Trending Assets

Top investors this month

Trending Assets

Top investors this month

Idea Competition - Cummins ($CMI) The Diesel Giant That Is Ready For The Green Revolution.

Tesla ($TSLA) pioneered EVs, and now the industry is packed with competition. EVs are great for the average commuter, but will Tesla/others have solutions for powering the trains, boats, construction vehicles, etc that make the world go 'round? Unlikely.

My stock pick might be the solution.

Cummins is a global power leader that designs, manufactures, distributes, and services diesel, natural gas, and now electric and hybrid powertrains. They sell to original equipment manufacturers (OEMs), distributors, and dealers in 190 countries for various uses from Ram pickups, heavy machinery, trains, and more.

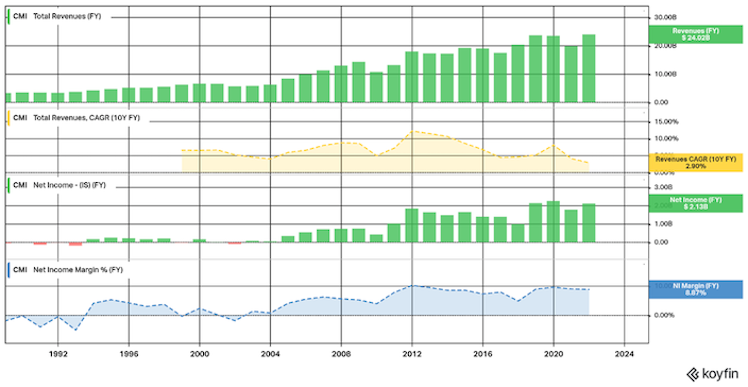

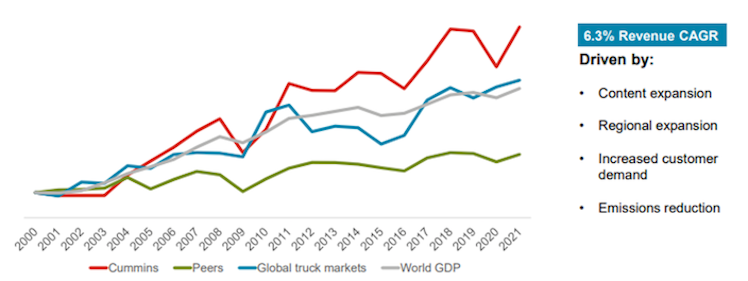

Since 2002, Cummins has outgrown competition and the segments they serve with 6.3% revenue CAGR. Cummins has also grown total revenues from $5.6B to $24B and net income from -$103M to $2.1B with 6.7% average net income margin and 22.2% average ROE.

Cummins has great capital allocation with $3B cash, $4.9B debt (1.3% is current), great credit access, strategic acquisitions (recently OEM Meritor) and $1.3B FCF which they use for dividends (2.29% yield) and $2B of share buybacks.

Thesis:

Attractive valuation and economic and political tailwinds are at Cummins’ back as potential catalysts for growth.

- New Power

Cummins commercialized diesel engines in 1919 and continues to make innovations and improvements to powertrains. They offer the most fuel and emission efficient engines in the market and invest heavily in R&D to anticipate, prepare for, and exceed the changing regulations in advance (EPA regulations have reduced emissions by 90% this decade).

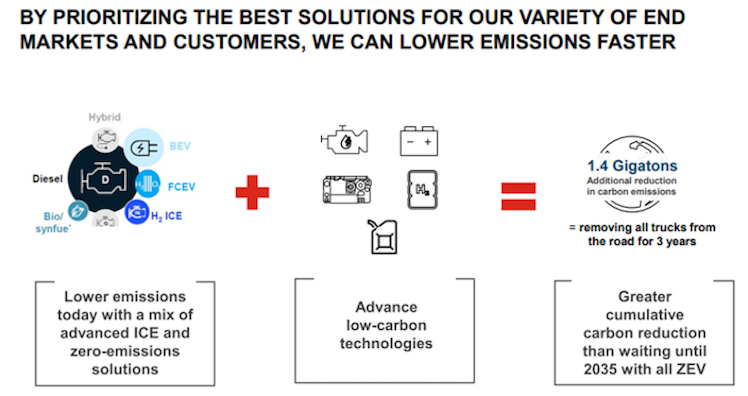

Some states, China, Germany, and other countries have announced plans to ban the use of diesel or other internal combustion engines by 2030. Cummins knows that zero emissions is the goal in the coming decades and are investing now to ensure they remain the power leader for a changing world.

"New Power" is Cummins' newest operating segment. It is focused on zero emission and zero carbon solutions. Cummins has a large customer base and strategic partnerships, all needing decarbonization answers.

Cummins believes the path to zero emissions creates a market opportunity of $100B for 2030. They will service that market by being an integrator and component supplier. Their components business will grow by providing efficient filtration, emissions collectors, and other components to aid emission reduction efforts. When regulations require net zero, Cummins will have already accelerated adoption of FCEV, BEV, and hydrogen systems among their customers before the regulations occur.

Cummins’ New Power financial targets are $6-13B revenue in 2030 (approx. 15%-28% total projected revenue) with ~$1.3B cash outflow of operations from 2022-2027 reaching breakeven in 2027. With continued worldwide engine population growth and a high-margin component segment, Cummins forecasts EBITDA to grow >20% by 2030. I believe these goals are not overly ambitious.

- Food Prices

Global food prices have jumped 40% since the beginning of the pandemic. The Russia-Ukraine war also contributed to a spike in food prices earlier this year as they are substantial exporters of wheat, barley, sunflower oil, and fertilizer. Food prices have been easing but have a long way to go before returning to the norm.

Cummins has over 1 million agricultural engines in operation worldwide. Their products provide greater fuel efficiency, horsepower, durability, and less ownership costs than competitors. During periods of high food prices, farmers can widen margins if they manage COGS and I expect this benefit to extend to Cummins as farmers look to their products to unlock efficiencies and savings.

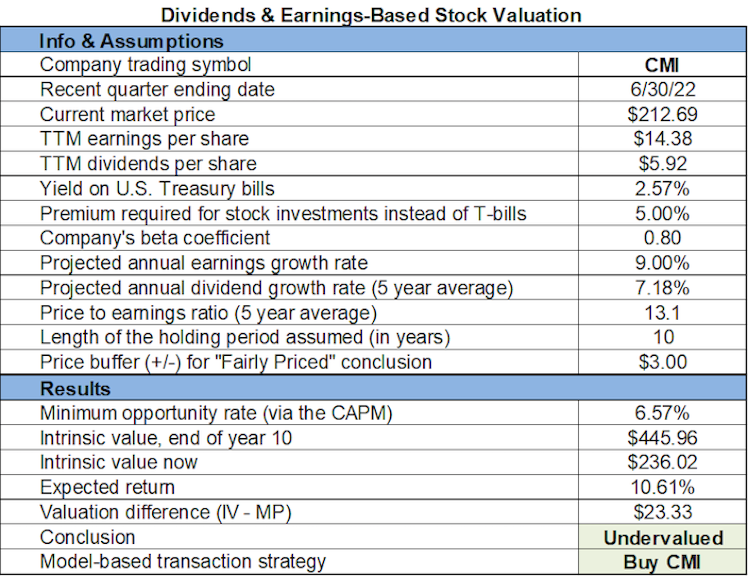

- Valuation

Using a 10-year timeframe and above assumptions, $CMI appears undervalued with potential long-term and short-term returns per the model and thesis.

Risks:

- Freight Demand: Cummins is sensitive to freight demand. With a looming recession, consumer spending could slow causing truck operators to delay new fleet purchases.

- Regulation: Though regulation is my main bull case, strict regulation could push competition to invest in technologies and dull Cummins’ edge.

- Inflation: Cummins’ COGS has increased via more expensive materials and shipping costs. They have raised prices to counter, improving margins for two quarters. However, continued price increases could pose a problem.

Author’s Statement

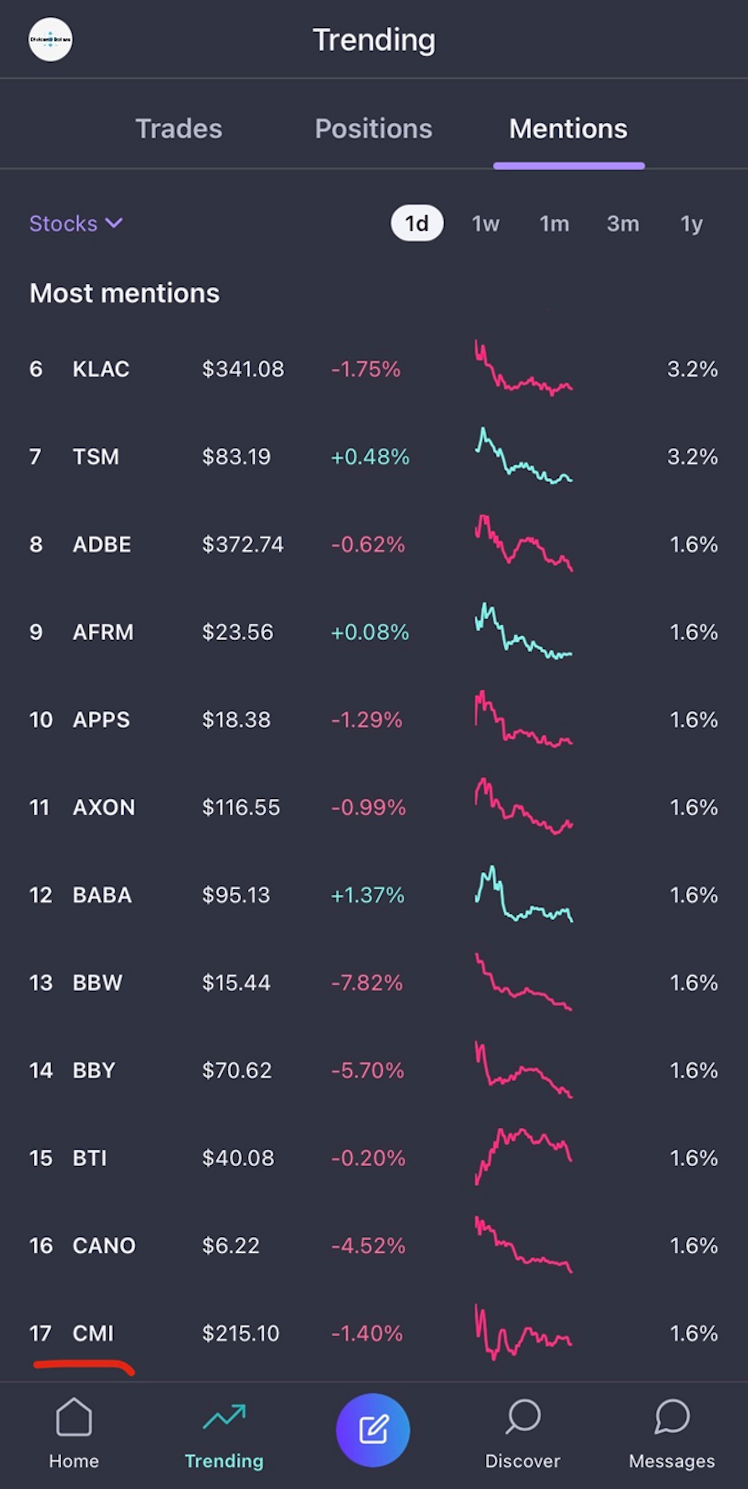

I have a position of 2.372312 shares with $209.56 average cost. Understanding the potential upside and risks, I plan to hold, buy more shares, and reinvest dividends long-term. Below is a screenshot of $CMI trending in Commonstock mentions on 8/31/22 and linked is a verified purchase.

Already have an account?