Trending Assets

Top investors this month

Trending Assets

Top investors this month

$KLAC Corporation Earnings Preview Q4 FY22

KLA Corporation is the world's leading supplier of process control and yield management solutions for the semiconductor and related microelectronics industries.

Its recent earnings release for Q4 of its FY22 was ‘as usual’, executing and beating estimates across key metrics.

Profitability

- Revenue for Q4’22 of $2.49B (up 29% compared to Q4’21) beating estimates by $65M and slightly higher than the mid-point guidance provided. FY’22 Revenue of $9.2B up by 33%.

- Gross Margin (Non-GAAP) of 62.4% in Q4’22, 0.1% lower than mid-point guidance.

- GAAP EPS for Q4’22 of $5.40 (up 32% compared to Q4’21) beating estimates by $0.22 and $0.25 higher than mid-point guidance. FY’22 GAAP EPS of $21.92 up by 64%, demonstrating KLA’s earnings leverage.

- Non-GAAP EPS for Q4’22 of $5.81 (up 31% compared to Q4’21) beating estimates by $0.32 and $0.33 higher than mid-point guidance. FY’22 Non-GAAP EPS of $21.15 up by 45%.

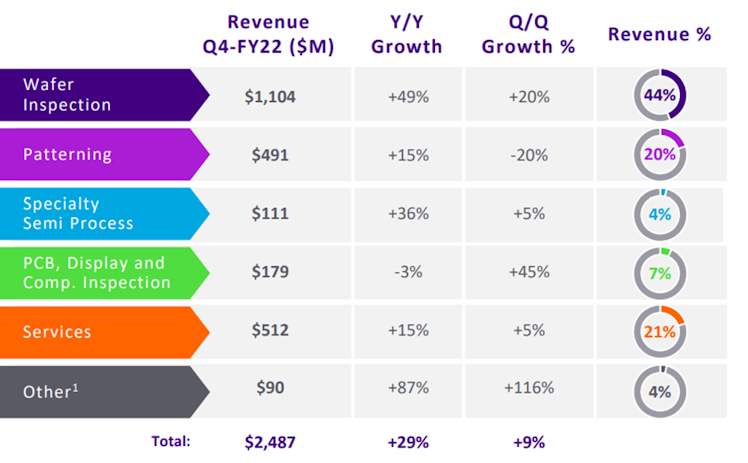

Source: KLA’s FY’22 Earnings presentations

- Wafer Inspection (per management -> strongly levered to EUV and evolving next generation architectures) which is the largest component of revenue delivered a Y/Y growth of 49% due to increased customer adoption of Wafer inspection application (leading edge technology).

- EPC record quarterly revenue (same for Services which surpassed $0.5B) further capitalising on the company’s efforts in Advanced Packaging, 5G and Automotive.

Cashflow

- Cash flow from operations of $819.2 for Q4’22 up by 76% compared to Q4’21. FY’22 cash flow from operations of $3.31B up by 51%.

- Free Cash flow of $746.1 for Q4’22 up by 82% compared to Q4’21. FY’22 free cash flow of $3.01B up by 54%.

- Free cash flow margin of 32.6% for FY’22 Vs 28.2% for FY’21.

Capital returns

- $5.52B (or c.10% of market cap) were returned to shareholders during FY’22 (well above free cash flows) with $3.67B returned in the last quarter ($3.47B share repurchases and $158M dividends).

- Despite the new debt of c.$3B and $0.5B senior notes which effectively will fund the Accelerated Share Repurchase ($3B in the next 3-6 months) the credit ratings of the company remain unchanged compared to the Investor Day (16th June 2022) with the exception of S&P rating that upgraded KLA by a notch. However, the upgrade was before the debt issuance.

Current environment

- Some end markets such as PCs and mobile weakened, however, management indicated that they continue to see strong demand, beyond their ability to supply and noted that the digital transformation (data centres, 5G, EV digital healthcare etc.) makes cycles more durable.

- Due to supply chain challenges Management reduced its outlook for WFE in CY22 to $95B up by 9% compared to CY21 (previously estimated around $100B).

It shall also be noted that on 25th of July a team of Morgan Stanley analysts reduced their WFE estimates from $100B to mid $90B for 2022 and to c. $83B for 2023 due to demand softening and supply chain constraints.

On 15th of July Wells Fargo analysts noted a cyclical correction and Capex cuts thus revised WFE estimates to $96B for 2022 and $91B for 2023.

- Management also expressed concerns about the macro-environment and that this could affect the plans of its customers in 2023. Despite this, KLA will continue to strategically adding capacity across their manufacturing footprint to support its customers’ growing process control requirements.

- All in all, it seems that the current environment is not expected to significantly affect KLA with Rick Wallace, President and CEO stating that “No real churn in backlog and in expectations in terms of delivery timing” and Bren Higgins, EVP and CFO adding that they feel their position is a bit different than other process players.

Regionalisation

- New U.S. licensing requirements for China related to sub-14-nanometer development and production => Management does not expect any material impact, at least in the next 12 months.

- CHIPS Act => Rick Wallace indicated that the Act does not change or drive their manufacturing strategy => “based on where it makes the most sense for us to build the products to support our customers where we can get the talent and where we can have the supply chains that we need.”

- KLA is dependent to China as 29% of its shipments are to China.

Outlook

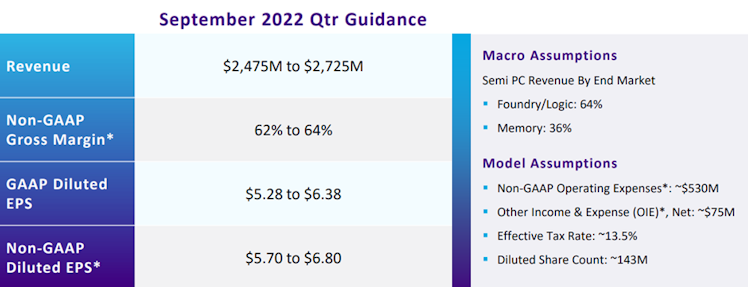

Source: KLA’s FY’22 Earnings presentations

The growth trajectory of KLA seems to be intact from the current macro developments with management setting a mid-point Revenue guidance of $2.6B i.e., a y-on-y increase of c.25% with most of the increase coming from Semi Process Control (richer GP mix and thus higher mid-guidance for GPM).

The projected increase in Non-GAAP expenses (c. $512 in latest quarter) accounts for investments in new product programs to support the business expansion and is also expected to trend higher over the 2nd half of CY2022 (majority is R&D).

As a result, the estimated (decrease) / increase in GAAP EPS and Non-GAAP EPS is c.(16%) and 35%, respectively. Q1’22 GAAP EPS included a one-off tax benefit of $394.5M.

It shall be noted that EPS metrics are also affected by the expected share repurchases, as the diluted share count is expected to reach c.143M from c.149M as at the end of June (i.e. a 4% reduction).

Concluding remarks

Another quarter with superb performance demonstrating the resilience of KLA Operating Model and management’s commitment to create value for shareholders.

Although, the sequential revenue increase implied by the mid-point guidance is only c.4.5% we expect Management to execute considering that demand outweighs supply ability.

Thank you for reading KLA’s earnings preview and make sure that you subscribe to our

newsletter to receive future posts directly to your email! In the following days we will also release our write-up on KLA.

Disclaimer: Not a financial advice.

stockopine.substack.com

StockOpine’s Newsletter | Substack

We focus on quality companies, providing high-quality fundamental research and stock ideas. Click to read StockOpine’s Newsletter, a Substack publication with thousands of subscribers.

Already have an account?