Trending Assets

Top investors this month

Trending Assets

Top investors this month

$MSCI Shallow Dive

A lot of the companies I invest in are a standard and are entrenched in a system. Another company I’ve been looking into, MSCI, is no different. MSCI index segment makes up ~60% of revenue and ~80% of operating profit and is entrenched in the financial system.

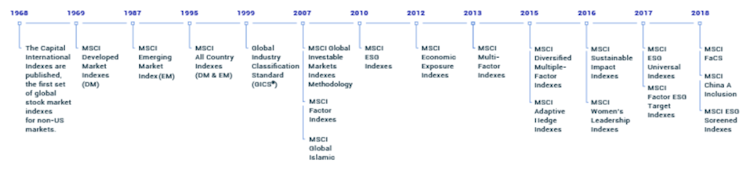

In 1968, MSCI became the first to publish a global index and many of their indexes today focus on international markets. Since 1968, many companies have built financial products using MSCI indexes, further reinforcing MSCI brand name and place in the system.

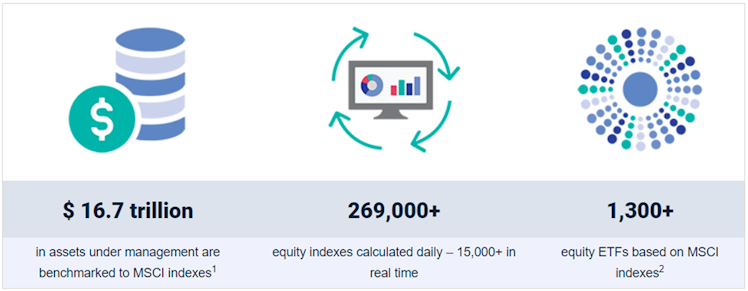

Over 1,300 ETFs based on MSCI indexes with 16.7T in AUM have been created and MSCI charges asset-based fees and other fees. ETF buyers want to be able to buy products based on indexes they recognize and as more ETFs are offered, people better recognize MSCI’s indexes.

MSCI also generates revenue from allowing active managers to benchmark their performance to MSCI indexes. Active managers face customer complaints and outflows when switching to a more unknown index as customers want to recognize which index the manager is competing against.

The fees are a relatively small percentage of active managers’ total cost. This provides little incentive for active managers to switch to another index provider, thus, MSCI has been able to raise prices by 3-4% per year with little churn.

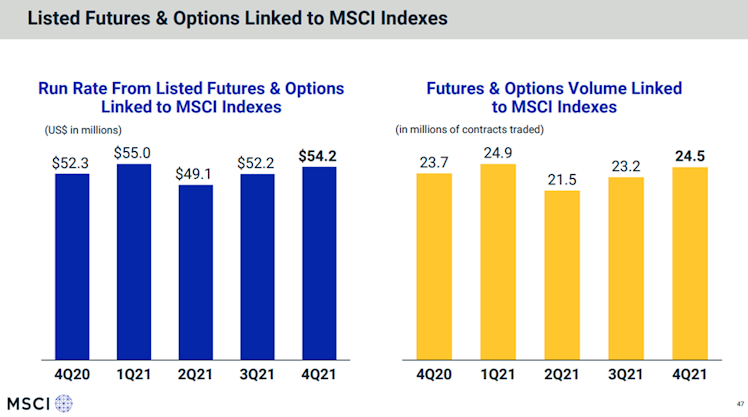

MSCI also generates revenue from royalties for futures and options trading based on their index. Given the notoriety of the index, there is higher liquidity in these indexes, allowing traders to take speculative positions cheaper.

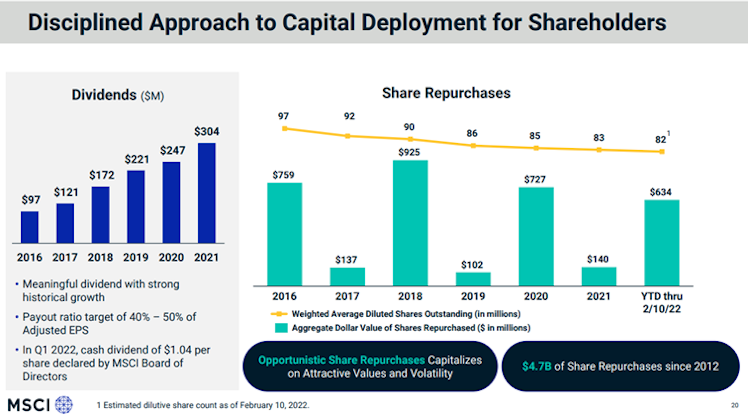

These businesses are very “moaty”, yet, capital-light. MSCI is able to return capital to shareholders in the form of dividends and share repurchases. They have been able to reduce their share count while increasing dividends. MSCI is a high-quality company.

I have no position in MSCI. I would love to hear what others think about the company as well.

Already have an account?