Trending Assets

Top investors this month

Trending Assets

Top investors this month

May Portfolio Summary

Not a lot of action in May. We have been focusing on using our extra money to pay down some credit cards to increase future cash flow, so I didn't have any new capital to work with. In the life of a buy and hold investor, that makes for a pretty boring month. No buys, other than automatic dividend reinvestments, and no sells. Nonetheless, May provided an "organic" observation of my portfolio 😂

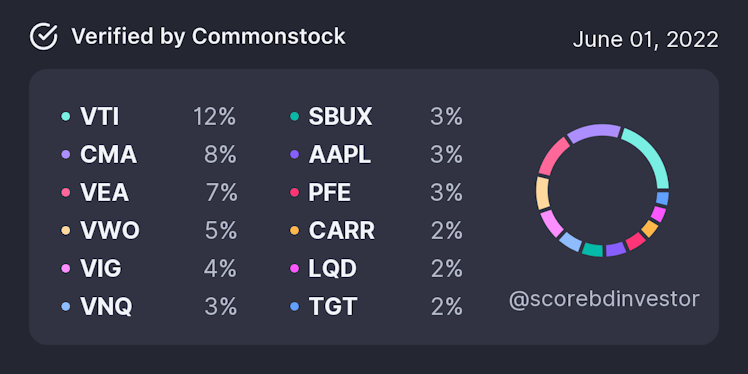

Below is my overall portfolio, with both accounts. I will break down where some of these positions are held in the discussions on each portfolio.

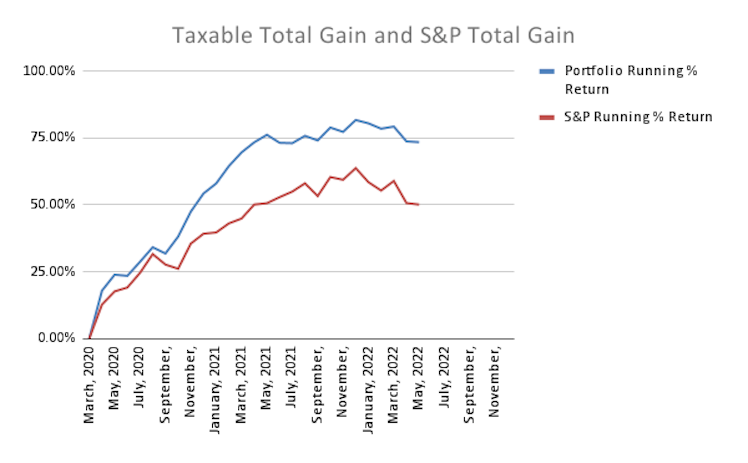

Taxable

% Change (vs S&P): -0.29% (+0.27%)

Contributions: $0

Dividends: $14.11 (+18% over May '21)

Buys: 0.0065 shares of $AAPL, 0.0096 shares of $ABBV, 0.0245 shares of $CARR (all Dividend Reinvestment)

Sells: None

Cash: 1.9%

Top 5 Positions:

Historic Trend:

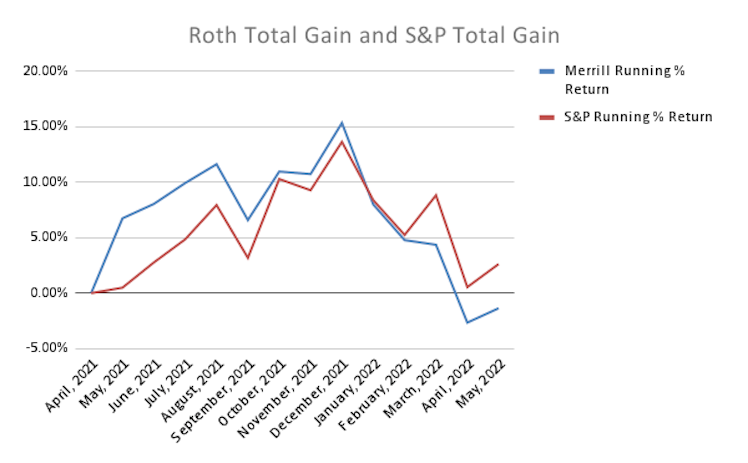

Roth IRA

% Change (vs S&P): -1.36% (-0.80%)

Contributions: $0

Dividends: $10.02 (+1,001% over May '21)

Buys: 0.0040 shares of $LOW, 0.0166 shares of $EMB, 0.0488 shares of $CARR, 0.059 shares of $SBUX (all Dividend Reinvestment)

Sells: None

Cash: 1.5%

Top 5 Positions:

Historic Trend:

One bit of commentary - I am happy to see 2 of the Top 5 in each account are individual companies. I have been working to balance the ETF portfolios I had built through Wealthfront and rolled over.

Looking forward to June - it is a large dividend month with the Vanguard ETFs paying out. Should provide some more opportunities to buy!

Would love to hear any of your questions, comments or concerns with my portfolio!

Already have an account?