Trending Assets

Top investors this month

Trending Assets

Top investors this month

Vanadium Twitter Spaces

For those who missed it, I am posting a transcript of my speech from tonight's Twitter spaces about "the next lithium", as well as some informative links & graphics. Vanadium could present a generational opportunity for investors, and I was very fortunate to have some incredible guest speakers join me for an excellent discussion. If you'd like to catch the entire dialogue, the always gracious host @nyetgoldblum will post a recording of the session soon.

"Thank you gentlemen, for having me back to present the case for another metal – this one certainly not as well-known as Dr. Copper. Not everyone has heard of vanadium but hopefully after tonight, it won’t be one you will forget.

Just a heads up that when I wrote my copper speech – it was TWELVE PAGES long & tonight I had planned on delivering a three-pager, but plans change and in this case that’s a good thing…because I was very lucky I was able to recruit not just two, not three, BUT FOUR amazing guest speakers, so I will introduce them to you all – briefly mention how I became interested in vanadium & then turn the floor over to them.

I’m sure many of you are familiar with Thomas George who is President at Grizzle & Portfolio Manager of the GRZZ ETF.

Thomas has over 17 years of global institutional investment management experience. At TD Asset Management he was Director of Global Resources and the lead Portfolio Manager for over $1 billion of global equities. Thomas is a CFA charterholder and has been featured on Fox Business, CNBC, Bloomberg, CTV, CBC and the National Post.

Thomas recently did a very interesting interview with the CEO of Largo and I will post the link in the nest.

Also joining us from Grizzle is Head of Research, Scott Willis. Scott has over 15 years of institutional investment management experience and his core areas of investment coverage at Grizzle include marijuana, energy, and technology. Scott is also a CFA charterholder and has been featured on Bloomberg, CBC, CNBC, and Macleans. Scott knows the fundamentals of the vanadium industry very well, and is also an expert on Largo – a company we will be discussing at length.

Next I would like to introduce Duane Hope, who is a Partner at Capital 10X; Duane brings over 15 years of communications and research experience to the firm. His research and writing has appeared in publications for North American, European and Asian audiences.

He has done some great work on VRFBs and I will post a thread with links to some of Duane’s writing in the nest as well.

Last but not least, Johnathan Lee is also here – Jonathan is a Director at Largo Physical Vanadium. Johnathan has been a board member at Largo since 2019, holds a degree in chemical engineering, and has previously held roles as a mining & metals equity research analyst.

Some of you may have noticed that I have the name “Vanadium Cassandra” in my bio. If you have followed me for awhile you would have seen that in the past I went by “Lithium Cassandra”. Someone gave me the name when they grew tired of me tweeting about the lithium bull case.

In Greek mythology, Cassandra was a Trojan priestess who spurned the god Apollo. He then cursed her to speak true prophecies that no one ever believed.

Several people I chatted with couldn’t see the bull case for lithium because they believed lithium is an abundant resource – and why would there be supply issues for something so prevalent?

However, as 2021 progressed it became increasingly clear that EV batteries were presenting an almost entirely new and significant end-use for the metal, and the lithium market would see an exponential increase in demand.

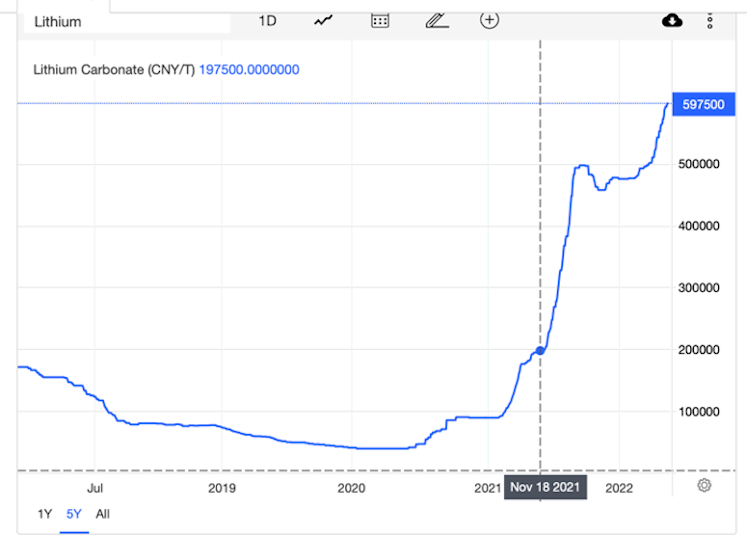

If you have a look at the lithium price chart I posted, you can see why it paid to be an early mover in the sector. Obviously if you had bought lithium in 2019, you would have required patience and timing these moves can be difficult.

I fully admit, I was and still am early to the hydrogen scene (according to Alberta Garbage, early in hydrogen means never) – but I believe I am much closer in timing my move with vanadium.

It might sound cliché, but as Wayne Gretzky said:

I skate to where the puck is going to be, not to where it has been.

A recent S&P Global report mentioned “One mineral that’s been overlooked in this entire cycle is vanadium, which has huge market opportunities. It’s increasingly difficult to see lithium-ion as a sustainable energy storage solution moving forward. Vanadium is more efficient than lithium-ion in the grid storage market.”

The Inflation Reduction Act includes incentives worth approximately $370 billion. This will supercharge climate change mitigation and increase interest in industrial, commercial, and residential energy storage systems such as vanadium batteries. Both the United States and Canada have now introduced a 30% tax credit for energy storage installations that could promote the adoption of VRFBs.

I have always been a proponent of the theory that following successful people dramatically increases your own odds of success. Well, one of the biggest factors that drew me to have a closer look at vanadium was seeing the appeal that it held for mining’s GOAT.

In 2017 Robert Friedland said “there’s a revolution coming in VRFBs” and in June of this year, Friedland IPO’d Ivanhoe Electric, which included under its umbrella a privately owned company named VRB Energy.

VRB produces a battery using vanadium recycled from petroleum waste. Syncrude is one of the largest operations in Canada’s oil sands industry and produces approximately 50,000 tonnes per day of waste product, which includes significant quantities of vanadium. Unlocking the economics of metal extraction in this area could prove to be not only lucrative for the Canadian oil sands but could also solve issues with waste disposal.

For now, steel is expected to remain the main driver of vanadium demand. A study from the University of Texas concluded that using vanadium can reduce carbon emissions in concrete buildings by up to 18% -- giving you yet another reason to become a vanadium bull.

Billions of dollars have poured into VRFB research & development over the past decade, and mass utility scale adoption seems all but inevitable – so now is a great time to consider adding miners like Largo to your watchlist.

And with that, I will turn the stage over to my panel of guest speakers…thank you for your time."

HELPFUL LINKS & GRAPHICS:

There is the potential for #vanadium prices to become the hockey stick graph that we saw with #lithium prices

Bushveld:

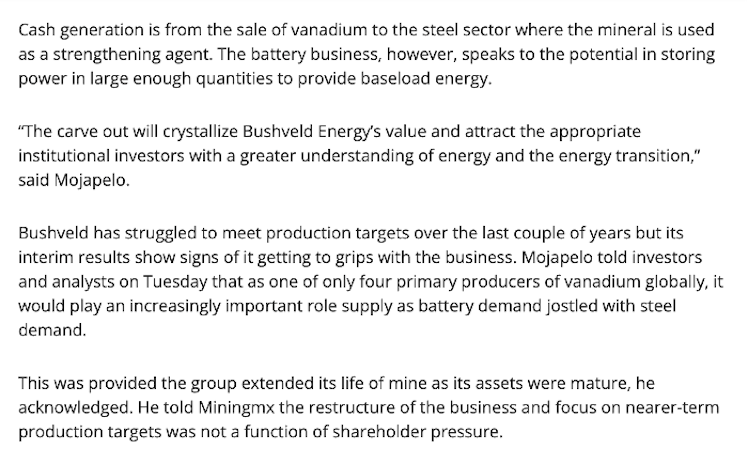

Bushveld “struggled to meet production targets…provided the group extended its life of mine as its assets were mature”.

Civil unrest hits South African mineral supply chains

Bushveld Minerals' told S&P Global Platts in an email that "The unrest has not had any impact on our production and no material impact on our supply chain."

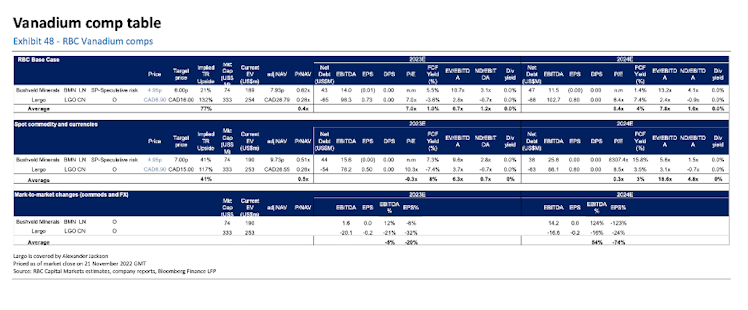

RBC comp Nov 22, 2022 of Bushveld to Largo

Bushveld implied upside 21%

Largo implied upside 132%

JMD’s WORK ON VANADIUM:

WHY VANADIUM PART 1, May 15:

WHY VANADIUM PART 2, June 13:

IVANHOE ELECTRIC, Aug 26:

DUANE’S WORK ON VANADIUM:

Capital10x on Largo:

Largo – Explosive Growth for Vanadium Miners

Largo 3Q 2022 Earnings: Maintaining Focus on the Structural Growth Ahead https://capital10x.com/largo-3q-2022-results/LPV: The Pure Play Vanadium Investment $VAND.Vhttps://capital10x.com/lpv-the-pure-play-vanadium-investment/

THOMAS’ WORK ON VANADIUM:

If you are interested in the vanadium space, this is an outstanding Grizzle Pod interview with the CEO of Largo. No doubt you will see why I am bullish on the metal.

VANADIUM INFO WORTH YOUR TIME:

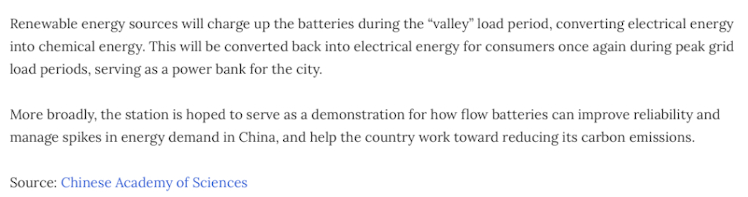

Chinese city of Dalian has just switched on a world-leading new energy storage system, expected to supply enough power for up to 200,000 residents each day

'Investors should expect rising profitability as we enter what we believe to be a bull market for vanadium. Vanadium-based energy storage systems...remarkable growth projection for long-duration storage needs over the next five years'

“One mineral that’s been overlooked in this entire cycle is vanadium, which has huge market opportunities. It’s increasingly difficult to see lithium-ion as a sustainable energy storage solution moving forward. Vanadium is more efficient than lithium-ion in the grid storage market.”

“Everyone wants in”

Traditionally used as a strengthening agent in steel, vanadium may become important in the energy transition as part of a growing market for VRFBs and as a cathode in lithium-ion batteries

IRA’s passing…will help “incorporate medium and long-duration energy storage such as vanadium redox flow batteries (VFRBs) into their operations more economically than before”

https://www.energy-storage.news/will-the-us-inflation-reduction-act-boost-demand-for-flow-batteries/

The IRA includes incentives worth approximately $370 billion. This could supercharge climate change mitigation and increase interest in industrial, commercial, and residential energy storage systems such as vanadium batteries.

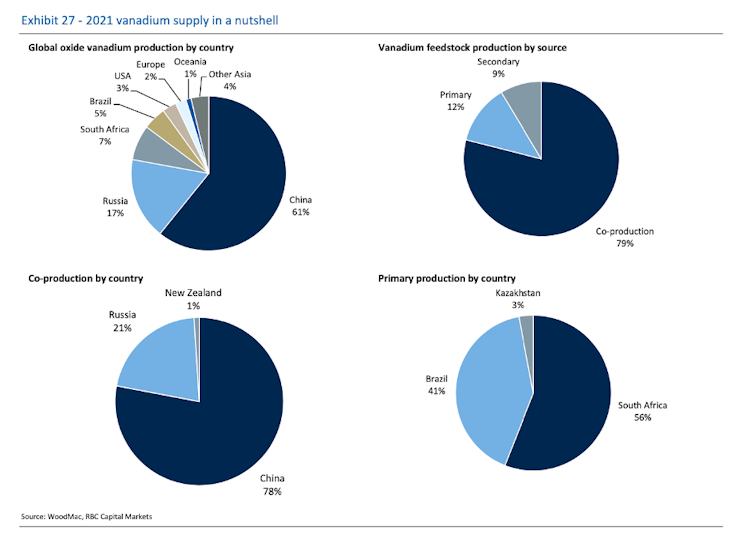

Global Vanadium Supply & Demand:

Vanadium redox flow batteries (VRFBs) are forecast to be the fastest-growing sector with a CAGR of +26%. By 2030 VRFBs are expected to account for 10% of annual demand up from the 1% in 2021.

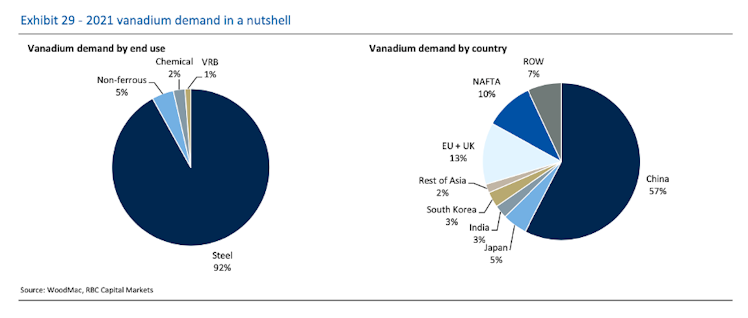

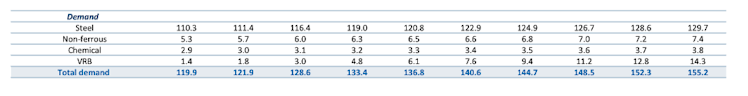

Woodmac, RBC Capital Markets Vanadium Demand Estimates:

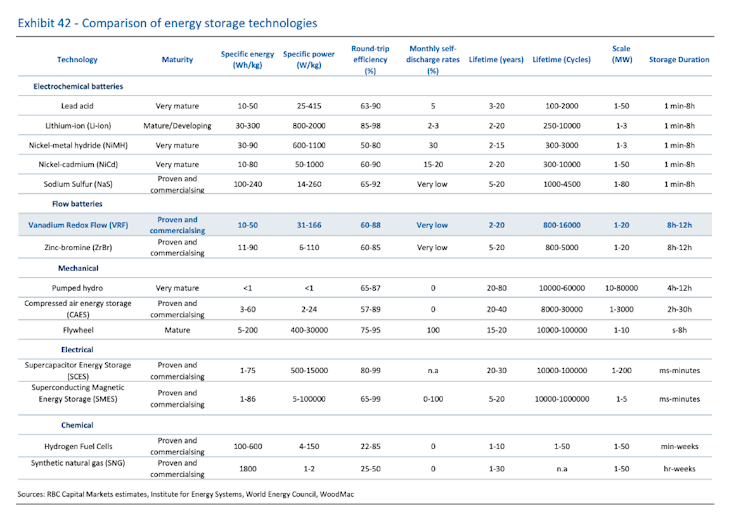

Comparison of energy storage technologies:

CleanTechnica

How Inflation Reduction Act Will Subsidize Residential Energy Storage Systems, Including Vanadium Batteries - CleanTechnica

The IRA could supercharge climate change mitigation and, in particular, increase interest in industrial, commercial, & residential energy storage systems such as vanadium batteries.

Already have an account?