Trending Assets

Top investors this month

Trending Assets

Top investors this month

Freshpet Inc (Ticker: $FRPT) - Brief Breakdown

Check out my full newsletter here.

Company Description and Qualitative Analysis

Freshpet, Inc. ($FRPT) is a company that produces and sells natural fresh meals and treats for both dogs and cats. In many retail stores you can find the Freshpet brand in their own separate refrigerator in the pet isles or close to pet isles. Freshpet specializes in pet food products and only pet food products under various labels such as Freshpet, Dognation, and Dog Joy.

Quantitative Analysis

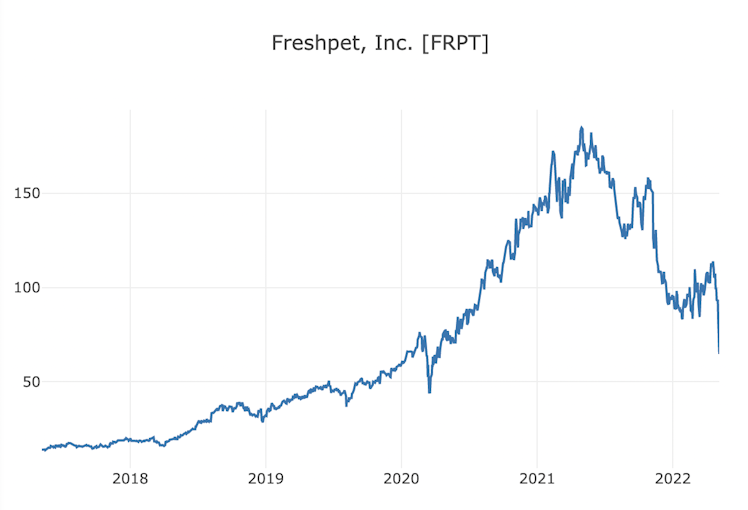

At the time of this writing (5/8/2022), FRPT is trading at $64.70 with a 52 week range of $63.52 - $183.38 and a market cap of $2.81B. In Q4 of 2021 net sales increased 41.5% to $132.2 million, net loss was $17.5 million compared to the prior year net loss of $10.9 million, and adjusted EBITDA was $5.1 million compared to $7.8 million. Return of equity (ROE: Net Income / Total Equity *100) of FRPT is -4.88% and net margin (net income / revenue) is -7.55%. The price to earnings (price per share / earnings per share) ratio was -80.13 and the debt to equities ratio (total liabilities / total equity) is 0.21. This financial analysis was done using financialstockdata.com (sign up using our promo code GCI here).

Bullish Thesis

Here are three points to support the bullish thesis updates:

- Increasing Sales: No matter how you want to look at Freshpet’s financials, growth in sales and growth to the magnitude they have grown is nothing to frown at. Increased growth means that Freshpet is onto a trend or has figured out a place in the pet food industry. As long as there will be competition, Freshpet will need to grow its footprint and increase the amount of daily/weekly/monthly pet owners that will be purchasing their food.

- Health Conscious Pet Owners: Pet owners love their fur babies no matter how you want to look at it. Millennials specifically are now having pets because it is too expensive to have children. More pet owners that do not have children has equated to more spending on pets in general. With this shift, pet owners have become more health conscious for their pets and having few children, pet owners are willing to spend more on their pets food and other items in order to try to keep their pets healthy. This is shown in the increasing sales and will continue as long as owners are willing to spend a bit extra on their pets' food.

- Habits: Humans and pets are creators of habit. Pets need to eat similar food regularly for digestive reasons, in order for them to not get sick or throw up consistently. Once pet owners begin the change to Freshpet it will be difficult for them to turn it around. My parents bought Freshpet for our dog growing up and our dog would freak out at the sight of this bag. Then when we tried to switch back to a more dry food, he wouldn’t eat it or would not get as excited for his food so my parents kept using the Freshpet. Dogs and cats can “convince” their owner they need Freshpet food and the owners most likely will give their pets what they want.

Bearish Thesis

Here are three points to support the bearish thesis:

- Specializing in Pet Food: Most other pet related companies have multiple lines of products, whether it be toys, beds, or other services related to pets while Freshpet simply provides food. This is good in a sense that they can master the art of pet food, but for revenue purposes it severely hinders the amount of growth that Freshpet can sustain. With only having one product and a product that is a little more high class, it will be difficult to continue growing at the rate it has. Freshpet is a one trick pony and relies heavily on consumers' desire to provide their pet with healthier food options. Although if a recession hits or expenses start to add up, pet spending will be one of the areas I could see consumers limiting spending.

- Blaming COVID for lack of growth: The Covid pandemic with shutdowns limited Freshpet’s growth because Freshpet relies on retail stores to hold their product in a dedicated refrigerator in the pet aisle. This is a huge limitation for the business. With increasing online sales, subscription based services, and easier access to pet goods, Freshpet relies heavily on foot traffic which has been decreasing since the shutdowns of the Covid pandemic. Although there may be a recent rise in sales, I am not sure this can be sustained with the limitations the business has for itself.

- Losing Money: In difficult economic times this is never a positive. The economy is starting to look somewhat similar before the crash in 2008, and with a company that specializes in higher end pet food for only two pets it seems like it is in a tough position. Overall, I am not sure how the economy will play out but I do see a big drop in various tech stocks that have been considered “growth” for the past decade or so. These drops are due to the overall macro environment and I believe the health of companies as a whole. It will be interesting to see how growth companies and companies like Freshpet that are losing money react to a declining economy and I for one do not feel it will be a good reaction.

Check out my newsletter here.

greencandleinvestments.substack.com

Freshpet Inc (Ticker: FRPT) - Brief Breakdown

In my Brief Breakdowns,I pick a stock and present opposite sides – I present the bullish argument and the bearish argument.

Already have an account?