Trending Assets

Top investors this month

Trending Assets

Top investors this month

Dividend Stock #7 🏪 $NNN

Hello fellow investors 👋

Post #7 out of #51, where I introduce you to the stocks in my portfolio.

Did you notice before they were #50 and now #51? Yes, cause the company I want to talk about today is the last addition to my dividend portfolio. Increasing also my REITs: National Retail Properties $NNN

$NNN is a Real Estate Investment Trust (REIT) that focuses on the Net Lease market. What does mean Net Lease? We talk about properties where the lessees pay taxes, maintenance, and insurance other than the rent. More simply, when you rent out a property with a net lease contract, you remove from yourself all headaches focusing on receiving your rent.

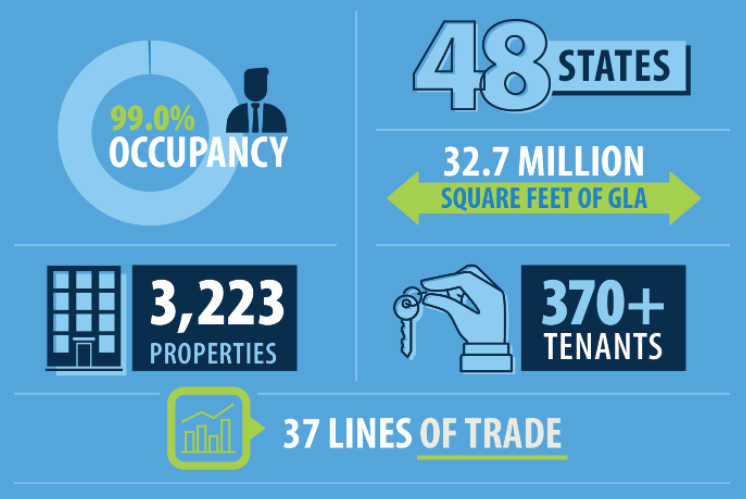

Such type of agreement is most common for commercial property, and $NNN has a wide portfolio across the US.

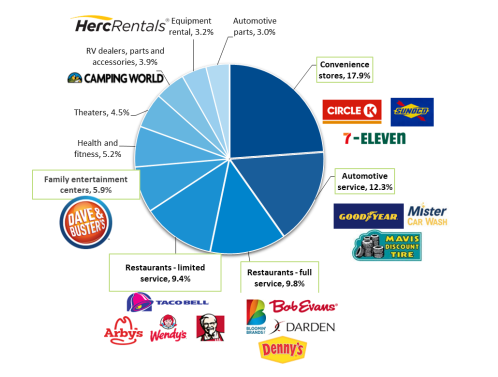

To enter more details, here are the biggest tenant's names:

At first glance, you can notice that $NNN is very similar to another famous REIT: Realty Income $O. However, while they are both in the same industry, $NNN is a much smaller company (only $7.6B) that gave proof of strong execution and an impressive track record.

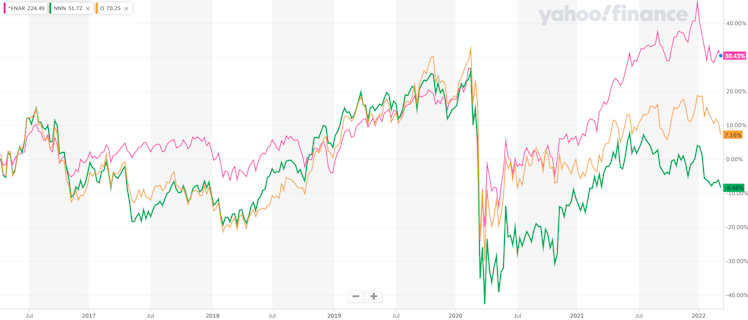

The stock price was hit during the Covid pandemic of 2020, as for the whole industry, but we notice that the price is still lagging compared to the NAREIT index and $O.

The reason is mostly related to the delinquency amount and deferral payments suffered in 2020/2021. The biggest nightmare for Real Estate companies has tenants that don't pay the rent. Fortunately, I have to say that the deferral payment schedule is working, and the company is cashing back when it was lost.

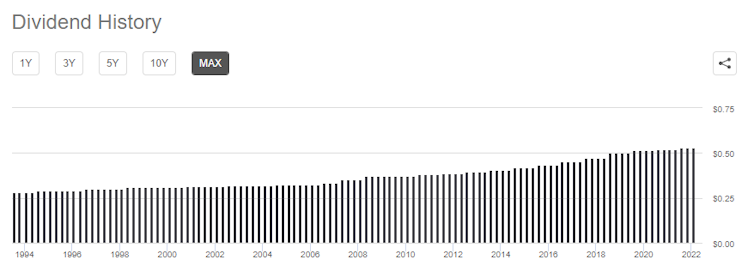

National Retail Properties is also a dividend beast: the company increases its dividend from 32 straight years, allowing the badge of a Dividend Champion.

FWD Dividend Yield 5.05%

Today, $NNN represents 1.4% of my portfolio.

Do you like such posts?

Give it an upvote, and follow me for more. 👍

I appreciate this post greatly. I have been obsessed with REIT's lately and I haven't stumbled across this one. Will definitely be taking a look into it. Although, simply based off of this post, I already want to start a position and get that DRIP going

Already have an account?