Trending Assets

Top investors this month

Trending Assets

Top investors this month

Solana's Optimizations and Tradeoffs

On June 9th Solana announced that it had raised $314 million in a private token sale round led by Andreessen Horowitz and Polychain Capital. Since that date, Solana is up ~360% as its market cap has gone from $11B to $52B.

What properties does Solana have that the market is loving right now? And more importantly, what tradeoffs is it making in order to achieve those?

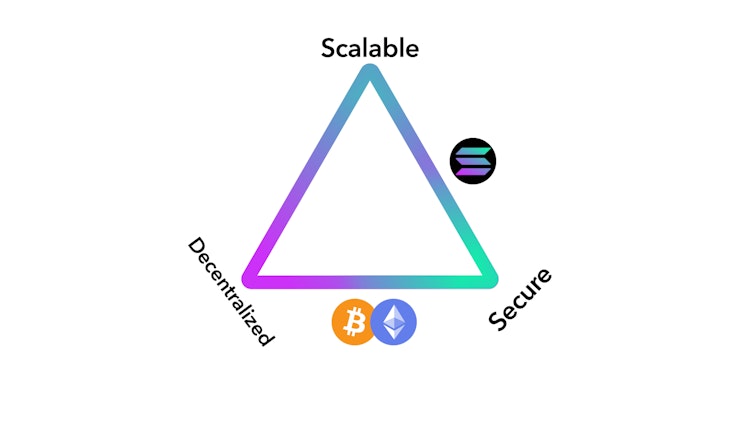

The scalability trilemma says that there are three properties that a blockchain tries to have, and that, if you stick to "simple" techniques, you can only get two of those three:

- Scalability: The chain can process more transactions than a single consumer laptop can verify.

- Decentralized: The chain can run without trusting a small group of large centralized actors.

- Security: The chain can resist a large percentage of participating nodes trying to attack it (ideally 50%; anything less than 25% is concerning).

Bitcoin and Ethereum have chosen to optimize for Decentralization and Security, which has allowed each find their own niche:

Bitcoin: Store of value

Ethereum: Ultrasound internet money

Ethereum would like to become more scalable in order to expand its potential use cases, and plans to do so when it upgrades to Proof-of-Stake sometime in 2022. Bitcoin on the other hand already has almost a $1 Trillion market cap and doesn't need to evolve much more in order to be a global settlement layer. Both take decentralization very seriously.

But 'decentralization' has a lot of nuance; and this is where Solana teases apart what decentralization is supposed to achieve and makes some judgements based on what 'decentralized' parts it finds essential, and what it is happy to leave behind.

Decentralization is typically interpreted to mean that your node should not rely on trusting any of the other nodes in the network. For Bitcoin and Ethereum this means that your node can verify the full objective history of the chain going back to the beginning without relying on information from any other node.

Bitcoin and Ethereum care a lot about this. They're religious about the need to be able to verify independently that the chain was consistent from its root point at day zero, and that there were no invalid state transitions and nobody fiddled with the amount of $ETH.X or $BTC.X in existence.

$SOL.X in contrast, merely wants to have the most censorship resistant messaging network. Instead of insisting on a full, independently verifiable history (which adds a lot of baggage and slows things down), Solana claims that finding a way to share time when nodes cannot rely upon one-another is the key ingredient.

To that end, Solana is happy to uses Delegated Proof-of-Stake as it's consensus mechanism and leave Proof-of-Work behind.

Solana's Delegated Proof-of-Stake implementation relies on a semi-centralized structure in which a node leader is elected and all nodes agree to adopt one universal source of time.

That universal source of time is archived through 'Proof-of-History' which is "the implementation of the arrow of time in math" according to founder Anatoly Yakovenko.

Proof of History is what allows Solana to verifiably order transactions without all nodes needing to agree simultaneously.

The tradeoff enables Solana to process 65,000 transactions per second whereas Bitcoin can handle about 7 transactions per second, and Ethereum can handle 30 transactions per second.

I'll leave the community with some open questions to discuss:

- Is Proof-of-History trustless enough to provide the decentralization required of a $50B blockchain?

- Will Ethereum and Solana compete or fill different niches?

- Is it acceptable to optimize for Scalability at the expense of Decentralization if your primary use case isn't store of value?

X (formerly Twitter)

toly 🇺🇸 (@aeyakovenko) on X

Co-Founder of Solana Labs. Award winning phone creator. NFA, don’t trust me, mostly technical gibberish. https://t.co/zyJoDMPFJg

Already have an account?