Trending Assets

Top investors this month

Trending Assets

Top investors this month

Investing Uncertainty and Volatility - This Too Shall Pass

We have been experiencing another market downturn caused by events and circumstances which have created uncertainty and turbulence for several months.

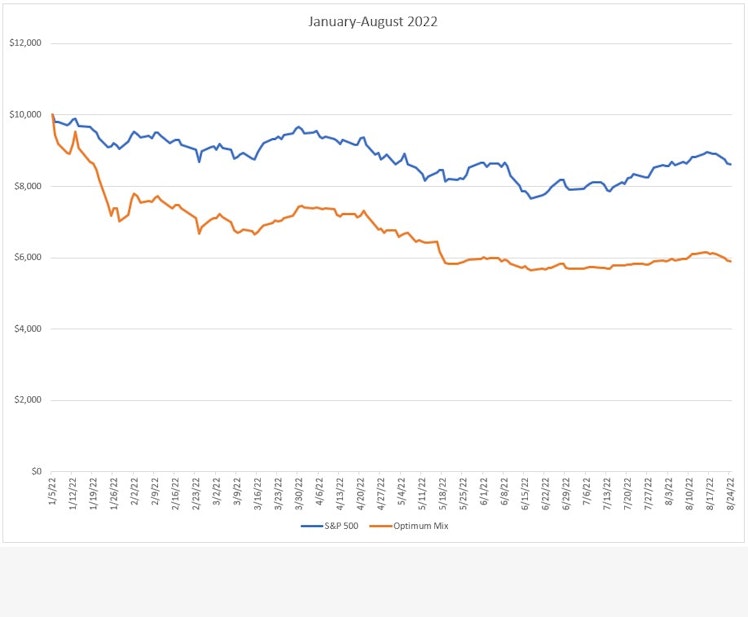

The Optimum Mix fell substantially during the first few months of 2022 as it continued to invest in high-momentum large cap stocks and leveraged equity ETFs until it slowed those losses in June by switching a portion of the portfolio from those leveraged equity ETFs to cash as indicated by the algorithms.

This chart compares the loss in value of $10,000 invested in the S&P 500 from January 4, 2022, through August 24, 2022, with the loss in value of $10,000 invested using the Optimum Mix during that same period.

As mentioned previously, the strategic takeaway for this period and other speed bumps, corrections, and bear markets is to “cover your assets.”

The time to develop an action plan for the inevitable temporary setbacks is before they happen.

Using an investing algorithm should enable an investor to be dispassionate, systematic, and evidence-driven.

Severe bear markets and rare black swan events with rapid substantial declines can be mitigated to some degree by systems which incorporate algorithms with manual stop loss orders and black swan indicators that indicate when to exchange stocks and leveraged equity ETFs for cash or leveraged bond ETFs.

Those algorithms also need to provide clear calls to action when it is time to switch back into stocks and leveraged equity ETFs.

Developing appropriate expectations and trust in an algorithm will enable an investor to take the necessary actions at the necessary times.

A backtested investing algorithm should help enable an investor to be dispassionate, systematic, and evidence-driven in markets like the one we are in now.

Market corrections and bear markets have always been followed by recoveries and bull markets.

The time to develop an action plan for the inevitable temporary setbacks and the inevitable recoveries is before they begin.

We must learn from the past to prepare for the future.

Any questions or feedback?

Already have an account?