Trending Assets

Top investors this month

Trending Assets

Top investors this month

Meta: When It All Matters

From “Moving The Goal Posts” (November 2022):

“If we assume FRL [Reality Labs] is worth negative $100 billion (rough guesstimate of cumulative losses over the next five years, with zero value created as a result), that leaves ~$315 billion for FOA [Family Of Apps]. That business will generate ~$113 billion in FY22 revenues, with TTM EBIT in Q3 FY22 of ~$47.9 billion… If you believe the core business can grow revenues and profitability over time, as I do, you would have to do some real gymnastics to argue FOA (as a standalone company) isn’t worth significantly more than its implied value. The answer to that question ultimately comes down to your views on the sustainability of the FOA user base (DAU’s / engagement) and Meta’s ability to effectively monetize that engagement (ATT headwinds). While much ink has been spilled about Apple killing Meta, I think that characterization is really tough to defend when put into numbers. ATT has clearly impacted Meta (and others) – but the ~$10 billion hit is off a ~$115 billion revenue base. When you compare Meta’s revenue growth trends over the past four or five quarters relative to a few of its peers – some of which are greatly affected by ATT and some of which are not – it tells a different story than what many seem to believe is true.”

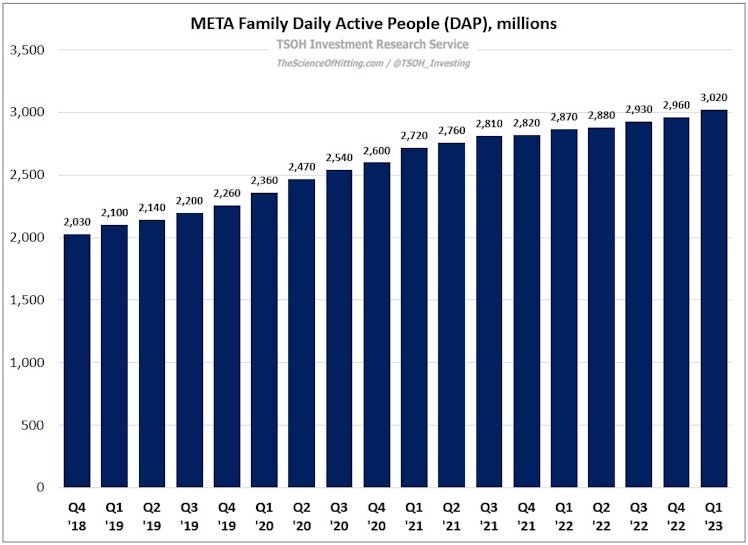

Let’s revisit those two questions: the sustainability of the FOA user base and Meta’s ability to effectively monetize engagement. On the first point, Meta crossed a significant milestone in Q1 FY23: more than three billion people around the world now use at least one of Meta’s services on a daily basis (de-duplicated). The growth and sustainability of the FOA user base, most notably at Facebook (now at >2 billion DAU’s), has been a frequent topic of concern in the investment community over the past 5+ years; the reported results continue to suggest that these fears are misguided. (I think a plausible explanation for that discrepancy may be that the people making these predictions are not representative of the broader population; said differently, they overweight views informed by their personal experience.)

Continued DAP growth, along with tailwinds from internal investments behind AI recommended content and new formats like Reels, is driving higher engagement; as CEO Mark Zuckerberg noted on the call, time spent on Instagram has increased by more than 20% since the launch of Reels (as a reminder, management noted on the Q3 FY22 call that aggregate time spent on Instagram and Facebook was increasing YoY in the U.S. and globally).

End Of Preview

thescienceofhitting.com

Meta: When It All Matters

From “Moving The Goal Posts” (November 2022): “If we assume FRL [Reality Labs] is worth negative $100 billion (rough guesstimate of cumulative losses over the next five years, with zero value created as a result), that leaves ~$315 billion for FOA [Family Of Apps]. That business will generate ~$113 billion in FY22 revenues, with TTM EBIT in Q3 FY22 of ~$47.9 billion…

Already have an account?