Trending Assets

Top investors this month

Trending Assets

Top investors this month

BNPL takes a hit

A lot of tweets today about $AAPL putting startups out of business by offering their entire business as one of the features in their ever-expanding ecosystem of products and services. Takes me back to this excellent piece by @jemimajoanna on BNPL

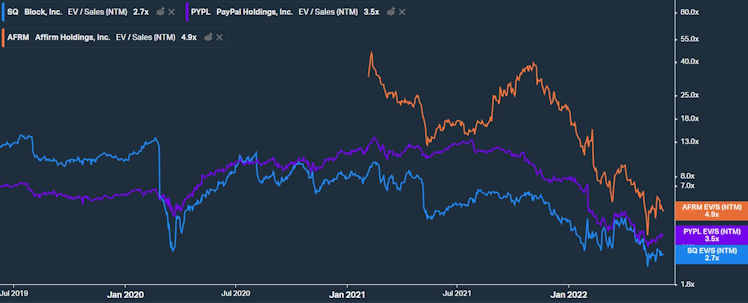

The author very rightly questioned whether this was a sustainable model as a standalone business. The emergence of the likes of Klarna and Affirm have pushed other fintech players to add this as a feature to their existing product portfolio. $AAPL entering the game is bad news for a lot of these guys. As the space gets crowded with much larger tech and payment players, the path to long-term profitability for the standalone models might have to be pushed further down the road.

From the article:

While BNPL is an accelerated method of customer acquisition, all roads in payment somehow point in one direction: bundled/super-app models.

Valuations have already taken a hit this year. $SQ, $PYPL and $AFRM are down massively. The standalone Affirm dropped 5% just yesterday post Apple's WWDC announcement.

Standalones have probably entered the buyout target territory with shares down 50-70% from the highs. Existing players from the payments and tech landscape might already be looking, is my guess.

For whom does something like $AFRM add the most value?

www.ft.com

Is ‘buy now pay later’ a viable business model?

BNPL might be the hottest game in town but standalone businesses are going to struggle to make any money.

Already have an account?