Trending Assets

Top investors this month

Trending Assets

Top investors this month

Dividend Portfolio Update 📉📉

Below is a paraphrase of the full portfolio update and market review article I write weekly. Click here for a full portfolio with more statistics, an economic review, plus a break down of all my trades (which you can see in my Commonstock profile as well).

Market Review

"This week I was out on vacation but still managed to monitor the market and make some buys. The S&P fell 3.1% this week following more disappointing corporate updates and data that shakes potential economic growth. The Nasdaq was down 3.8% for the week followed by the Dow which was down 2.9%.

Consumer staples and consumer discretionary segments were hit particularly hard this week as many retailers provided cautious outlooks due to cost pressures and supply chain concerns. Walmart ($WMT), Target ($TGT), and Ross Stores ($ROST) were the main players here, expect to see more of this next week as more earnings reports are published. My eyes will be on Best Buy ($BBY) who had a particularly rough week following the poor performance of these retailers.

On the other hand, utilities, health care, and energy sectors ended the week green, if only by a little. There was some rebound actions throughout the week pushed mainly by a contrarian approach to our potentially oversold market with a BofA survey showing that cash levels of fund managers are at their highest since 9/11 (6.1%).

The market barely stayed out of bear market territory this week amid growth concerns fueled by stubborn inflation, supply chain issues, and a number of economic data releases that were relatively disappointing.

The Federal Reserve Chair Powell spoke on inflation and said that the Fed will be more aggressive with rate hikes if inflation doesn’t come down in an obvious way. All eyes are on inflation and that will continue to be the driving narrative behind the market’s performance.

Portfolio

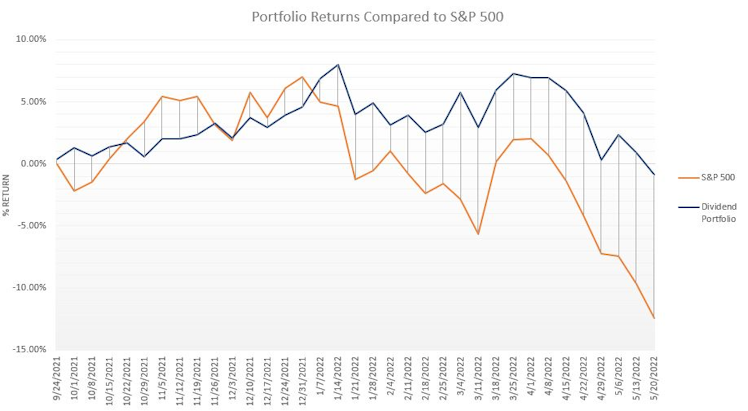

To date, I have invested $8,980 into the account, the total value of all positions plus any cash on hand is $8,901.17. That’s a mere loss of $78.83 for a total return of -0.88%. The account is down $142.75 for the week which is a 1.58% loss.

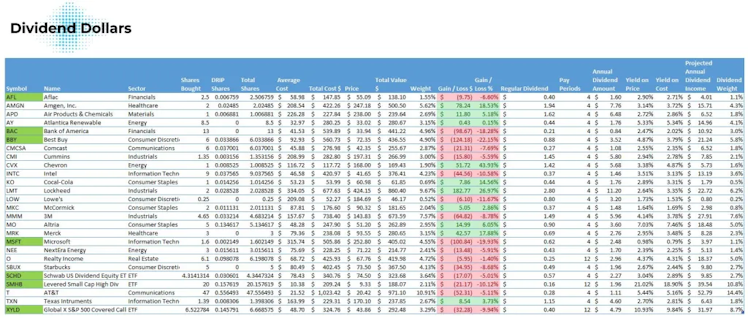

Below is a table of everything we are invested in so far. There you can see my number of shares, shares bought through dividend reinvestments, average cost, gains, and more. The tickers in green are positions that I bought shares in this week.

Dividends

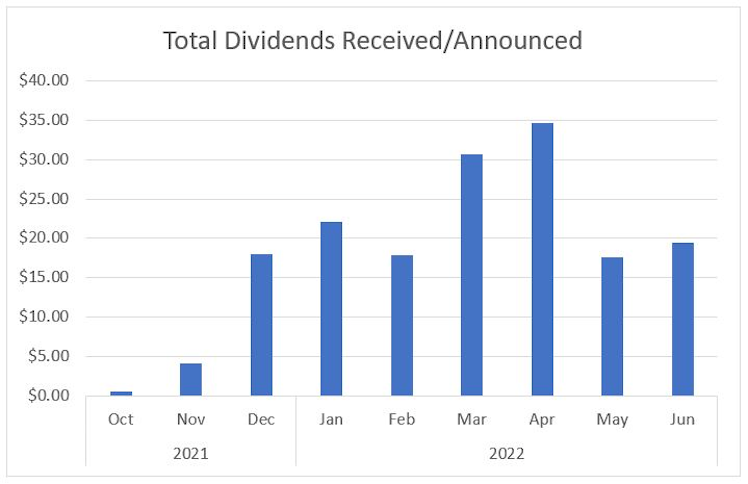

This week we received only one dividend. $1.44 from Texas Instruments ($TXN)

In my portfolio, all positions have dividend reinvestment enabled. I don’t hold onto the dividend, I don’t try to time the reinvestment, I just let my broker do it automatically. All dividends were reinvested.

Dividends received for 2022: $118.55

Portfolio’s Lifetime Dividends: $141.47"

Dividend Dollars

Dividend Portfolio: 5/20/2022 Week in Review | Dividend Dollars

Weekly update on the dividend portfolio! To date it is down 0.88%

Seeing people win, things you enjoy seeing.

Something so addicting to documenting the incomes of dividends :)

Already have an account?