Trending Assets

Top investors this month

Trending Assets

Top investors this month

September Idea Competition - PubMatic $PUBM

Summary

PubMatic is a supply-side platform (SSP) led by disciplined founders/management. They grow profitably, and through methods unincorporated by competitors. The digital ad TAM is expanding coupled with the company increasing market share. There are several factors to why smaller players will be consolidated out:

- unable to provide SPO

- not reached critical mass to scale cost

- publishers will consolidate SSPs for operational efficiency

Outflows had downward pressure on stock (VCs exited after lock-up); just 60% institutional ownership currently.

PubMatic can grow 20%+ profitably for years, with CTV optionality to grow above this. 7x EV/EBITDA is a great value for a strong performer. They will fortify their position as the SSP leader and grow market share.

The Business

PubMatic is a founder(s) led small cap company with a long-term strategy to grow conservatively. Publishers list their ad inventory on their platform and integrate with ID solutions to appropriately tag their audience. Buyers use ID solutions to match inventory they bid on. Identifying the audience is one way PubMatic increases return on ad spend. Alternative ID solutions are important as we enter a post-cookie world.

PubMatic is also investing in supply path optimization (SPO). Ad inventory is filtered to serve only the highest quality. PubMatic enters in agreements with DSPs, advertisers, and agencies allowing them to buy ad inventory from their platform and negotiate terms to increase their ad spend on their platform.

Advertising is cyclical. Higher volume taps into operating leverage, thus higher profit margins in H2.

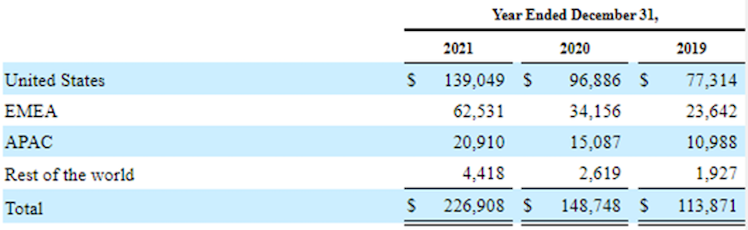

The business is diversified across regions and industries. There are few customer, sector, or region risks. The highest customer concentration in 2021 was 17% of total revenues, down from 28% in 2019 .

Financials

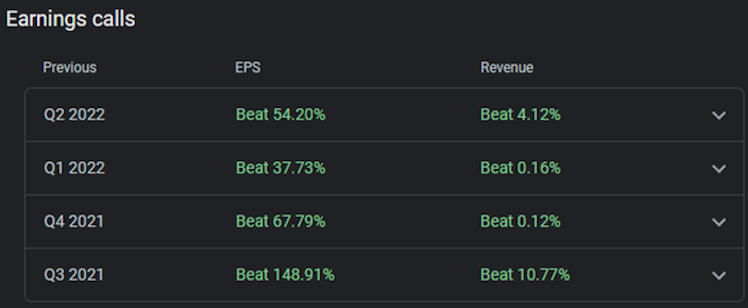

Q2 2022 marked their eight straight quarter of 20%+ YoY growth and 13th straight quarter of positive GAAP net income. They dropped their FY22 revenue guide but increased EBITDA guide (38% margin). They have 130% net retention rate; on average, clients spent 30% more this year. They ended the quarter with $183M in cash and no debt.

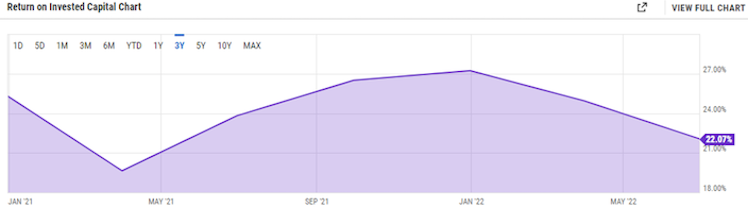

ROIC ranged from 19-27% since IPO in Dec 2020.

They set modest guidance and beat.

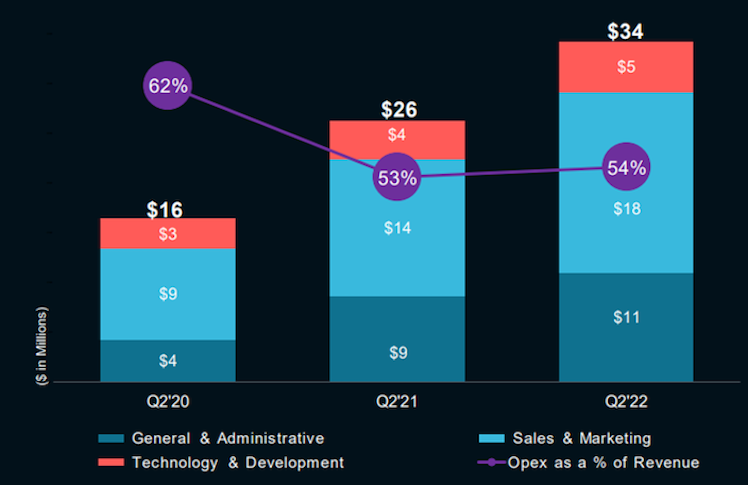

PubMatic has 70% gross margins and nearly 40% Operational Cash Flow margins.

They are in a strong growth mode and India-based engineering headcount increased 37% in the last 12 months. The team is growing in line with revenue:

Competitive Advantages

Owned Network Infrastructure

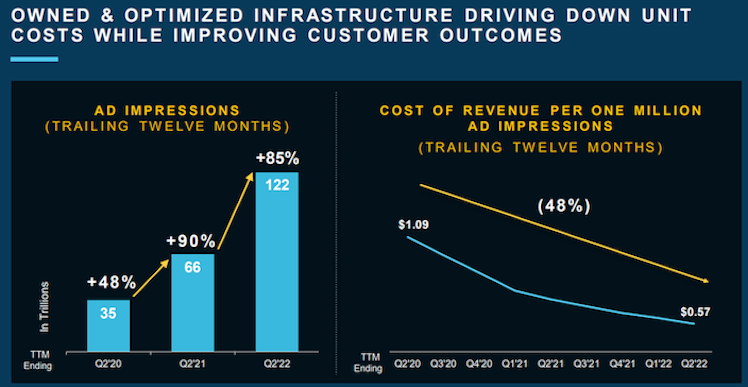

They process trillions of ad impressions/year. Instead of outsourcing to a 3rd party, they built their own servers. This provides operating leverage and better performance vs competitors. Maintenance and growth have expenses, but they’ve achieved impressive operating leverage:

They ~quadrupled the number of impressions processed while halving the cost to process each impression.

Data and Machine Learning

PubMatic collects data about each impression and feeds this into their ML models in real-time to modify pricing of high-quality ad inventory, increasing yield for publishers.

Their ML models also predict which bids will be higher quality and chooses which to present to the buy-side (SPO).

SPO

SPO is intended to ensure that marketing dollars are spent efficiently by processing only the highest quality inventory. Smaller players will naturally be consolidated out if they cannot provide this.

Management

PubMatic was founded in 2006 by 4 co-founders.

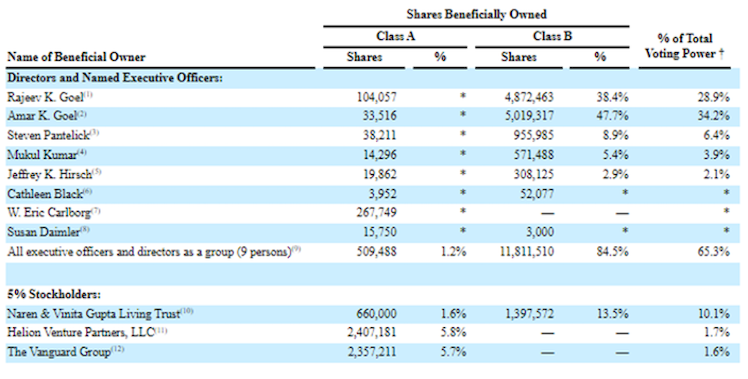

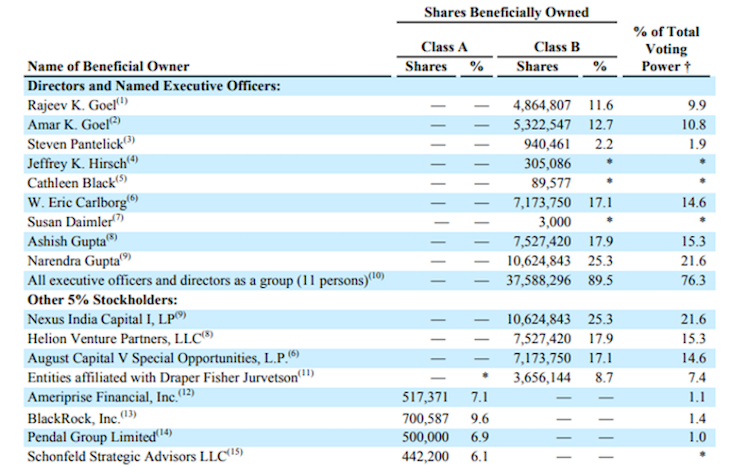

As of Apr 2022, Rajeev and Amar Goel control 63% of the total voting power. The Goels spent two decades building the company; they don’t want to see it derailed for short-term goals.

IDFA and Cookies

Apple’s IDFA threw off many ad-dependent companies, but had minimal impact on PubMatic:

- Majority of revenue is derived outside iOS

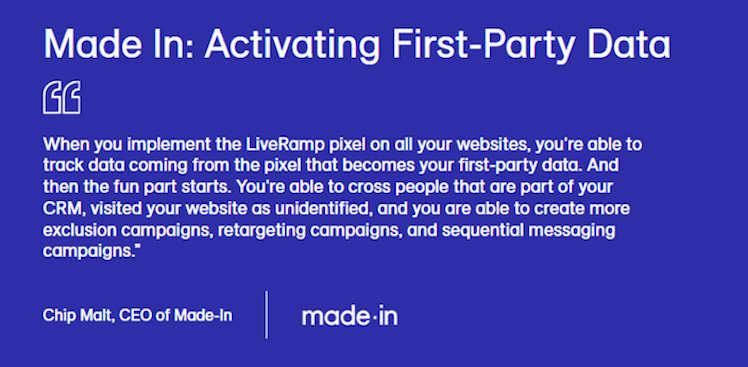

PubMatic works with publishers who own the 1st party relationship with their user vs 3rd parties who are no longer allowed to collect data.

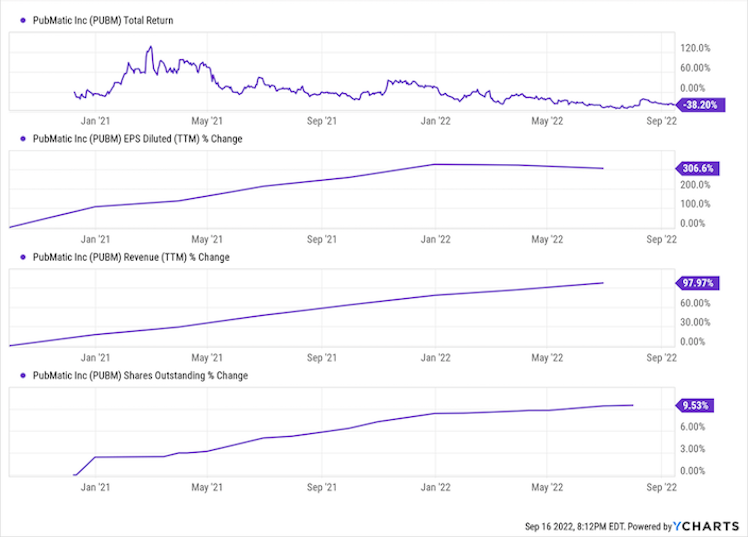

Stock Performance

· Stock is down 38% since its IPO in Dec 2020 (down 74% since Feb 2021 peak)

· PubMatic’s EPS increased 307%

· Revenue increased 98%

· Shares outstanding increased 10%; this makes sense given the increase in headcount.

Comparing insider ownership in 2021 to table in management section, early VCs exited the stock after lock-up . This put downward pressure on the stock and implies less overhang now.

Valuation

- $105M FY22 EBITDA

- $890M market cap

- $180M cash and no debt

- Deduct $26.5M upfront payment for Q3 acquisition

- $736.5M EV

The company trades at 7x EV/EBITDA and is growing 20%+.

PubMatic

PubMatic and LiveRamp Post-Cookie Partnership Boosts Publisher eCPMs 101% While Improving Consumer Privacy

LiveRamp® and PubMatic’s global partnership to deliver improved omnichannel addressability is helping publishers worldwide boost their effective CPM (eCPM) up to 101%, according to a just-released case study.

Already have an account?