Trending Assets

Top investors this month

Trending Assets

Top investors this month

Overview of Semiconductor's recent performance

The semiconductor industry has gained attention in the past years due to secular trends like AI, robotics, 5g, EV.

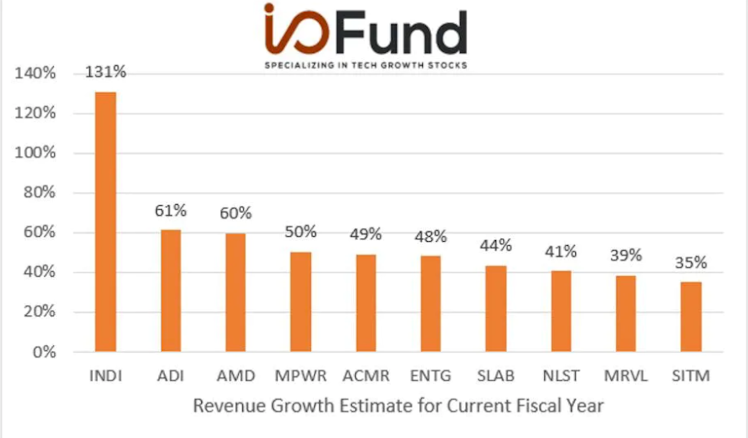

Highest top line growth:

$INDI is benefiting rom the growth trend in advanced-driver assistance systems and EVs.

$MWPR presented solid growth while guiding for 51% growth.

Highest guided top line growth:

$AEHR has developed a technology with tangible benefits to test emerging semiconductor components.

Analysts expect continued growth from Aehr and, it turned profitable on a NI basis last year.

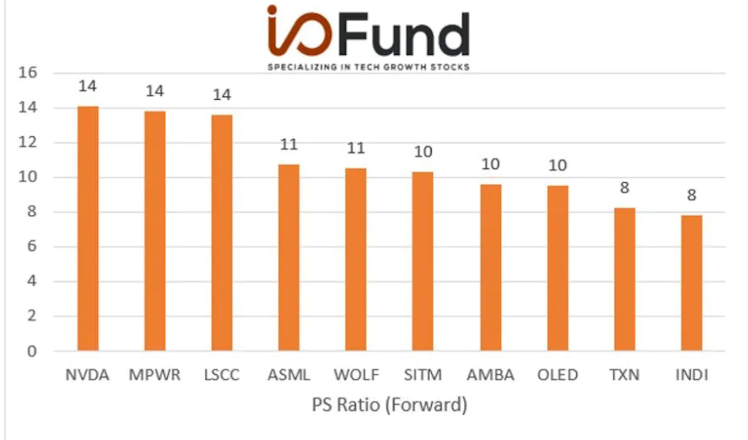

Highest Forward PS:

Companies with very solid fundamentals and bright future prospects deserve a premium.

Worth noticing top 4 is heavily profitable.

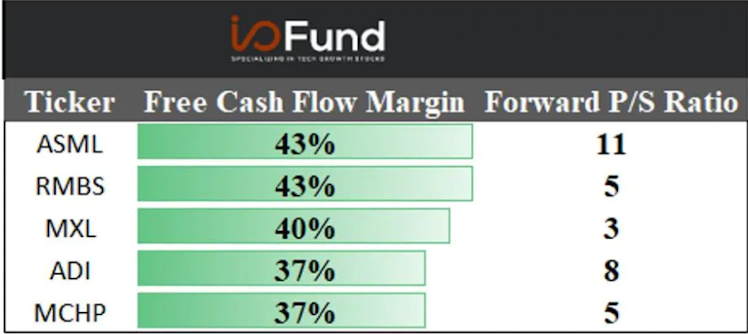

Highest Free cash flow margin and Forward PS:

Companies with a high cash flow margin also have a premium valuation. This is an important metric in the current environment.

$ASML leading the group.

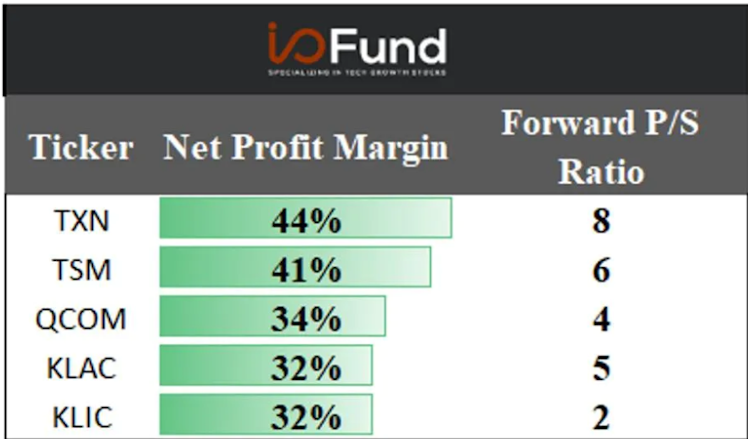

Net Profit Margin and Forward PS:

A company with a higher net profit margin generally deserves a premium valuation on a PS standard since a top line dollar gets cleaner to shareholders pocket.

$TXN Leading the group.

In conclusion:

The semiconductor industry is a high growth yet profitable sector, with very bright future prospects.

Source:

IO Fund

Semiconductor Q3 2022 Overview

Semiconductor stocks have gained prominence due to growth drivers such as artificial intelligence, high-performance computing, 5G, robotics, machine learning, and electric vehicles. Despite semiconductor companies underperforming YTD, there is evidence that more supply will come online by the end of the year that will be met with equal or greater demand.

Already have an account?