Trending Assets

Top investors this month

Trending Assets

Top investors this month

Nvidia's position as king can't be shaken by anyone!

In this paper,$NVDA After comprehensive evaluation, it is worth noting that we have observed that its share price has risen by more than 100% recently, covering and exceeding the expected target price of US $244.06.

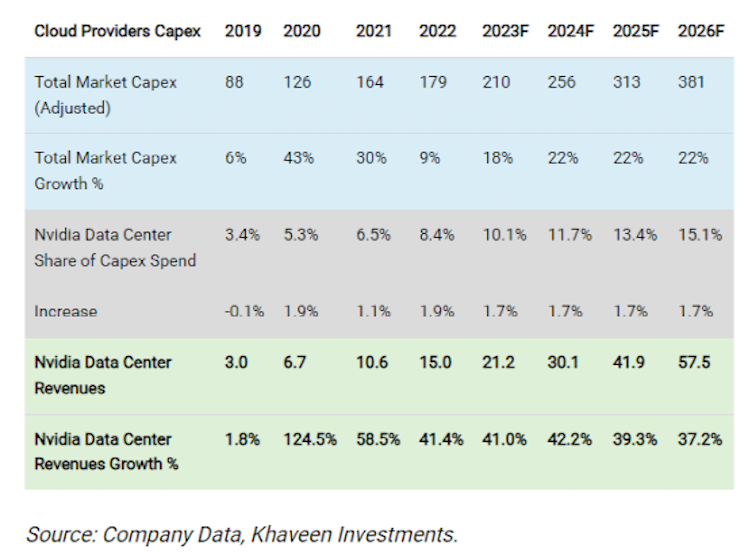

In fiscal year 2023, NVIDIA's total revenue increased by only 0.2%. Compared with previous analysis, NVIDIA's total revenue in fiscal year 2023 is predicted to increase by 4.5%, which is quite consistent with NVIDIA's actual growth. As expected, the data center is its main driving force for growth. However, its real growth was more than twice as high as expected, with an increase of 41.4%, compared with the forecast of 19.7%.

Although the growth of data center was stronger than expected, the growth of game business was higher than the actual growth, which was-27.2%, because NVIDIA's PCGPU revenue declined more than expected. Its smaller part, professional visualization, also performed poorly compared to expectations. In contrast, the auto industry grew stronger than expected.

So despite the weak PCGPU market, NVIDIA managed to generate revenue similar to the previous year, as its data center division remained a bright spot for growth.

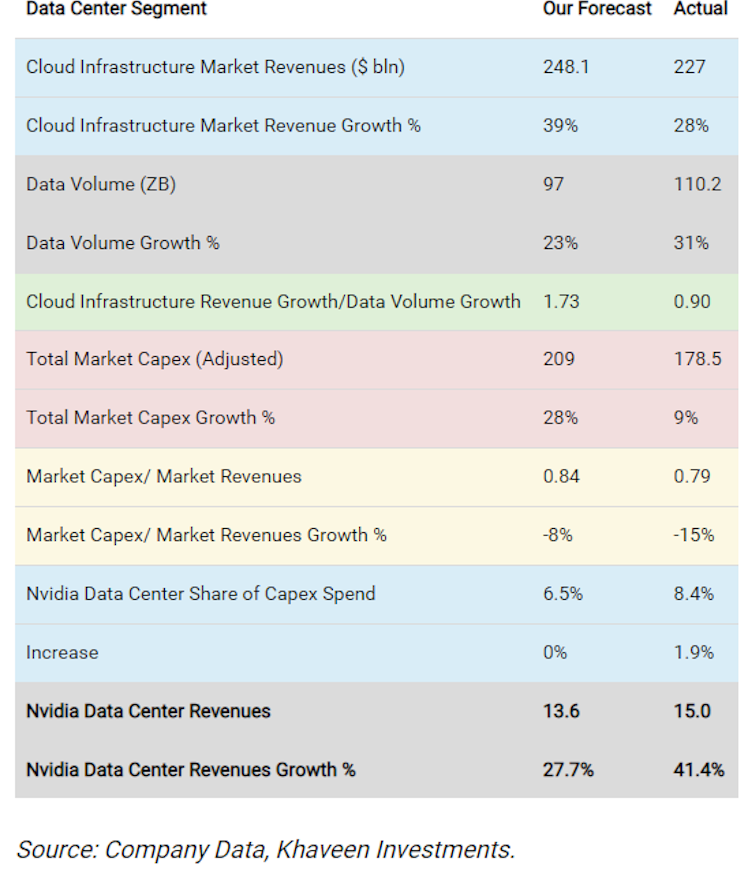

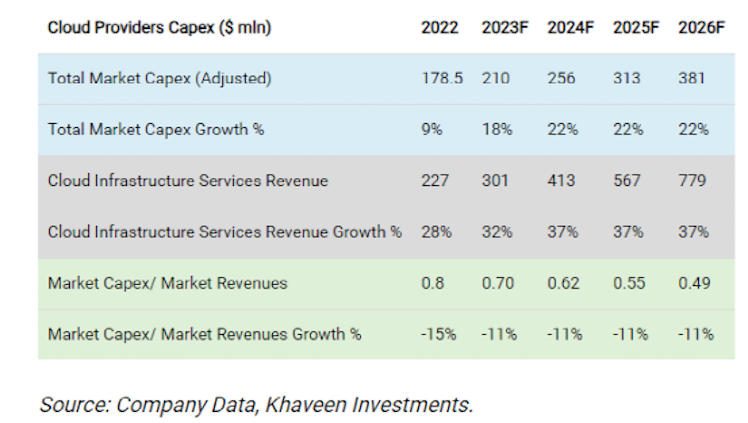

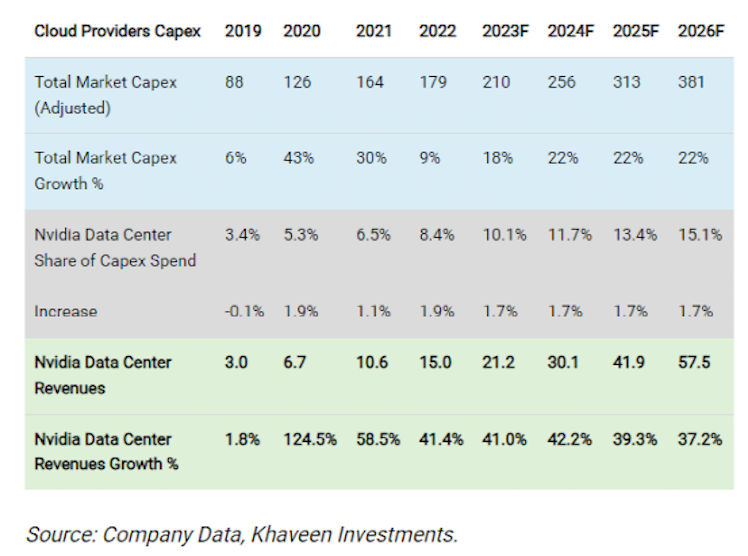

The above table compiles the forecast for the data center department of the company. As shown in the figure, although the data volume growth is higher due to the lower cloud infrastructure revenue growth, the actual growth of the cloud infrastructure market in 2022 is lower than our forecast.

In addition, the estimate of capital expenditure in the cloud market, which is composed of the top four participants such as Amazon, Microsoft, Google and Alibaba, is lower than the forecast in 2022, because the decline of market capital expenditure/market revenue is larger than expected.

However, NVIDIA's data center revenue is still better than forecast, because its share of data center capital expenditure has increased to 8.4%, compared with 6.5% predicted based on its fixed ratio in the previous year. Therefore, this shows that NVIDIA performed better than predicted due to its growing share in the data center market.

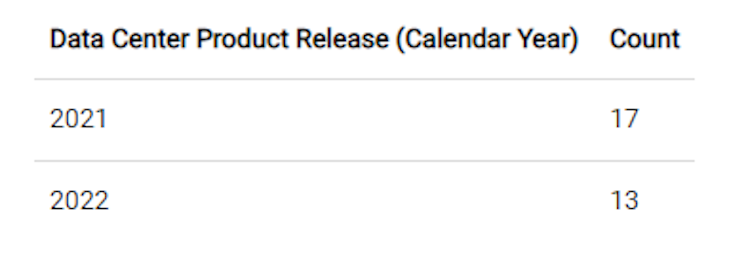

The number of new product releases in the data center field decreased slightly, from 17 in 2021 to 13 in 2022. Some new products released in 2022 include IGX platform, GraceCPUSuperchip and H100GPU.

In the third quarter, NVIDIA launched its most advanced chip, the next generation data center GPU (H100). According to Nvidia, "the revenue of the H100 is already far higher than that of the A100", which the company mentioned highlights its excellent performance, explaining that it is "9 times faster than the A100 in training and 30 times faster than [reasoning] (ph)-based large language model based on transformer."

Overall, the decline in the number of product releases indicates that the increase in the company's share in the data center market is not due to more product releases compared with the previous year, because its product releases declined in 2022.

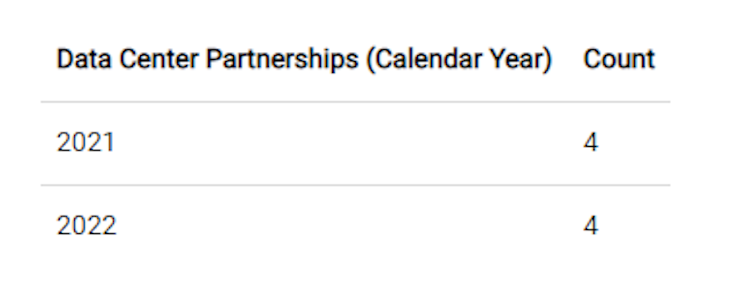

The number of new partners in the data center field remains unchanged, with 4 in 2021 and 4 in 2022. The new partners in 2022 are Microsoft, Dell, Deloitte and Booz Allen. In addition, the company recently announced more partnerships this year with top CSPs including AWS, Microsoft and Oracle. According to the company, "for the fourth consecutive quarter, CSP customers drove about 40% of data center revenue."

Overall, NVIDIA has the same number of data center partnerships in 2022, so its higher-than-predicted growth is not due to it getting more partnerships.

Improve competitiveness with data center competitors

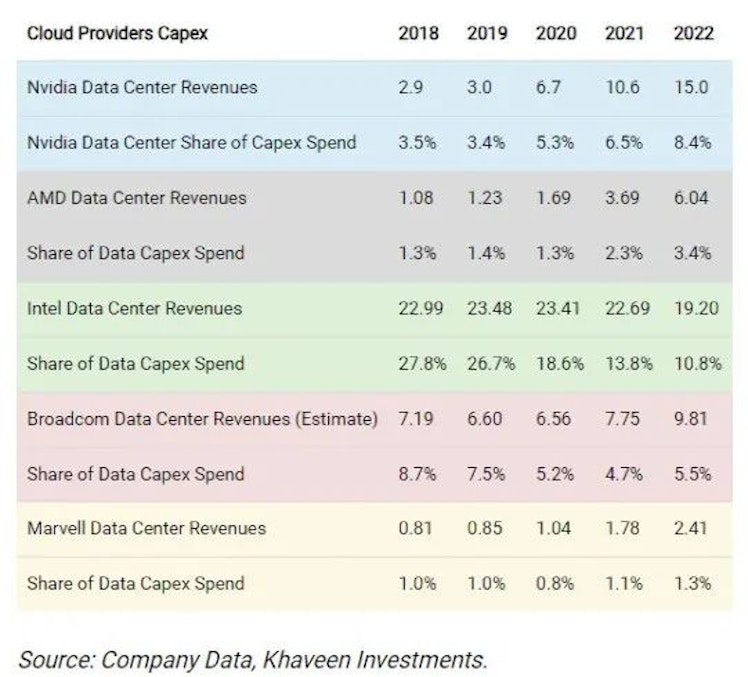

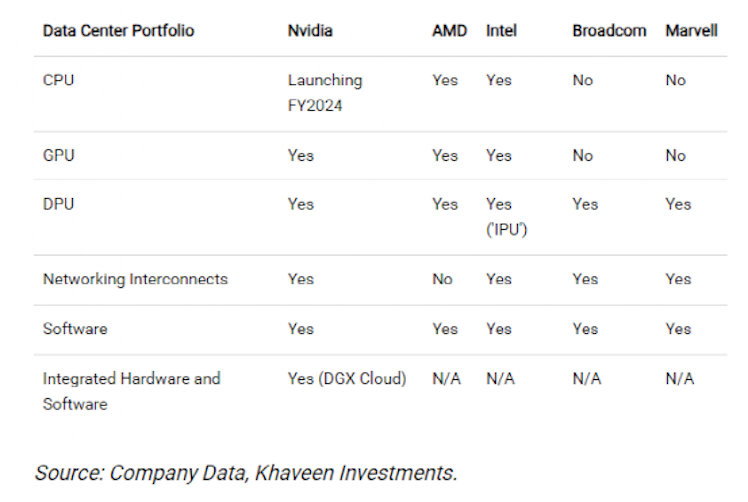

According to the above table, the data center revenues of NVIDIA's major competitors, including AMD, Intel, Broadcom and Marvell, are summarized, and their share of revenues in the total capital expenditure of the data center is calculated.

As can be seen from the table, Nvidia's share increased by nearly 2% in 2022. The company has been increasing its share in the past five years. AMD has also increased its share, but remains a relatively small player compared to Nvidia.

At the same time, both Broadcom and Marvell have increased, because Broadcom's share has been declining until 2021, while Marvell's share has increased by only 0.2% and has been relatively stable in the past four years before 2022.

On the other hand, Intel's share continued to decline, with the largest decline of 10.8% in 2022. The reason for the comparison between NVIDIA and Intel is that NVIDIA focuses on the faster-growing data center GPU market, while Intel focuses on CPU. GPU benefits from the growth of data center, because it was previously concluded that "GPU is more suitable than CPU to handle many calculations required by artificial intelligence and machine learning in enterprise data center and ultra-large-scale network", which can provide NVIDIA with the opportunity to continue to be the market leader of data center GPU, occupying 88% share.

As shown in the figure, it summarizes the breadth of NVIDIA's data center products compared with its competitors. NVIDIA has the most powerful product portfolio, including CPU, GPU, DPU, network interconnection and software to be launched in 2024. In addition, the company explained that it remains focused on expanding its software and services.

In addition, the company also announced a data center integration solution called NVIDIA DGXCloud, which it claimed was "the fastest and easiest way to have its own DGXAI supercomputer". It stressed that top CSPs such as Microsoft, Google and Oracle are already adopting its products, and it is expected that more CSPs will adopt it in the future. DXGCloud is an example of a powerful product integration opportunity between its DC portfolio.

This paper updates the revenue forecast for NVIDIA. First, it updates the cloud market forecast, predicting that it will grow by 32% in 2023, based on the cloud infrastructure revenue growth/data volume growth factor of 1.06 times, and then increase to 1.22 times to 2026, with an average growth rate of 37% in five years.

In addition, this paper updates the cloud market capital expenditure composed of AWS, Microsoft, Google and Alibaba. Based on the updated market capital expenditure/market income coefficient of 0.7 times in 2023, it drops by 11% every year according to its 10-year average level, with an overall growth rate of 22%.

Nvidia's share of top-tier cloud capital spending continues to grow in 2022, according to updated Nvidia's revenue forecast model for its DC division. It is predicted that it will continue to grow on the basis of an average growth rate of 1.7% in three years. Got NVIDIA's latest 41pc DC segment growth rate, which is more in line with its 2022 growth rate.

Therefore, assuming that the company continues to improve its competitiveness in the data center market and gain share, resulting in a higher average growth rate of 40%, which is more in line with its performance in 2022, the growth forecast has been raised.

All in all, NVIDIA's data center growth is better than predicted, because its competitiveness in the data center market is increasing and its share in the whole market is higher, which is due to the company's strong competitive data center product portfolio and GPU performance advantages. Nvidia continues to gain share through the breadth and performance advantages of its portfolio as it acquires more partnerships and continues to expand its portfolio, predicting 41pc growth in its data centre segment in 2023.

Games and other departments

In addition to the data center part, this paper also studies NVIDIA's game part, which is very important because it accounts for 33% of the revenue. In addition, this paper also reviews its professional visualization and automotive departments.

In fiscal 2023, Nvidia's gaming division fell short of forecasts, falling 27.2 pc, below forecasts based on prorated quarterly revenues.

However, the company provided positive guidance to its gaming division in the first quarter of fiscal year 2023.

Graphics processor market share

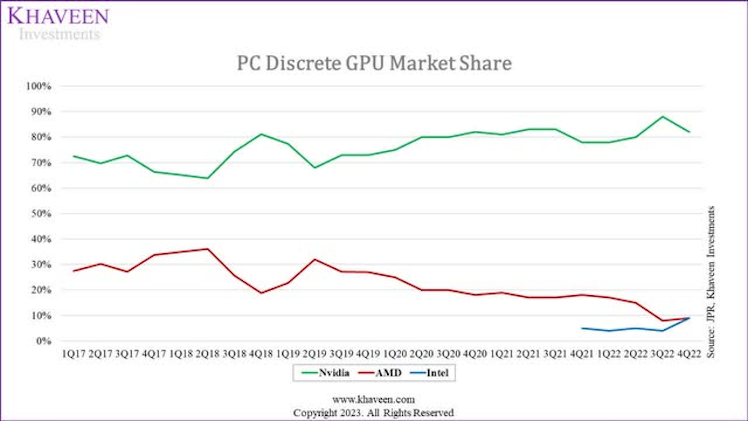

According to the GPU market share chart, NVIDIA consolidated its leading edge in the GPU market in 2022 with an average share of 82%, with an average share of 82%. But, in the fourth quarter of 2022, Nvidia lost its share, while Intel gained after its release. AMD's share remained stable. Nvidia's average market share in 2022 was 81.3 pc compared to 2021, roughly the same as the previous year. Therefore, the maintenance of the company's stable dominant position in GPU market is not the reason for its poor performance in 2022.

Shipments and pricing

Further examine the company's GPU division by summarizing market share, unit shipments and average pricing to determine the factors leading to its decline. According to the table, the company's shipments in 2022 dropped sharply to-48%, which is consistent with the overall market shipment growth rate of-48. 33%.

However, its average pricing was positive and provided some cushion for falling revenues as it increased by 40pc. Therefore, the decline of GPU revenue in 2022 is mainly due to the sluggish GPU market and significant contraction. Compared with the forecast, the larger-than-expected decline is due to the worse-than-expected performance in the second half of 2022. According to JPR data, in terms of shipments, the GPU market decreased by 40.1% in the second half of the year compared with the first half of the year. This is because the sales volume of PC market will continue to decline in the second half of 2022.

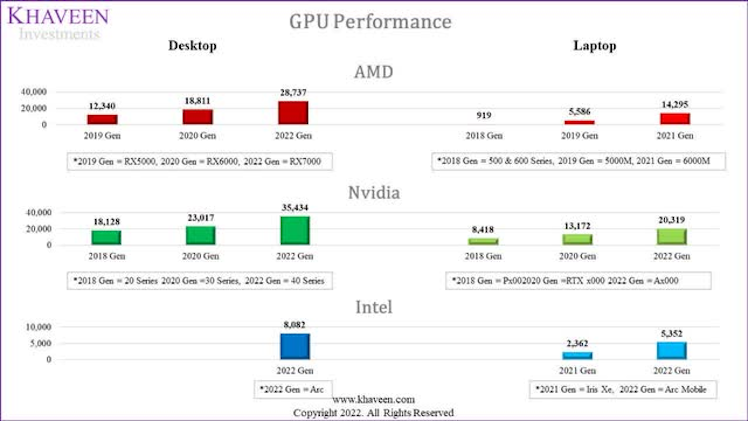

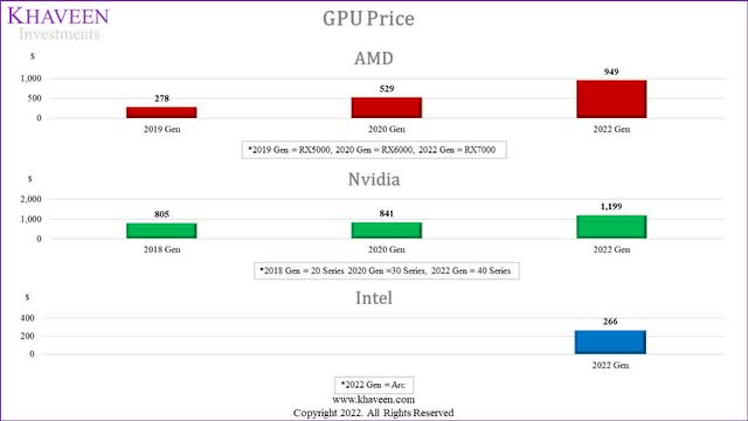

After the launch of its RTX40 series, the analysis of the company's GPU products with competitors such as AMD and Intel was updated according to previous analysis. According to the company, "gamers responded enthusiastically to the new RTX4090, 4080, 4070Ti desktop GPUs, and many retail stores and online stores quickly sold out."

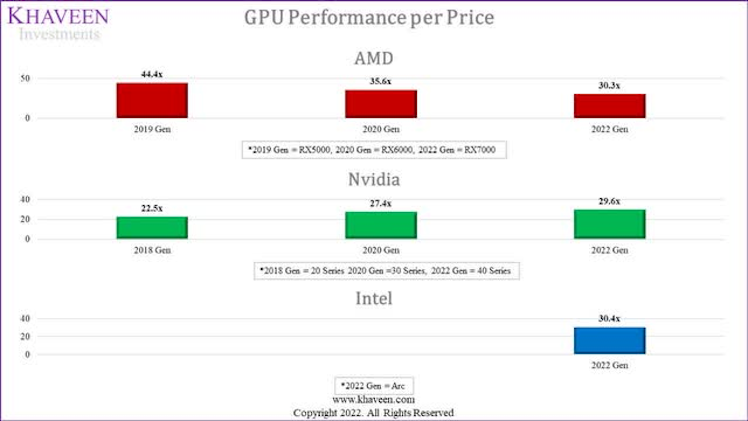

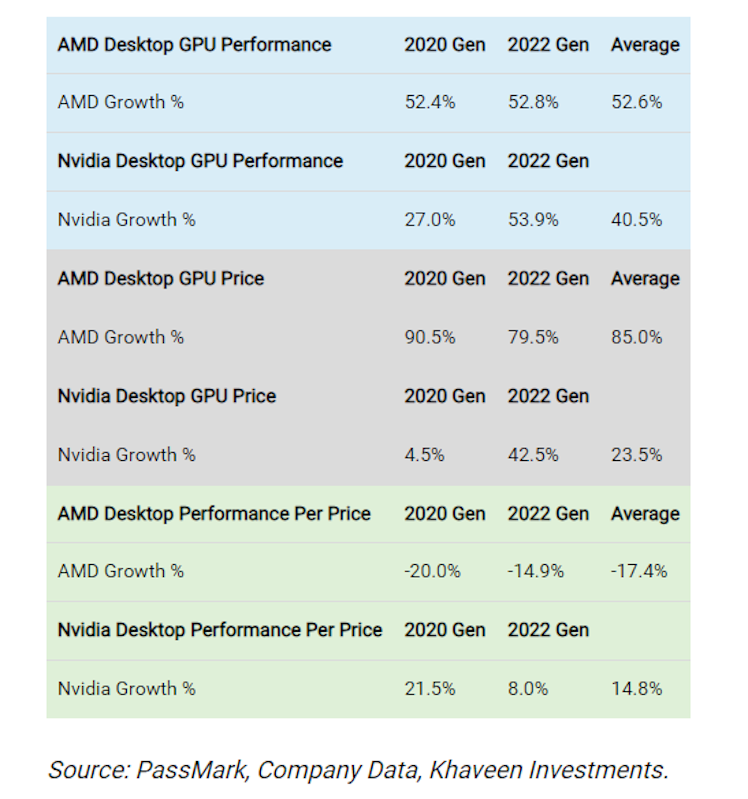

According to the table, the average performance growth rate of NVIDIA's latest generation GPU is as high as 54%, while its average price is 43% higher. As pricing growth slowed to 8%, its value measured by pricing performance increased. Overall, the company maintains its position with excellent performance advantages over AMD and Intel.

However, compared with NVIDIA, the unit pricing performance of AMD and Intel's latest generation products is slightly higher. In other words, the pricing performance of AMD products per generation decreased by 17% on average, while NVIDIA increased by 15%. Therefore, this highlights another advantage of NVIDIA by adding its value.

In addition, its car revenue increased by 60pc, reflecting the sales growth of autonomous driving solutions, computing solutions of electric vehicle manufacturers and the sales strength of artificial intelligence cockpit solutions. The growth also includes the growth of automobile development arrangements.

In 2022, Nvidia launched its next generation Nvidia DRIVEThorADAS chip. The company claims it achieves performance of up to 2,000 teraflops, unifying intelligent functions-including automatic and assisted driving, parking, driver and occupant monitoring, digital dashboard, in-vehicle infotainment system (IVI) and rear seat entertainment system.

Nvidia emphasized the advantages of "multi-domain computing", because the chip is a centralized computing system, which can handle multiple ADAS functions at the same time, instead of relying on multiple ECUs traditionally. Therefore, it is believed that the integration capability of the new chip provides ADAS manufacturers with higher efficiency and enables NVIDIA to benefit from the AV market estimated at 31.3% in our analysis of Mobileye.

All in all, while seeing the company's gaming division continue to face headwinds in the declining GPU market in 2022, it is expected to recover to a positive growth rate of 11.6% supported by higher prices. This is important because games account for 33% of revenue.

Financial analysis

In addition, the company's operating profit was significantly lower than expected. As a result, a financial analysis is conducted to determine NVIDIA's operating expenses and whether they have increased, which has led to its lower profit margins.

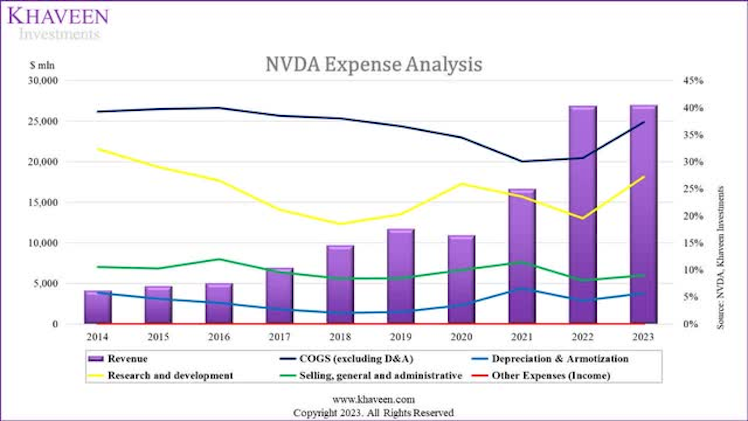

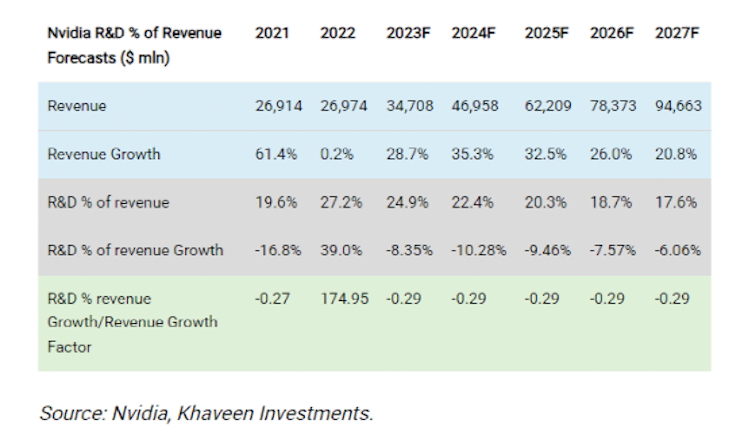

According to the cost analysis, the company's R&D expenses have shown a downward trend since 2018 and stabilized at over 20%, which is the largest operating expense of the company.

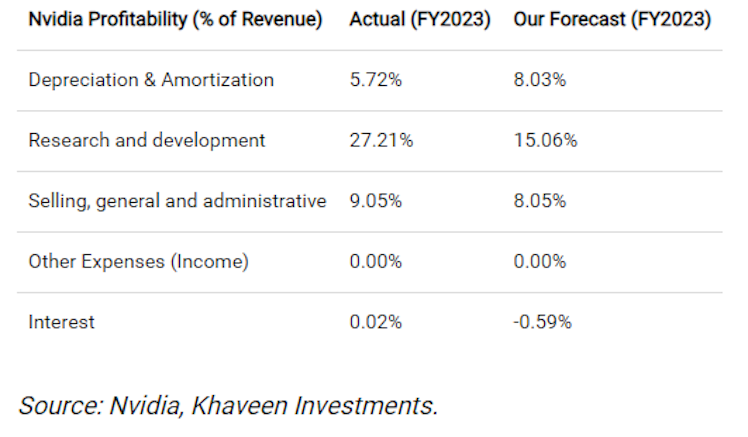

As can be seen from the table, the company's operating expenses show that its R&D growth is higher than expected. However, SG & amp; A Costs are in line with projections. According to NVIDIA's annual report.

The increase in R&D expenses in FY 2023 is mainly due to salary increase, staff growth, engineering development cost and data center infrastructure "-NVIDIA Annual Report.

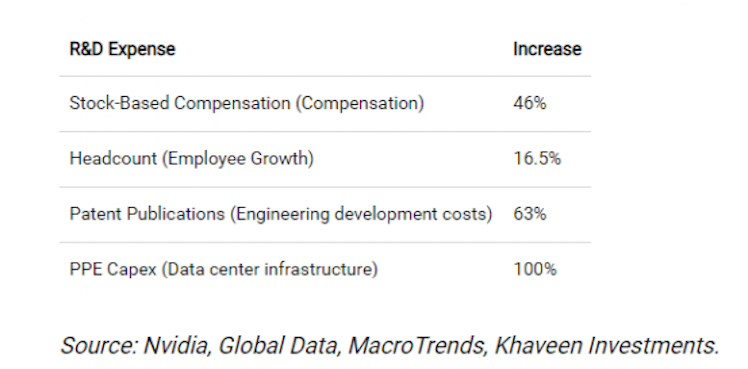

In order to determine the exact factors leading to its R&D growth, this paper compiled the growth percentage of each component in the above table.

Its stock compensation related to R&D increased by 46% in FY 2023, accounting for 26% of its total R&D expenses, which made it one of the main contributors to the expense growth in FY 2023. However, the increase in stock compensation is not uncommon, because the total stock compensation of companies has increased at a five-year average growth rate of 47%.

The number of employees in the company increased by 16.5% in the past year, which is actually lower than the level of 18.4% increase in the number of employees in the previous year. Therefore, this shows that it is not the main factor. Although the company is expected to continue to increase the number of employees to support its growth, its employee growth is not an important factor in its R&D growth.

In terms of patents, the total number of patents disclosed by the company has increased by 63% in the past year, reaching the highest level ever, which reflects the company's commitment to product development to expand its product portfolio.

Therefore, this may indicate its higher engineering development cost, which may lead to higher R&D expenses, which is one of the main factors for its substantial increase in R&D expenses in FY 2023.

However, it is expected that the company's project this year will be developed intoThis would not have increased significantly because the annualized number of patent disclosures obtained by the company from Global Data as of March was 8% lower than last year's total.

In addition, the company's capital expenditure increased by 100% from $900 million in the previous year to $1.8 billion, which may indicate the expansion of its data center infrastructure and lead to an increase in the company's operating costs. Therefore, this may also be the main factor for the increase of R&D expenses in FY 2023.

Looking ahead, it is not expected that the company's data center infrastructure cost will increase significantly, because it is expected that the company's capital expenditure will be reduced to 1.2 billion US dollars in fiscal year 2024 according to the midpoint of management guidelines, and it is assumed that it will be 1.5 billion US dollars every year after fiscal year 2024.

Overall, the main factors leading to the strong growth of NVIDIA's R&D expenses are its salary, engineering development costs and data center infrastructure.

However, the company's strong growth in R&D in fiscal year 2023 will not continue in fiscal year 2024, because its stock-based salary is lower than its five-year average, its patent disclosure number is expected to decline in fiscal year 2023 according to annualized data, and its capital expenditure this year is expected to be lower than that in fiscal year 2023. This paper updates the model to predict the company's R&D expenses according to the percentage of R&D revenue growth/revenue growth factor.

By dividing the average R&D percentage of income growth by the income growth during the period, the average R&D income growth percentage/income growth factor excluding negative growth and flat growth period is obtained, which is-0. 29 times. According to the revenue forecast, the predicted percentage of R&D in revenue is 24.9% in 2023, and will drop to 17.6% in 2027.

In addition, according to the average decline of-0.2% in the past 10 years, the company SG & amp; A Revenue Percentage forecast is updated to decline, so it is predicted to be SG & amp; A the revenue percentage was 9.05% in fiscal year 2024 and dropped to 8.96% in fiscal year 2028.

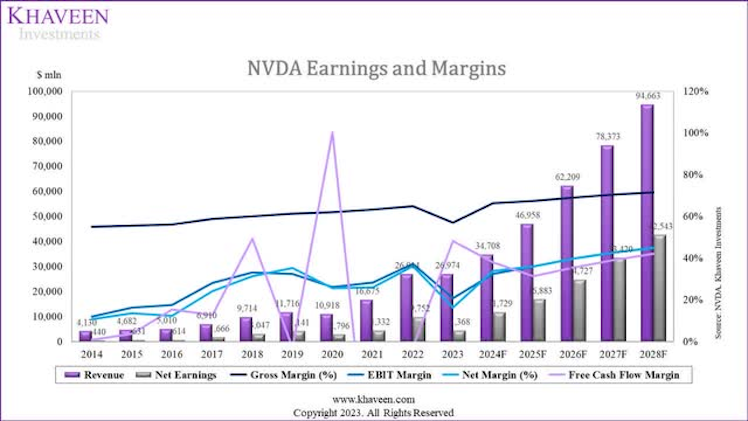

This paper predicts that its net profit margin will continue to increase by 2028, from 33.8% to 44.94% in fiscal year 2028. Compared with our previous analysis, the updated margins are more conservative because they are lower than previous forecasts, because more aggressive profit margin growth assumptions were assumed for the company by reducing R&D expenses as a percentage of revenue.

Conclusion

Nvidia Corporation's data center division, driven by its strong data center product portfolio and excellent GPU performance, exceeded analysts' initial forecasts with its competitiveness and growing market share. Based on these factors, NVIDIA is expected to continue to expand its share, and the growth rate of its data center part is expected to reach 41% in 2023.

Although games and professional visualization are facing challenges in GPU market, it is expected that there will be a better prospect of actively reviving games and professional visualization in FY 2024. In addition, driven by the high growth rate of ADAS market and the improvement of the efficiency of the next generation chips, the automotive sector shows the potential for rapid growth.

The free cash flow ("FCF") profit margin model of this paper predicts that it will rise to 42% by fiscal year 2028, supported by the increase of gross profit margin and the decrease of operating expenses, because it is expected that R&D expenses will gradually decline after abnormal increase in fiscal year 2023. After reassessing NVIDIA Corporation's prospects, this article raised the target price to $271.60.

Already have an account?