Trending Assets

Top investors this month

Trending Assets

Top investors this month

Gabe Plotkin's Melvin Capital got crushed by $GME, but the fund still has a massive $14B in AUM with a record of outperformance.

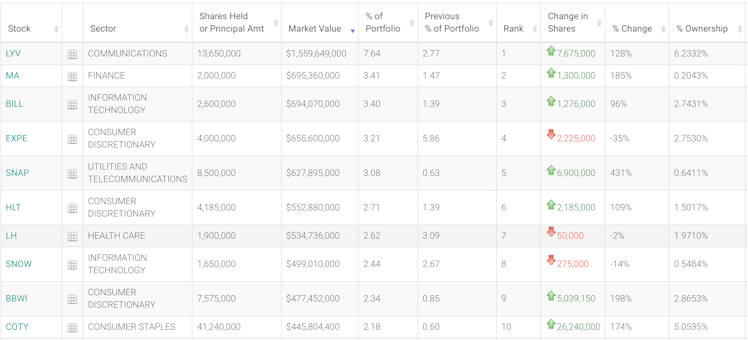

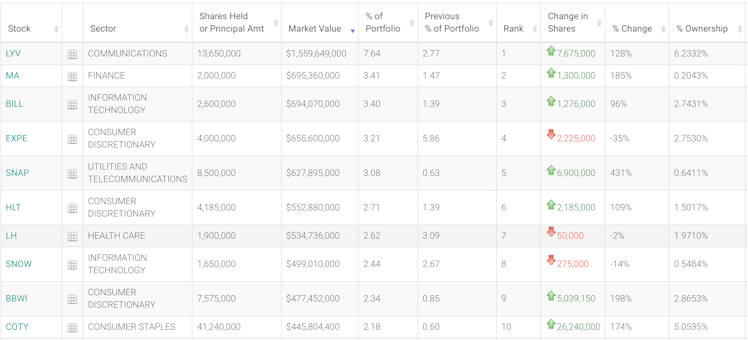

Here's what Melvin Capital did during Q3:

Top 10 Positions ⬇️

Already have an account?