Trending Assets

Top investors this month

Trending Assets

Top investors this month

SLT Core Portfolio: Copart ($CPRT) - From Junk to Gold

Copart is another idea sourced using our internally developed Quality-Growth stock screener. We found it very interesting and challenging to analyze due to our unfamiliarity with CPRT and the salvage vehicle auction market in general. We hope you will enjoy this write-up and as always, please let us know what you think!

Thesis

- CPRT disrupted the salvage auto auction industry and transforms junk into gold. Driven by its technological competitive advantage, the company is a leader in its industry. Moats are multiple and we believe the company will be able to sustain its leading position thanks to high barriers to entry and its network effect.

- The salvage auto auction market is set to continue its above-average growth fueled by higher total vehicle miles travelled, older fleet and hence higher salvage rates.

- We are attracted by CPRT's long history of revenue growth, high profitability and very healthy balance sheet.

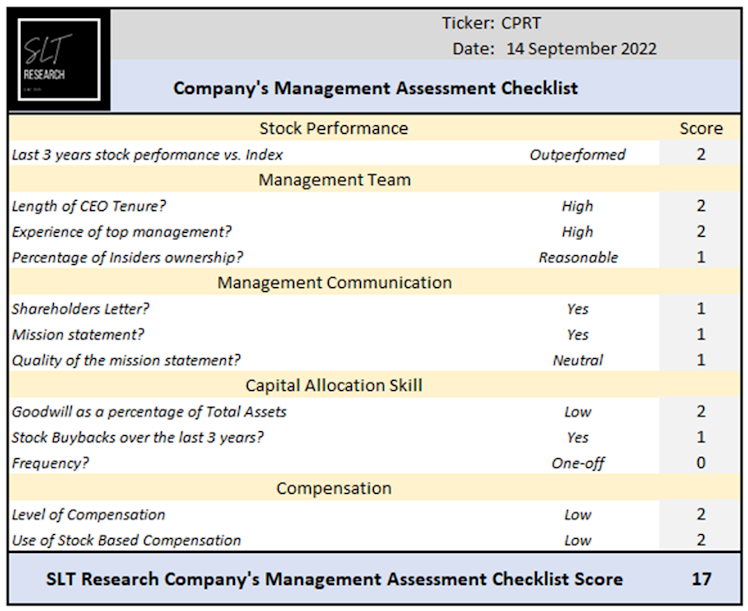

- CPRT kept its entrepreneurial spirit established by its founder Willis Johnson and perpetrated by its son-in-law, now CEO for more than 12 years. Management scored an impressive 17/20 using our management assessment checklist. Over the years the company has been able to consistently compound shareholder wealth at superior rates of return.

- CPRT valuation is attractive. Share are trading well below historical average multiples and at a lower premium vs. peers.

Company Description

Copart was co-founded in 1982 by Willis Johnson and is one of the leading provider of online auctions and vehicle remarketing services. It takes those vehicles and auctions them primarily for insurers (80% of the salvaged vehicle supply). Buyers are mostly rebuilders, licensed dismantlers, and used-car dealers and exporters. The company has replaced live auctions with internet auctions using a platform known as Virtual Bidding Third Generation (VB3 for short). It also provides services such as towing and storage to buyers and other salvage

companies. Copart serves customers throughout North America, Europe, the Middle

East, and Brazil, although the US accounts for about 85% of sales.

Before we jump into how CPRT is actually making money, we would like to detail the “salvage equation” which is key and which will follow us throughout this analysis.

When a car is in an accident, it is usually assessed by an agent appointed by the policy holder's insurance company. The adjuster estimates the repair costs. Given the amount of the repair costs, the insurance company faces two choices:

- If the pre-accident vehicle value (PAV) minus repair and supplemental costs is greater than salvage value, the vehicle is repaired.

- If PAV minus repair costs is less than salvage value, the vehicle is totaled and sold through auction.

It's when the second scenario occurs that CPRT comes into action. When an insurance company decides to declare a total loss on a vehicle and to sell it via an auction, CPRT arranges for the transportation of a vehicle to its nearest facility (salvage yard). The salvage vehicle then remains between 45-60 days on the salvage yard, period during which ownership documents are transferred and the vehicle is declared as salvage. The vehicle can then be sold at auction on VB3, typically within seven days. In order to participate to an auction, a buyer must be a member. Currently, three memberships are available: Guest (free, members are only available to see the inventory and set-up alerts when specific vehicles are added), Basic ($59 p.a.), Premier ($199 p.a.). The last two differ on the number and amount of transactions allowed. When a transaction is agreed, proceeds are then collected from the member, typically seller fees are subtracted, and the remainder is remitted to the seller.

At a glance, CPRT operates and own more than 200 salvage yards in 11 countries, which allow

them to list more than 265k vehicles online every day and sell more than 3mn vehicles per year. CPRT has buyers in more than 190 countries.

Competitive Moat

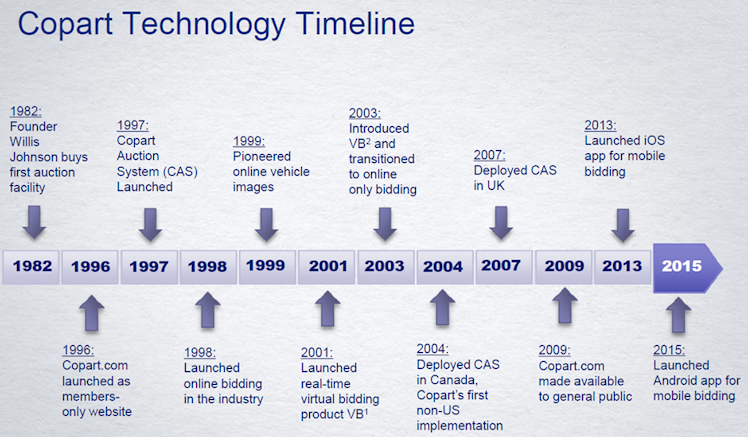

Technology: CPRT is a disruptor by nature. Long before the pandemic forced other businesses

to adopt virtual work practices, the company established an exclusively digital auction marketplace in 2003, creating an environment in which sellers and buyers from around the world can transact on a reliable, trustworthy platform. VB3 has been classified as the best auto online auctions platform by a lot of experts.

Source: Investors Presentation

Network Effect: CPRT also enjoys a strong network effect, which is a powerful competitive advantage we love to see at SLT Research. The network effect is a phenomenon whereby increased numbers of people or participants improve the value of a good or service. Thanks to CPRT developed network of insurers and salvage yards, it offers diverse supply which attracts more members. As more buyers bid on the platform, vehicles are sold quicker, at a higher price, which attracts more insurer to sell through CPRT and the flywheel goes on and on. Some of the leading, fastest-growing companies have achieved success because of

network effects.

Barriers to entry:

- Scale: it takes time before reaching the necessary scale to be able to match thousands of sellers and buyers. CPRT spent 40+ years developing relationships with major insurance carriers.

- Land: salvage yards are not easy to acquire as multiple requirements are necessary. No one is able to match the CPRT's 200+ permitted yards network.

- Process complexity: managing catastrophes, providing detailed reporting to sellers, deploying sub-haul network of 4,000 providers, navigating regulatory and title processing across 50 states and multiple countries. The sale of salvage vehicles requires more expertise than used cars.

Sustainable Growth

One of the long-term growth drivers is international development. The company, despite having international buyers, is mainly centered around North America. Continued expansion in Europe and new markets in Asia could unlock massive opportunities.

We will focus here on the “macro trends” that are driving CPRT demand, independently of the location.

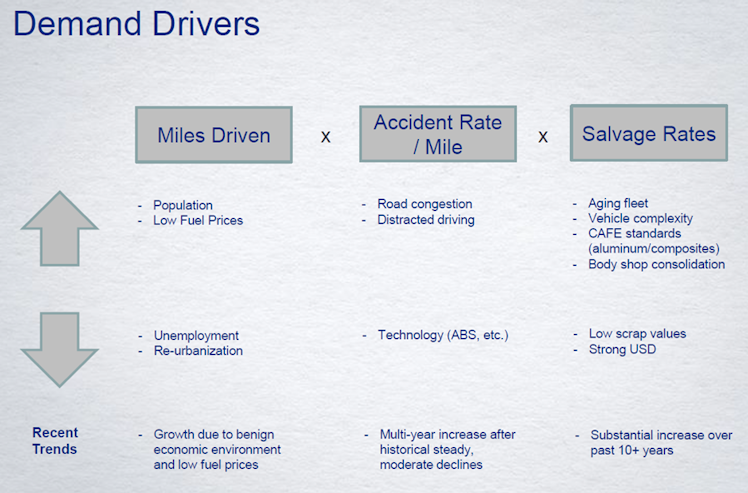

Source: CPRT investors presentation, April 2016 – please note that some trends might not be relevant anymore.

The equation is relatively simple, more miles driven imply more accidents given stable or even increasing accident rate per mile. Above this, aging fleet (lower pre-accident vehicle value) with higher costs to repair due to increased complexity (materials used, technology…), and coupled with higher salvage rates, result in more vehicles declared as total loss after an accident. It is important to note here that the transition toward EV has a little impact on CPRT as EV are still susceptible to be involved in a accident, and instead might inflate repair costs.

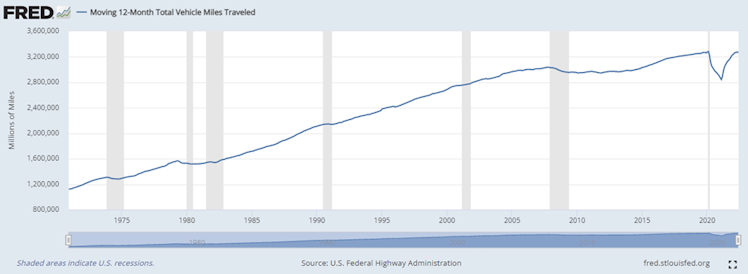

Total vehicle miles travelled: The below graph shows that miles travelled significantly increased over the years, with a logical decline during the pandemic. However, according to FRED data, we are back to pre-pandemic level and this trend is expected to remain upward slopping, fueled by emerging countries and overall increasing population.

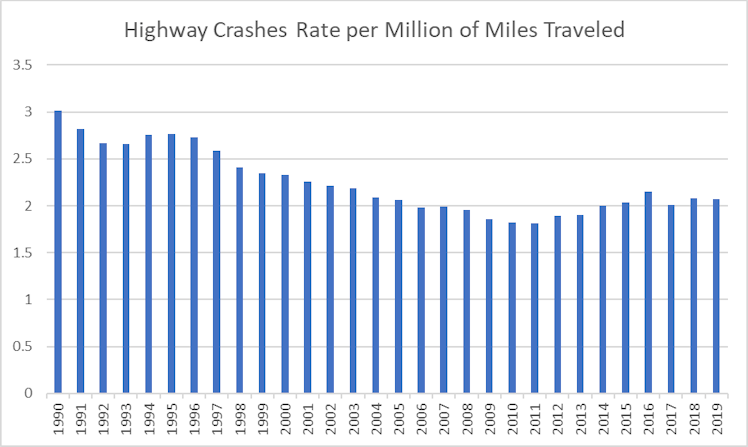

Accident rate per million miles:

Source: FRED, NHTSA, SLT Research

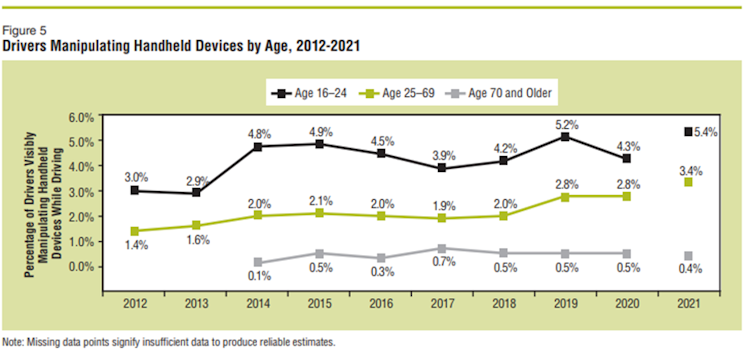

Improved safety in new cars helped to enhance safety during the period covered by the above bar chart. However, we can see that starting roughly ten years ago, the downward trend reversed. Accidents occur more often nowadays, mainly due to increased distraction brought by the use of devices (e.g. smartphone) while driving as exhibited in the below graph.

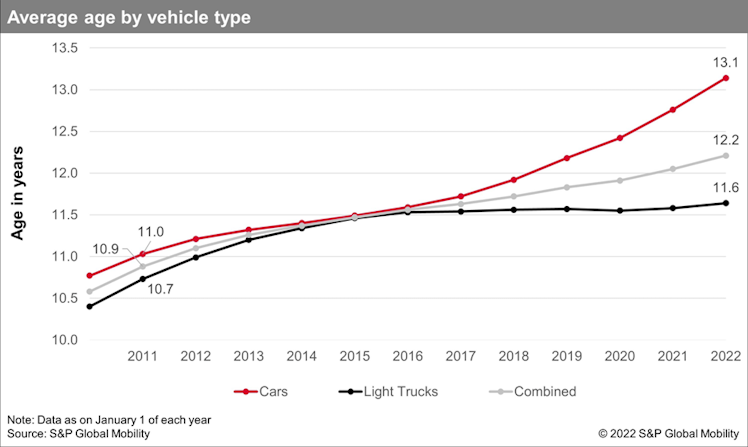

Salvage Rates: Salvage rates tend to be higher for older vehicles as the pre-accident value decline with the years. The average age of light vehicles in operation in the US rose to 12.2 years in 2022.

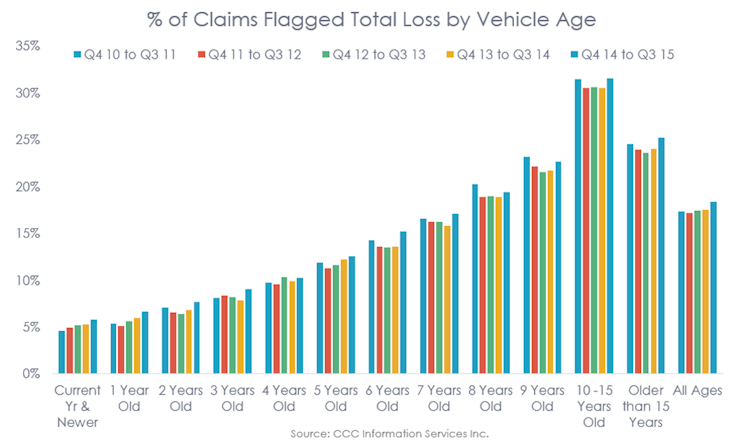

We can observe in the below chart that the percentage of claims flagged as total loss is more important for old vehicles, hence there should be more potential vehicles being sold by CPRT.

Financials

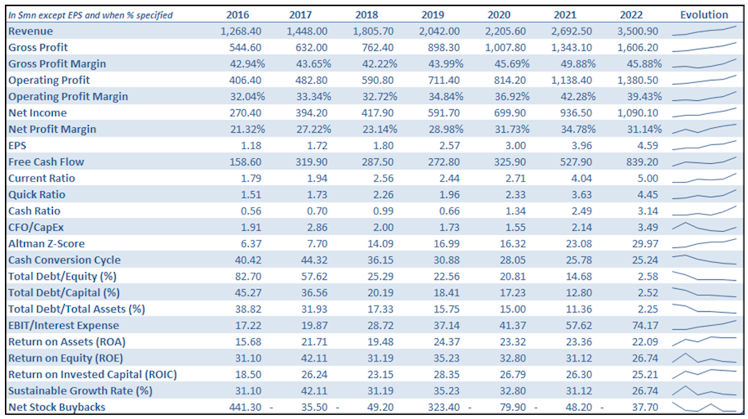

Before delving into the numbers themselves and when looking at the evolution trends below, we can see that all ratios moved in the right direction over the last 6 years (except ROE but this will be discussed later).

Revenue grew from $1.3bn in 2016 to $3.5bn in 2022 (FY ended 7/31), representing an 18.44%

CAGR over the last 6 years. 85% of the revenue is classified as service revenues (membership subscriptions and transactions fees) while only 15% come from vehicles sales by CPRT.

Gross and operating profit margins both improved, the latter increased by almost 10% over the period under review, while the former rose by c.3%. Margins improvement has been driven by a reduction in yard operations expenses. It represented 37% of revenue in 2021, declining constantly over the period, which implies that, with scale, CPRT became more efficient at operating its salvage yards. SG&A was the other area of improvement as they have been cut to 4.5% of revenue (from 7.1% in 2016). What is really important to highlight here is that CPRT does not spend a dollar on selling and marketing expenses. The company has been attracting buyers only thanks to its network effect and the superior quality of its VB3 product. This customer acquisition cost of $0 allows the company to hire more than 700 IT engineers working on the platform while keeping margin levels relatively high.

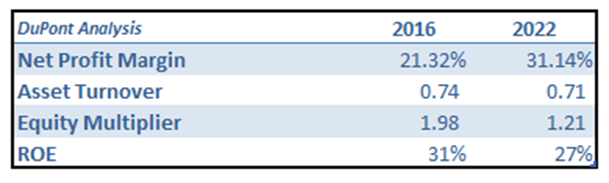

ROE decreased over the period, however it is important to put things in context and nothing

is better than a DuPont analysis to demonstrate why it is actually a positive sign. ROE declined by c.4% over the period despite a net profit margin jump of 10%. One could assume that, all else being constant, the ROE should have increased by the same amount. However, and even if asset turnover remained stable, leverage significantly decreased. We can see now that ROE is mainly driven by the net profit margin rather leverage, which we are more comfortable with.

CPRT's balance sheet is very strong. From a liquidity point of view, current assets represent 5x current liabilities. As of FY2022, the company was sitting on c.$1.4 billion of cash & cash equivalents. The cash ratio has been multiplied by 5.6x (vs. 2.8x for the current ratio). This is explained by both accounts receivable and inventory representing a lower portion of the current assets, and cash significantly increasing as % of current assets.

From a solvability perspective, CPRT level of debt is low. Total debt in 2022 represented less than 3% of total equity and total assets respectively. Management has been focused on reducing CPRT gearing over the last years, as demonstrated by the total debt to equity ratio dropping from 82.7% in 2016 to 2.58% in 2022. Last reported EBIT was at a level able to cover more than 74x the company’s interest expense. The Altman’s Z-Score around 30 supports even more CPRT’s very healthy financial condition.

The company generated a free cash flow (FCF) of $839.2mn in 2022. The latter fluctuated in line with Net Income. From an investing point of view, the main use of cash was the acquisition of fixed prod assets. Regarding financing, and as already mentioned, CPRT management has been mainly repaying long term debt as well as repurchasing stocks.

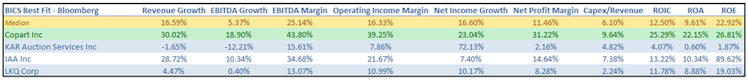

- Quick comparison with main competitors

CPRT largest competitor is IAA. They evenly share 80% of the total market for years however,

CPRT has been gaining share in recent year. As exhibited in the above table, CPRT upgrades all its competitors by far with the higher profitability of the group and by doing so with very low leverage. CPRT is the only company of the group with a negative net debt. In comparison, IAA debt represents more than 75% of its total assets and net debt equals 4.9x equity, which explains why IAA ROE is misleading in the above table.

Management and ESG considerations

CPRT has the highest management score we assessed so far. Willis Johnson founded the company out of a single lot in Vallejo, CA in 1982 after several years operating a dismantling yard near Sacramento. He took the company public in 1994. Johnson stepped down as CEO in 2010 and handed over the reins to his son-in-law, Jay Adair, who first joined CPRT in 1989 at age 19. There is no doubt that Adair knows the company inside out and learned a lot from his father-in-low and we’d guess mentor. They created CPRT unique corporate culture, and made it one of its core strength. CPRT's mission is to create value and opportunity through vehicle auctions and exchange.

As already mentioned, the management has been focused on buying back shares opportunistically and/or reducing drastically CPRT's leverage which both benefited shareholders. CPRT is a true compounder, where earnings are reinvested in the business for 40 years now and we expect this trend to continue as long as management finds positive NPV projects. The retention rate is 1 and we would like it to remain so because we believe that the future of CPRT is international. We believe there is more shareholder value to unlock if CPRT pursues its bold international development rather than returning cash to investors.

On the ESG front and from its inception, CPRT plays a critical role in the automotive circular economy as the key intermediary enabling the recycling and reuse of automobiles and automotive parts. Across the globe, approximately half of the employees are women, and 52%

are non-Caucasian. Furthermore, the management team is 35% women and 33% people

of color.

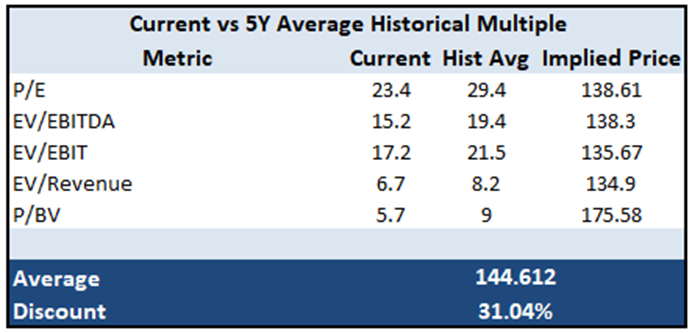

Valuation

As of September, 14th 2022

Shares of CPRT trade at an important discount to the 5Y historical average multiples, especially with regards to P/BV (37% discount, biggest ever experienced in the last 5Y). All

the above multiples are below or around -1 standard deviation from their 5Y historical average.

Historically the company has always been valued at a premium compared to competitors, and for obvious reasons, as explained at the end of the financials section (comparison vs. peers). If we use the P/E ratio for example, the current premium is only 26% vs. a 5Y average of 57% representing a standard deviation of -1.8. We believe that, based on both absolute and relative valuation basis, the current share price offers a nice opportunity to buy CPRT stocks.

Risks

- Self-driving cars: they do not drive drunk or exhausted and are not distracted by a notification popping-up on their smartphone about the new CPI print while driving. It is easy to assume that these cars will reduce accident rate per million miles travelled however, there’s still a lot of innovation to be done before driverless cars can become affordable, widely adopted products at a global scale.

- Global and greener re-urbanization may impact global use of cars.

- International development might cause margin contraction in the short-term.

Disclaimer: The information provided in this post is for information only and solely on the basis that you will make your own investment decisions after having performed appropriate due diligence.

Already have an account?