Trending Assets

Top investors this month

Trending Assets

Top investors this month

$CRSR, Signs of Life?

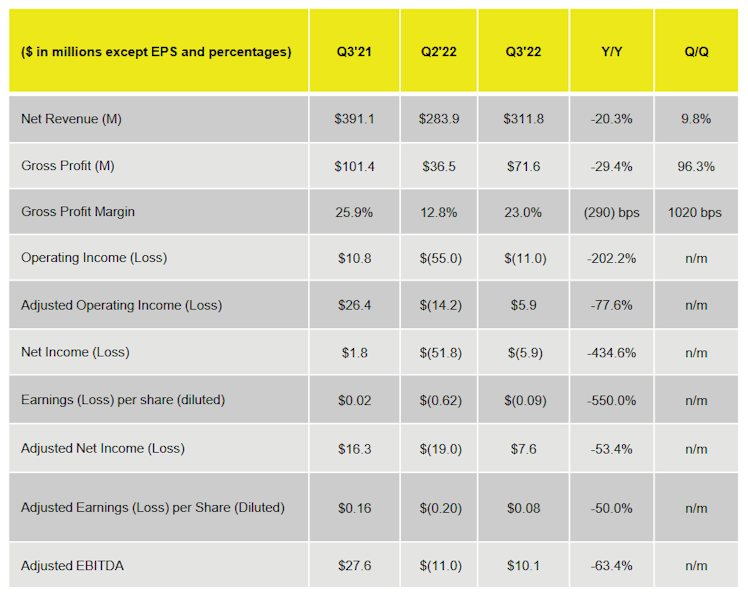

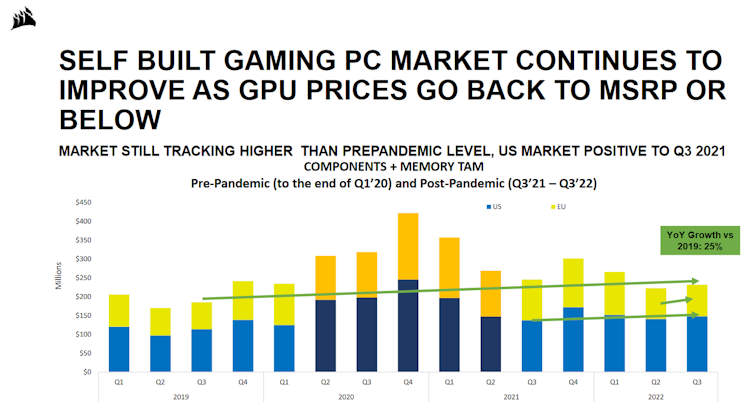

What was once more than 15% of my portfolio Corsair has fallen quite a bit. Most of this has been due to supply chain issues and slowing demand for their products. But as of this most recent earnings call it seems something is improving, although it is hard to tell what exactly.

On the surface, these numbers look bad, and they are, however, I tend to agree with management when they say stimulus drove consumer spending in gaming and streaming. As that fades Corsair must face the hard reality of declining revenue.

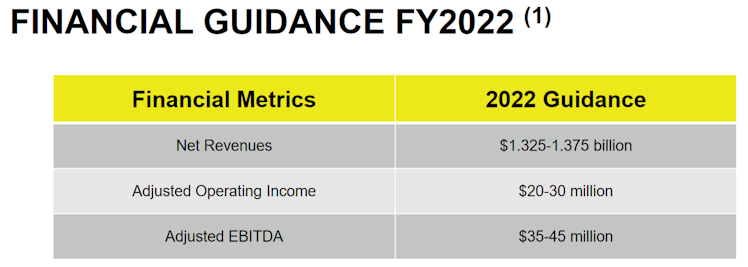

On top of this Corsair cut guidance for the third time this year. Lowering all targets by quite a bit.

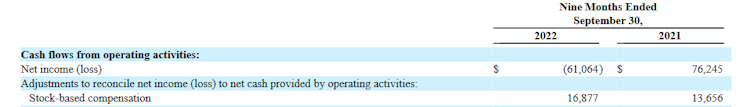

On top of that SBC was up 20%, although still not a large amount overall which seems fine.

So where is the good?

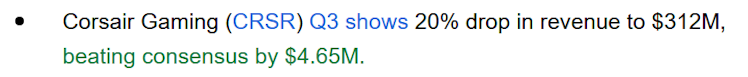

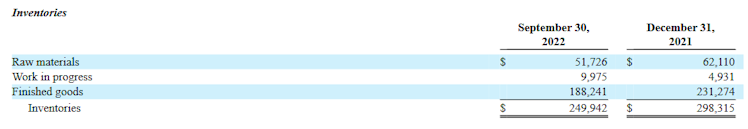

Well, there is the 1% revenue beat. But I think more important is falling inventories.

I imagine this was a signal that constraints may be easing and Corsair can get back on the path to profitability again.

To me, it seems like things are trending upward. After all, the company is still growing revenues nicely, making solid acquisitions without piling up too much debt and now things seem to be normalizing.

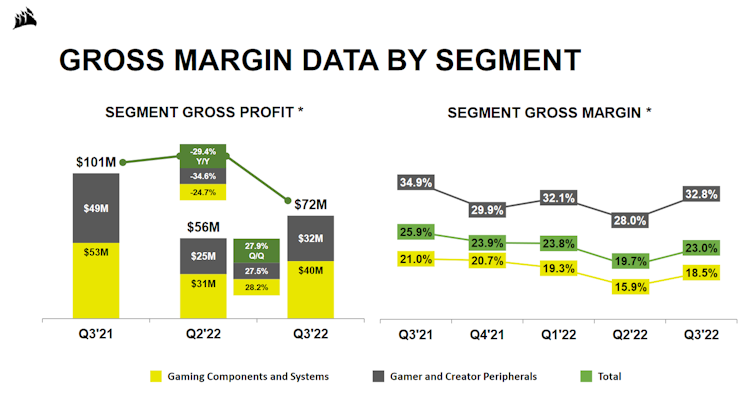

Also, the gross margin saw slight improvements.

All-in-all, I like it, cautiously optimistic.

Already have an account?