Trending Assets

Top investors this month

Trending Assets

Top investors this month

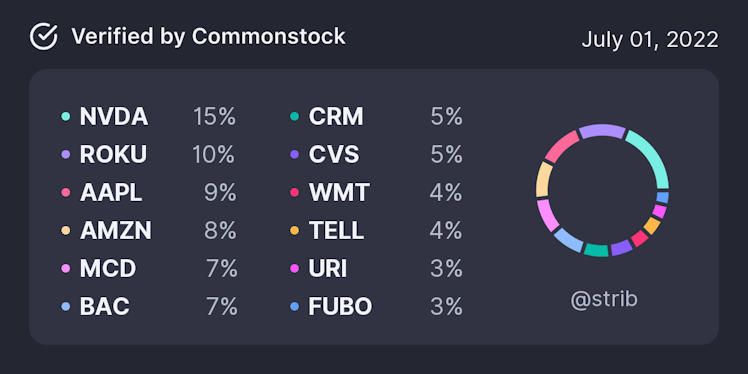

Portfolio and Macro Update

Hey everybody!

Welcome to the second half of the year.. and good riddance with the first half!

Portfolio Update: During tough times like these I go into auto-pilot. I let all of my dividends continue to DRIP (dividend reinvestment programs) helping me systematically DCA (dollar cost average) and take advantage of the down turn. I have not made any material changes with the exception of selling out of my $Y position as the company is being acquired and it was more or less a mission accomplished situation for me. I rolled the proceeds into existing positions consolidating my portfolio a bit.

Personal Strategy: Less is more. While it certainly hurts watching some of my favorite stocks get beaten down this is no time to panic. I intend to hold firm and weather this economic storm like the ones that have come before it and the ones that have yet to come.

Macro Thoughts:

- I believe we are in the midst of a recession already. It may take a few more months for the talking heads to admit it / come to terms with it but I believe we are already there.

- Inflation is the key driver here but I am of the opinion that it is a supply side issue meaning the Fed's rate increases will not materially affect the root cause. Raising rates decreases demand by constricting the money supply but does not increase the supply of the goods, namely energy and food, that are driving the inflation in the first place.

- Energy - We have entered a new phase of the problem. Where crude supplies have been the main focus over the past few months, refining capacity is going to be the next area that needs to dramatically increase before we see relief at the pump. Additionally, there is hope among many that OPEC+ will be able to increase capacity but they have been missing their production goals already so I am of the belief that they simply do not have a lot of spare capacity to tap into.

- Food - Food inflation has been the second most important issue for many on main street. As the war in Ukraine continues to rage on, this crisis will continue to exacerbate as both the Ukraine and Russia are normally large bread baskets for the EU and other Mediterranean countries. This will not have a quick fix either as wheat harvests should be taking place now but are not due to the war. Even if they were to harvest, the blockade of Odessa and the mining of the Black Sea have the grain reserves essentially land locked.

- Economy - We are starting to see some cracks. The housing market is cooling as rates rise, major companies are internally preparing for a downturn via proactive layoffs and hiring freezes. To me, seeing companies like $TSLA, $META, and other mega caps slowing down is indicative that the problem is more widespread than we may believe.

Key Take Away / What To Do: The current macro backdrop is rather bleak and there are no quick fixes to the root causes driving the rampant inflation. Despite this, downturns are part of this game we call investing and if you are in for the long term panic selling at this point is one of the fastest ways to destroy capital. Instead, focus on your core jobs, hunker down and continue to raise cash. Take advantage of any dividends in your portfolio to reinvest and over the coming months / year slowly average into your highest conviction names. With volatility like it is, quick trades may seem attractive but in my experience luck can be easily confused for skill in the short term so I chose to stay steady and consistent vs. trying to time the ins and outs of the wild price movements.

Already have an account?