Trending Assets

Top investors this month

Trending Assets

Top investors this month

$MNDY Monday.com Q2 Earnings Crushed It

In my last post on Monday(dot)com, I made the case for the "Workflow Software" trend, and reasons to go long $MNDY against $ASAN and $SMRT. That post can be found here.

Today, the company reported an impressive earnings beat on sales consensus and raised their FY guidance. See the Q2 shareholder letter here.

Q2 Results Highlights

- Revenue of $123.7m, which grew 75% YoY, and 14% QoQ

- # Customers with over 50k contracts grew 147% YoY

- -$19.4m in Free Cash Flow implying a -16% margin

- FY Guide was raised by $10m to $502m in the high range, implying 62% YoY growth

The company remains with a whopping $830m in cash on its balance sheet so the current burn is relatively minor in the scheme of things and the fat market opportunity at hand.

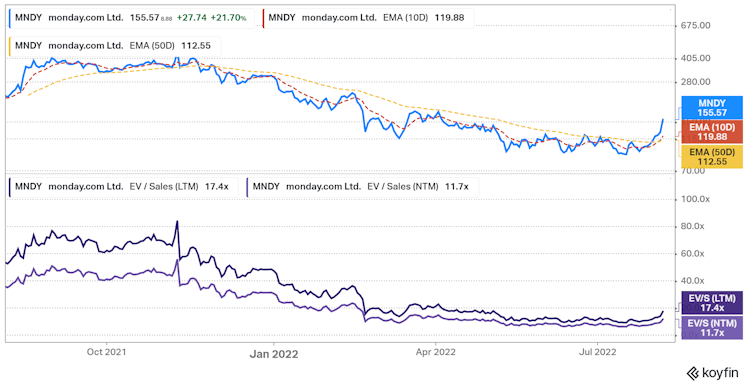

Source: Koyfin

With a 20%+ bump in stock price today, and the increase in valuation, my thesis remains unchanged. Monday and its closest peers are making software that is theoretically applicable to every moderate to large enterprise on the planet by quantifiably increasing efficiency and productivity. The company has been outperforming on growth vs peers and is financially in a better space to keep spending on sales and marketing. The platform, going by all the review sites, is consistently #1 or #2 for customer satisfaction.

It helps to see this business against a really long growth runway. It will now trade at ~11.3x NTM EV/S on consensus if I have to account for their forecasts, but this is perfectly fine for a high-growth category leader that offers immense promise. It's a little more expensive than before, but the recently dark clouds of macro appear less threatening, while Monday's market share gains stand strong against the category. So for now, I'm letting this winner run. I'm long $MNDY.

Already have an account?