitalist

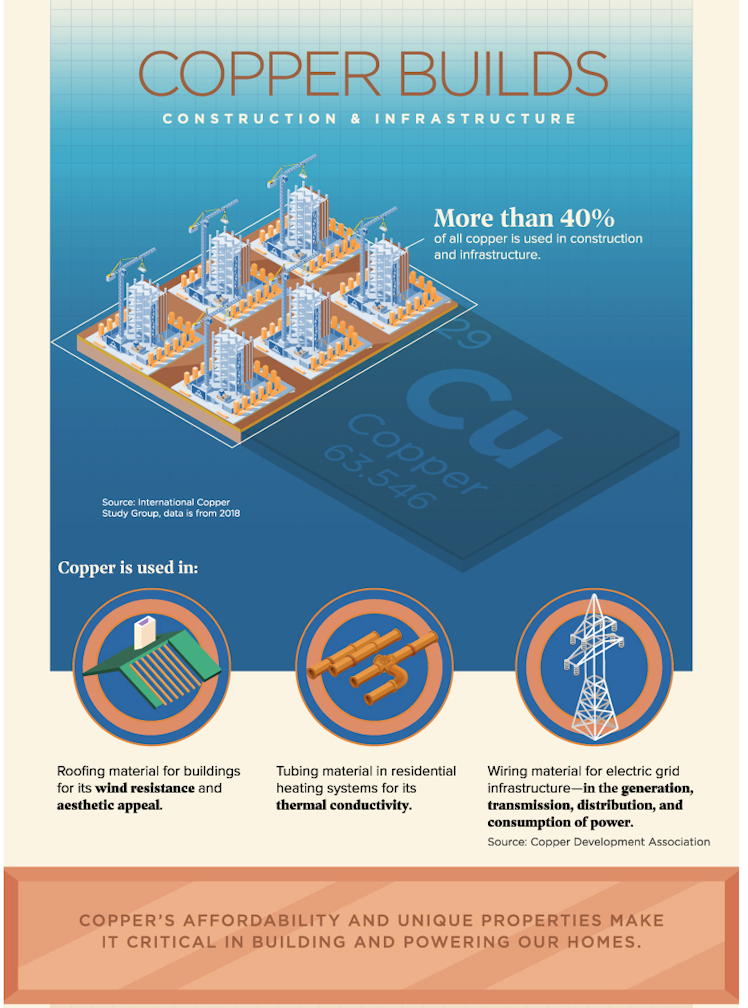

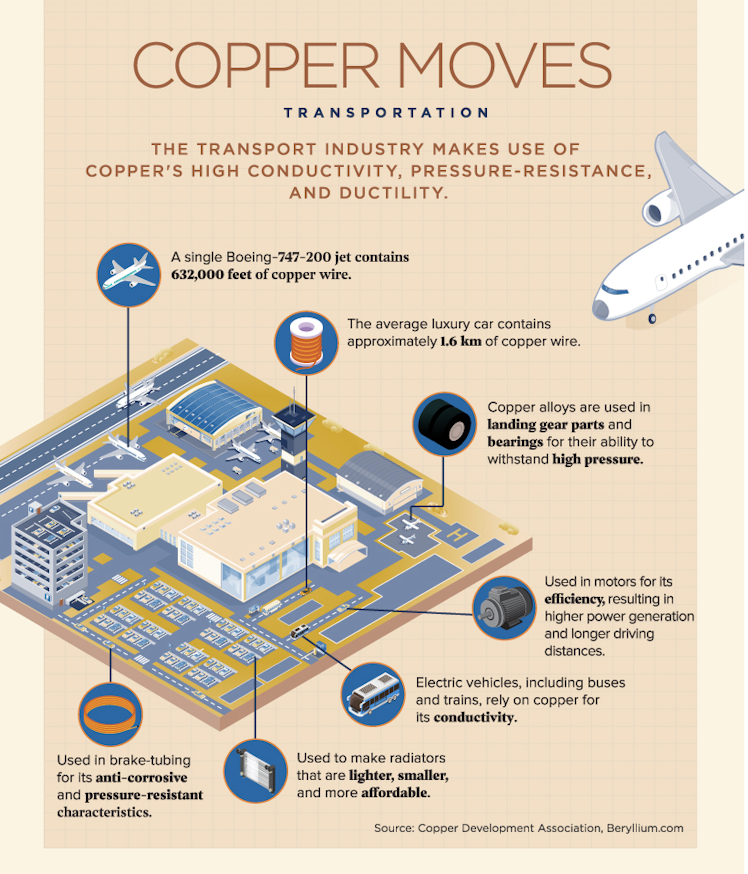

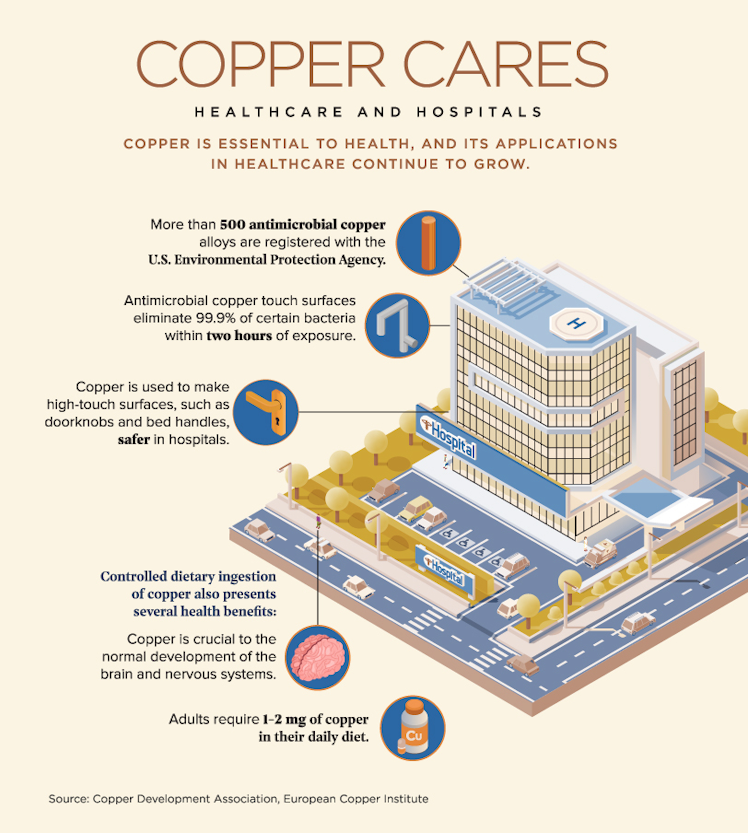

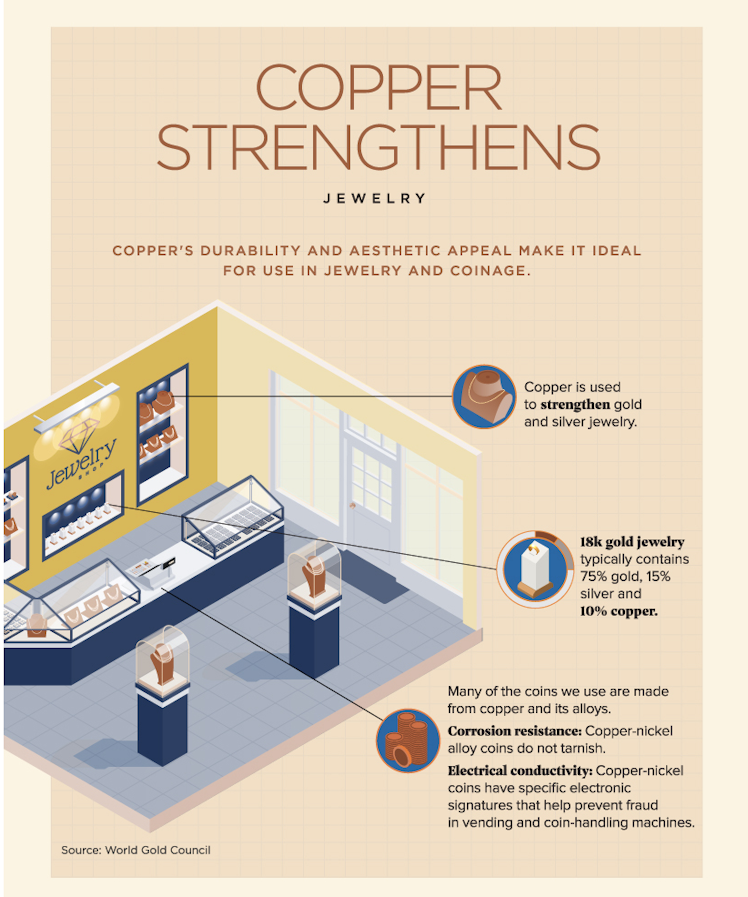

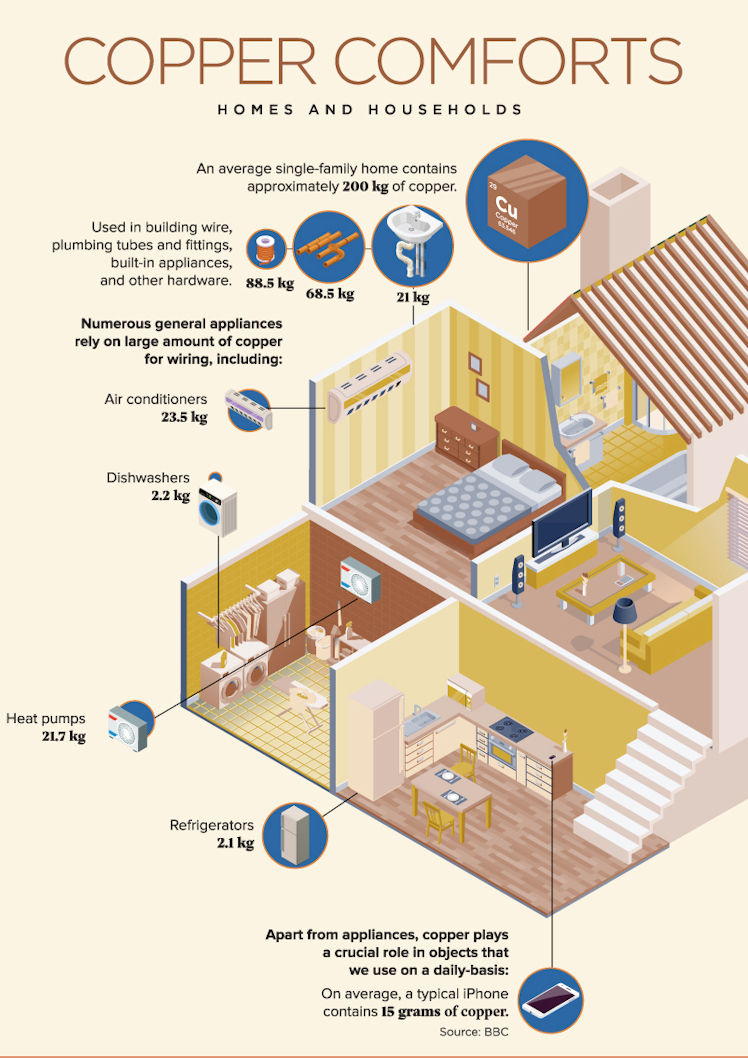

As we go about checking our phones for the latest updates, watching our favorite television shows, or even cooking our daily meals, we often don’t think about the uses of copper and other metals that fuel, power, and drive our modern lives.

From electrical appliances to jewelry, healthcare, and transport—we use copper everywhere–and its applications are only growing as the world moves towards sustainable technologies.

The Material for a Modern Economy

Today’s infographic comes to us from Trilogy Metals and shines a light on the varied uses of copper and the important role it plays in enabling a cleaner, greener future.

Some of my top copper picks in junior mining include:

$FDY.CN

$ACOP.V

$NGEX.V

$SURG.V

$VCU.V

$MRZ.V

$TM.V

A reminder that junior mining is a high-risk sector and I usually limit my allocations to 1-2%, 5% max for a high-conviction pick. Please don't hesitate to ask me if you have any questions, I always do my best to provide an answer.

Visual Capitalist

Copper: Critical Today, Tomorrow, and Forever

We use copper everywhere in our daily lives. This infographic highlights the uses of copper and its applications in various industries.

Already have an account?