Trending Assets

Top investors this month

Trending Assets

Top investors this month

"The Business of Selling Mistakes"

This article continues where my last article left off. I hope to explain why The Joint Corp is a compelling business.

What is The Joint Corp?

The Joint Corp is a franchisor (~85% of clinics) and operator (~15%) of a cash-pay (no insurance) retail chiropractic concept focused on convenience (walk-in only; located in popular strip malls) and affordability ($29 first visit, $89 monthly membership).

The concept’s playbook is relatively simple:

- Open a small (~800—1,200 sq. ft.) clinic in a busy strip mall.

- (Locate clinic within a regional cluster to maximize brand awareness.)

- Offer consumers affordable, convenient access to chiropractic care.

- Follow a proven local and digital marketing strategy to attract patients.

- Upsell the patient to a monthly membership after the first visit.

- Retain the patient as long as possible.

With over 800 locations, the concept has proven to be simple and repeatable, with The Joint now among the top 2% of all franchisors by size. Its model suits chiropractic because adjustments are brief (5-7 minutes) — there’s no need for an appointment. For consumers, this is convenient; it’s easy to stop in as they often visit the strip mall during the week anyway. For clinics, it’s efficient; each doctor can handle more patients per day.

What are the economics?

From the Lens of a Franchisee

From a franchisee perspective, the total investment comes out to ~$300-350k (typically 1/3 cash, 2/3 financed by SBA or other lender):

- $39,990 franchise license fee ($10k less for each additional)

- ~$200-250k clinic build-out (leasehold improvements, equipment purchases, security deposit, business licenses, recruiting, etc.)

- ~$76k Year 1 losses

This compares to Sport Clips at ~$300-400k, Massage Envy at ~$600-900k, and generally over $1 million for Planet Fitness.

After ~6-9 months, the average clinic breaks even, and the franchisee begins to recoup their investment with profits. After ~3.5 years, the franchisee is fully paid back, at which point they tend to be earning a 50% cash on cash return annually. The average clinic progresses as follows (after Year 1 losses):

- Year 2: $78k EBITDA on $432k sales (~18% margin) // ~25% cash-on-cash return for franchisee

- Year 3: $141k EBITDA on $531k sales (~26% margin) // ~45% cash-on-cash return

- Year 4: $161k EBITDA on $565k sales (~28% margin) // ~50% cash-on-cash return; full investment recouped mid-way through year

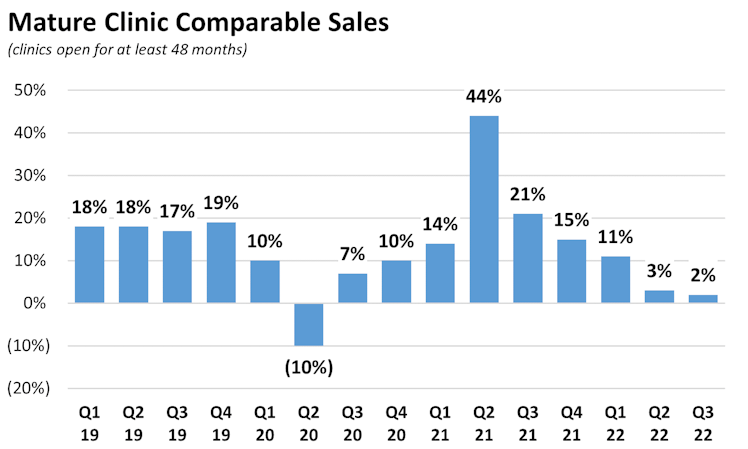

These clinics also continue to grow after Year 4, leading to EBITDA margins of ~30% at maturity. And with no working capital and minimal maintenance capex (clinics get paid upfront and only need a few chiropractic tables, chairs, and computers), EBITDA can be a useful proxy for cash flow.

If you're interested in the business, keep reading at the link below:

investorsperspective.substack.com

A Look at The Joint

What is The Joint? What are the economics? How large is the opportunity? What prevents competitors from copying its strategy?

Already have an account?