Trending Assets

Top investors this month

Trending Assets

Top investors this month

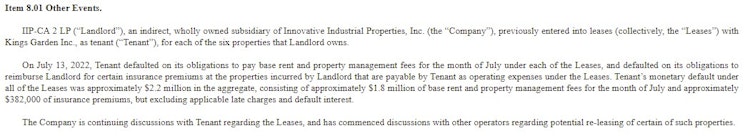

Innovative Industrial's ($IIPR) tenant, Kings Garden, defaults on July rent and other obligations

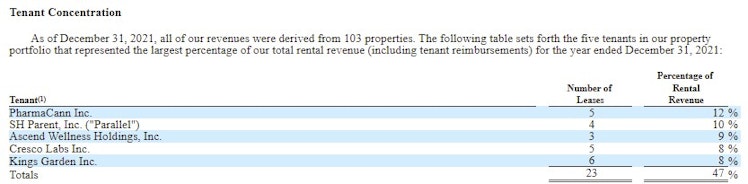

Kings Garden rents 544,000 square feet across 6 properties and is IIPR's 5th largest tenant by rental revenue, accounting for 8%, or ~$16.3MM in rental income in 2021.

In their 8-K filing yesterday announcing the default, IIPR stated they are in discussions with Kings Garden as well as other potential renters to take over the leases.

There was a short report BY Blue Orca Capital on April 14 that called IIPR a "marijuana bank masquerading as a REIT" and specifically called out Parallel (IIPR's 2nd largest tenant by rental revenue) and... you guessed it, Kings Garden, as two companies that were already in default.

in their Q1 earnings conference call, management made a point to call our Kings Garden as a high quality producer of marijuana but also caveated that with some statements that, in hindsight, seem to hint at the prospect of Kings Garden perhaps having trouble dealing with the macro environment and California's heavy tax burden on marijuana producers.

"We have been Kings Garden's partner for three years now and believe Michael King and his team have one of the best reputations for product quality and consistency and perhaps the single largest cannabis market in the world. While we are disappointed in how the California state and local governments have performed in the rollout and administration of the regulated adult-use cannabis program with continued heavy and even increasing tax burdens in certain jurisdictions and lack of enforcement for illicit activities by non-licensed operators, we believe Kings Garden has navigated this environment well.

And our firm believers that high-quality producers like Kings Garden will continue to effectively adapt to the changing landscape in California. While we touched on just two of our tenants today, we apply a similar multifaceted approach to underwriting our tenants, the properties and the markets across our portfolio. I would also like to point out that it is our belief that our portfolio has a replacement cost that is well above our current basis, driven by the significant and continuing increases across the board in building costs that we are all experiencing. As one example among many, structural steel costs have increased by over 40% in just the last 15 months." - Alan Gold, Execute Chairman

Analysts asked directly if Parallel had paid their May rent ("They paid May rent, and there's been no discussions about rent relief." - Alan Gold) but interestingly analysts didn't ask the same question about Kings Garden.

It'll show up tomorrow here on Commonstock but I bought today's dip. Tenants defaulting isn't uncommon for REITs so I don't find this too alarming as long as IIPR is able to agree to new terms or finds new tenant(s) in a timely manner. There is obvious risk to the dividend being reduced, however, if they can't regain that rental income quickly. Additional risk comes in the prospect of just being invested in a marijuana REIT. It's still the wild west for the most part of a lot of companies, some of whom lease property from IIPR, could very easily go belly up. Worth noting I also own shares in $NLCP.

What do the other IIPR shareholders think? Is this buy, sell, or hold moment for you?

Ooooof. I owned this 2018 to 2020, haven't caught up with it in a while, but that's a sore one.

Already have an account?