Trending Assets

Top investors this month

Trending Assets

Top investors this month

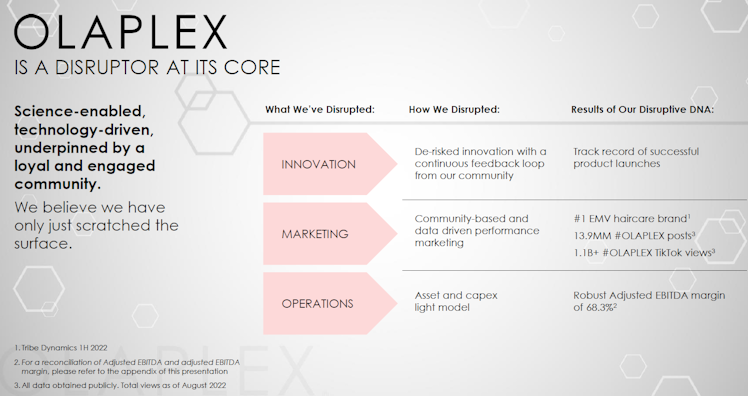

Sept Idea Comp: Olaplex ($OLPX) - unique investment story and financial profile across Consumer Staples.

- Unique brand with relatively low awareness, supported by loyal stylists and customers.

- Growth driven by increased penetration and "premiumization" of the market. Significant whitespace to fill with adjacencies and new geographies.

- Unique combination of robust top-line growth and solid profitability, fueled by an asset-light operating model and experienced management.

- Attractive absolute/relative valuation.

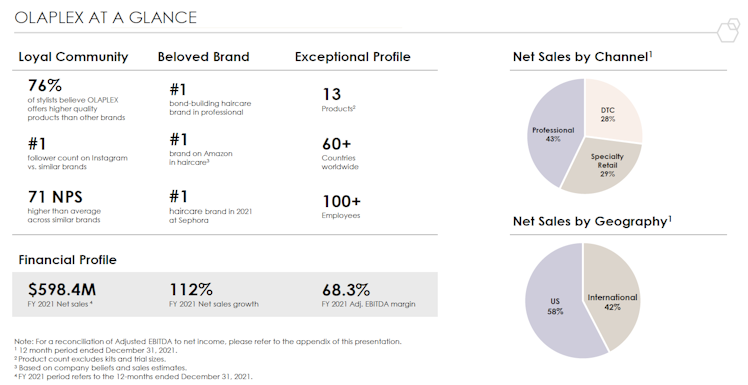

OLPX was founded in 2014 after two chemists discovered its patent-protected active ingredient: bis-amino. It works on a molecular level to improve hair from within by repairing disulfide bonds in hair that break when damaged. OLPX produces and retails a suite of premium hair care products, designed to promote hair health.

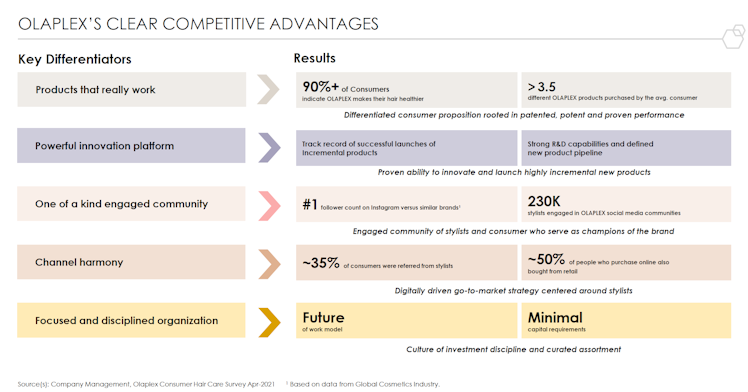

Competitive Moats

Patent-Protected-Disrupting Technology__: OLPX is the only company offering a product able to repair hair at a molecule level and not simply mask hair damage. The company has a portfolio of 100+ patents. Interestingly, it includes not only hair but applications to new segments like nails and skin care.

Community__: Loyal stylist community is an underappreciated asset and contributes to the competitive moat. Shortly, OLPX created a strong community. Since the beginning, OLPX opted for a smart overlooked strategy and gathered professional stylists to create an unpaid network of advertisers, which increases awareness and credibility (stylists recommendations are leading purchasing decision factor for 61% of consumer).

Sustainable Growth

Global hair care represented a $82bn opportunity in 2021, but OLPX operates only in a subset of the hair care market which is prestige hair care. It's a $13bn category and accounts for just 16% of the overall hair care market but expected to change with OLPX being a driving force behind the “premiumization” of the market, a phenomenon already observed within the makeup and skincare segments.

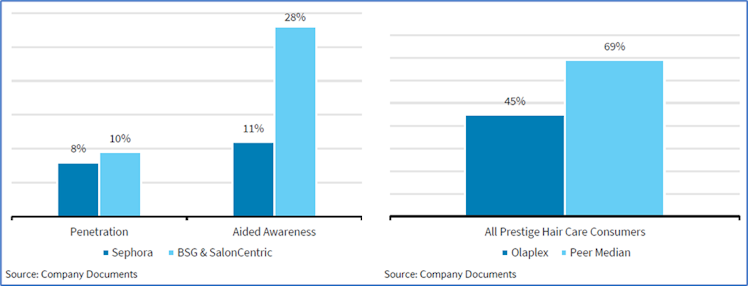

OLPX has a huge growth potential as both its penetration of specialty retailers and professional distributors and its aided awareness are low.

It represents OLPX greatest near-term upside opportunity, especially given OLPX impressive repeat sales rate of 17%, way higher than hair care peers (4-6%).

Longer-term, the company has multiple options to support sustainable double digits growth:

- International: entering markets where the company does not currently have a presence. OLPX mentioned that roughly half of its growth is expected to come from outside the US in the mid-long-term.

- New products: there are still plenty of sub-segments the company does not address currently (hair color...). Another opportunity resides in adjacent products. Global skin care represents a $155bn opportunity and 82% of consumers familiar with the brand would like to see a skin care line from OLPX.

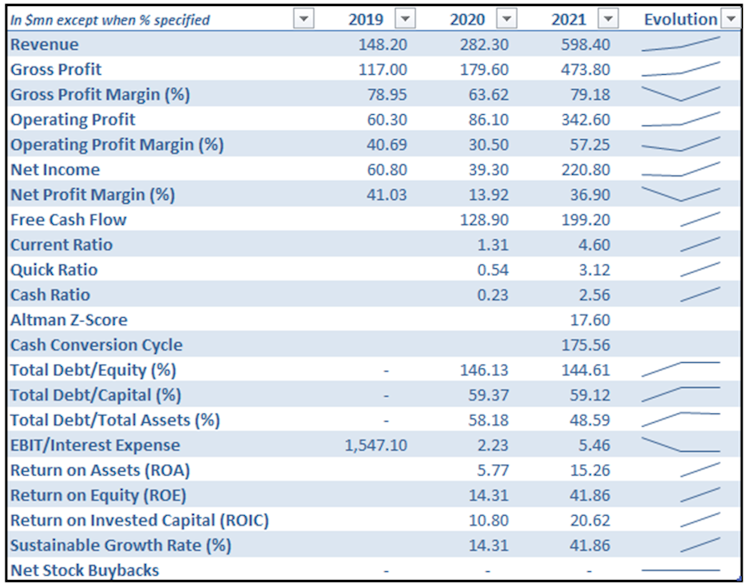

Financials

Since the company is pretty recent and we only have 750 words, we'll focus on the outlook.

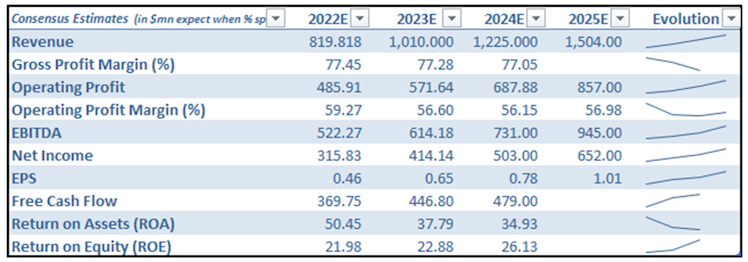

Revenue is expected to grow at an implied c.26% CAGR by 2025. OLPX currently operates with an attractive margin structure thanks to its asset-light business model. OLPX differentiates itself with its high operating profit margin :

- SG&A: OLPX operates an extremely lean organization of 100+ employees with no corporate headquarters i.e. c.$6mn of revenue per employee (around 6x more productive than Estee Lauder or L'Oréal). As previously mentioned, community based marketing results in a low customer acquisition cost for OLPX.

- R&D: It offers to the company the possibility to invest (more than competitors) in R&D to stay ahead of the innovation curve.

OLPX margins rival not just those seen across Consumer Staples, but place it in S&P 500 top tier. EBITDA margin is expected to be 2.5x higher than best-in-class beauty peer, and even further above the average Consumer Staples company.

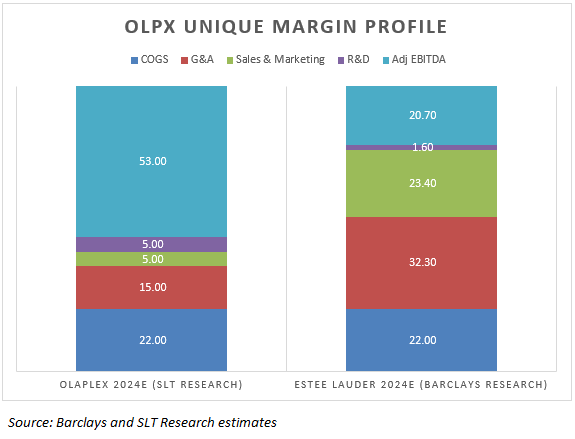

Management and ESG Considerations

Management has strong industry experience and made smart strategic decisions, especially going from the professional (build brand credibility) to DTC (higher margins, shift to e-commerce) channel. Management created a synergistic omnichannel distribution strategy. CEO Jue Wong joined OLPX three years ago after departing Moroccanoil, a competitor offering hair/body care products. Across the broader beauty market, ESG characteristics are increasingly being factored in consumers’ purchase decisions, and ultimately becoming an important brand loyalty consideration.

Valuation

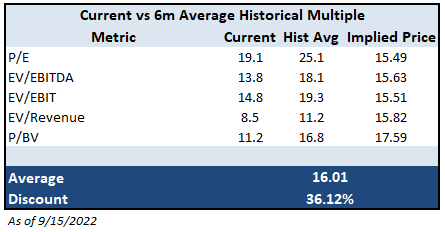

Given OLPX short history as a publicly traded company, it's more relevant to look at valuation on a relative basis:

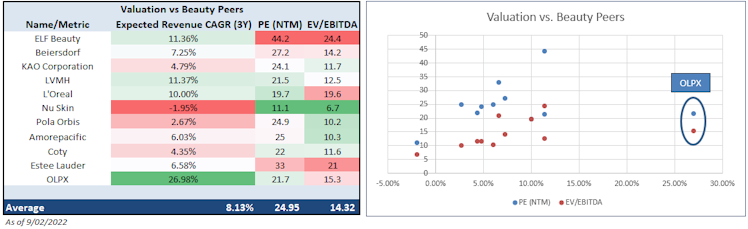

Interestingly, when we look at the relationship between future growth expectations vs. current

valuation, the data suggests that OLPX valuation is very attractive vs. Beauty peers. OLPX trades at a PE ratio lower than Estee Lauder with an expected growth significantly higher.

We have enjoyed this volatile period to initiate a position.

Already have an account?