Trending Assets

Top investors this month

Trending Assets

Top investors this month

$AMD's Q2 Earnings & The Same Old Thesis

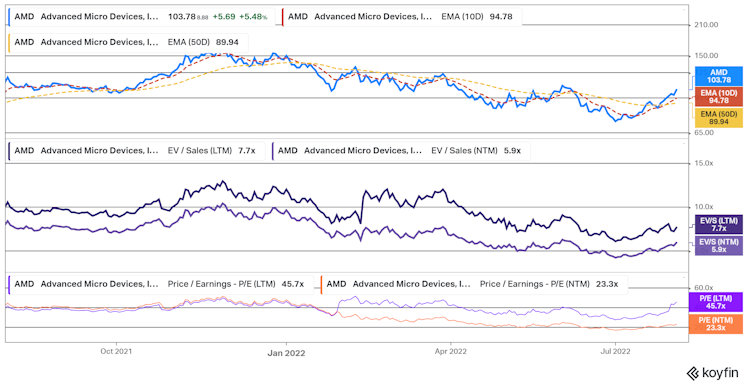

I had presented a short thesis on AMD about 3-4 weeks ago (attached), highlighting the "Buy The Dip" opportunity that the market had given to us in the high $70 range. With some help from bullish market spirits, and some strong stock fundamentals, that trade worked out very well quickly. $AMD trades at $103 as I write this.

Here's my last post:

As for Q2 Earnings:

- 70% YoY Sales Growth, in-line sales vs consensus

- In-line EPS

- Q3 guidance within range, if not slightly under

- Strength across the same verticals (embedded, enterprise, data centre & server, with some caution on PC or consumer-oriented market demand

Compared to previous quarters, this wasn't anything special. But as mentioned in my last post, AMD only has to execute against their own expectations reasonably well to deliver long-term alpha. The multiple has compressed to a forward P/E <20x before, but even today's 24x leaves room for long-term expansion. Perhaps a 20% IRR if not a 30%+, or the 50% 12-month alpha potential I pointed out.

While some profit taking might be warranted depending on your position size, I reckon it's still worth staying with the stock as the same old thesis continues to play out: market share gains vs Intel, particularly in data center and enterprise back-end spaces. Perhaps the most important thing to note is that the company remains "underrepresented" in this particular vertical with 10s of billions in opportunity, and a $135B TAM. Meanwhile Intel $INTC has specifically said that their data center growth will be slower than the data-centre market growth for the next two years. Big ships take time to alter course. If the competitive space was murky a month ago, it got a little clearer last week.

So the same old thesis stands, although with a less pure alpha available to investors compared to a month ago. There's such a long growth runway to go and it should pay to bet on the winning trend here. The following part of the Q2 transcript stood out to me:

"So I do think, to your overall question, do we become more correlated to the market, I mean, I think we are -- we've certainly gained a lot of share. So we're a larger piece of the market, but we are still underrepresented. And the visibility with our customers, especially our large cloud customers, second half of this year into next year is very good." - CEO Lisa Su, on Q2 Earnings

I'm staying long $AMD.

Already have an account?