Trending Assets

Top investors this month

Trending Assets

Top investors this month

Why are insiders buying the dip on $RKT despite slowing demand for mortgages?

Rocket Mortgage is a fintech mortgage originator that became America’s largest mortgage originator, all within a few years.

Outside of the fees they generate from every mortgage they originate, Rocket Mortgage makes money by servicing mortgages, meaning that they generate fee for the collection of payments and maintaining relationships with borrowers. Finally, Rocket Mortgage also makes money from offering title insurance, marketing, and from having a real estate brokerage.

Usually, the company sends over 90% of its loans to Fannie Mae and Freddie Mac so that those mortgages can be securitized. But as of the past few years, Rocket has been holding more of the loans that they originate onto their books, giving them passive income.

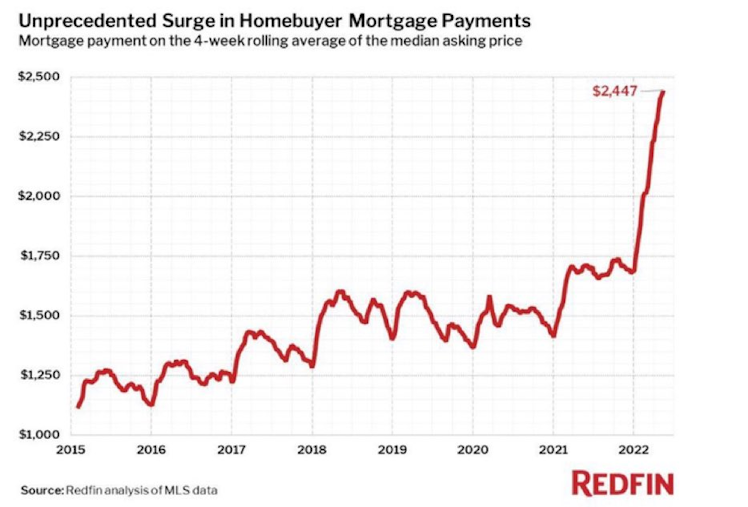

With mortgage demand dwindling and home sales plunging, insiders of Rocket continue to buy the dip.

When considering that mortgage payments have surged, insiders are optimistic that the company will see a surge in earnings from the interest that come with holding onto mortgages.

That's why insiders are buying the dip on $RKT

openinsider.com

RKT - Rocket Companies, Inc. - SEC Form 4 Insider Trading Screener - OpenInsider

Insider trades for Rocket Companies, Inc. (RKT). Monitor SEC Form 4 Insider Trading Filings for Insider Buying and Selling. Real-time Insider Trading Stock Screener. Long and Short Trading Ideas using Insider Transaction Data.

Already have an account?