Trending Assets

Top investors this month

Trending Assets

Top investors this month

September Idea Competition - CMC Markets (XLON:CMCX)

Summary

- CMC Markets is a spread betting, CFD and online share trading platform based in the UK and with operations in Australia and Singapore

- Innovative online and mobile platform aiming to diversify into non-leveraged income streams (investing platform)

- Highly profitable business model with above 25% profit margins

- The Company is undervalued using the Graham Intrinsic Value Method

Company

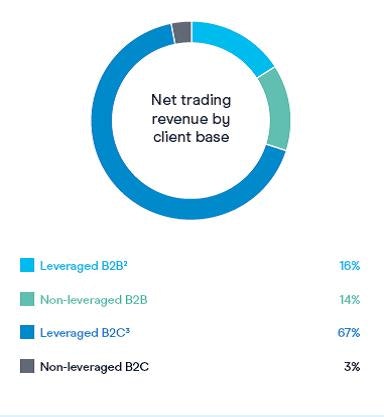

CMC Markets is a high-quality global provider of online trading - shares, spread betting, CFD and FX - offering services to retail, professional and institutional customers. It has leveraged and non-leveraged businesses which complement each other with B2C and B2B offerings.

Source: Annual Report 2022

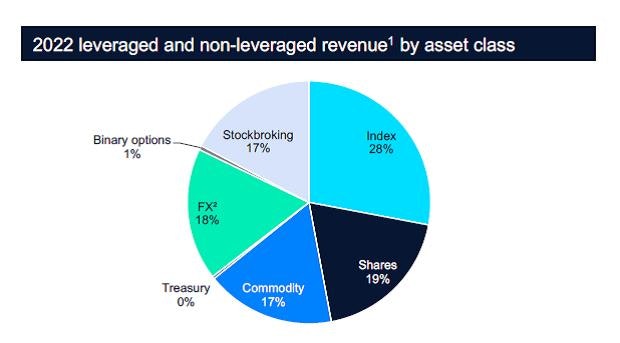

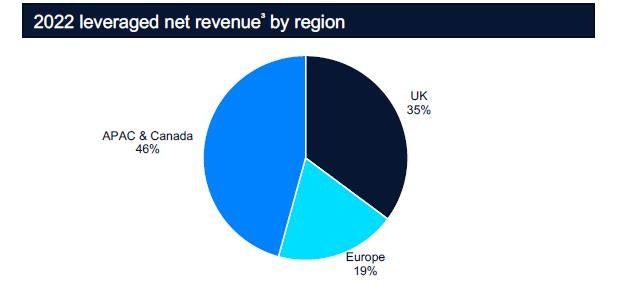

It's most recent annual breakdown of revenue (combined leveraged and non-leveraged) by asset class - Index (28%), Shares (19%), Commodity (17%), FX (18%) and Stockbroking (17%) - and leveraged net revenue by region - APAC & Canada (46%), UK (35%) and Europe (19%), show a well-diversified income stream benefitting the core leveraged business in times of volatility and uncertainty.

Source: FY Analyst Presentation 2022

Source: FY Analyst Presentation 2022

Market and Competitors

- Leveraged business: The UK is leading the global ranks for a top CFD market. The market share is split between the following companies - Plus500, IG Group, CMC Markets and other smaller players with marginal share in the ranges of lower single digit %-ages. Plus500 has the leading market share of 18% and IG Group and CMC Markets following in the next 2 places.

Source: Plus500 Investor Presentation 2022

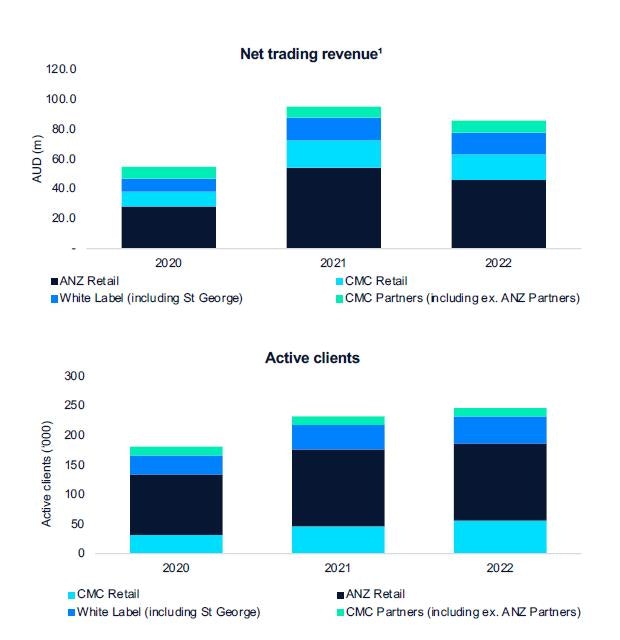

- Non-Leveraged business: CMC Markets non-leveraged business is concentrated in Australia where they are the 2nd largest retail stockbroker and the largest white label provider. Their trading revenue is up 51% vs pre-pandemic normalised levels with a record AuA of AUD $80.2bn.

Source: FY Analyst Presentation 2022

Competitive Advantages

- Well-known and established brand name

The Company has been in existence since 1989 carrying the moat of well established brand name among the UK B2B and retail traders.

Source: Annual Report 2022

Source: Annual Report 2022

- Ownership of own technology as a significant differentiator

The Company in-house developed leverage platform will be able to be scaled up in the future by offering non-leveraged solutions across different geographical regions worldwide with the primary focus being the APAC for the next couple of years.

- Heavily regulated industry

Since 2018-2019, tighter regulations have been implemented regarding requirements for CFD providers by ESMA (Europe) and FCA (UK). There are significant limits introduced for advertising and incentives and also on customer's leverage which will further lead to consolidation within the industry.

Financials

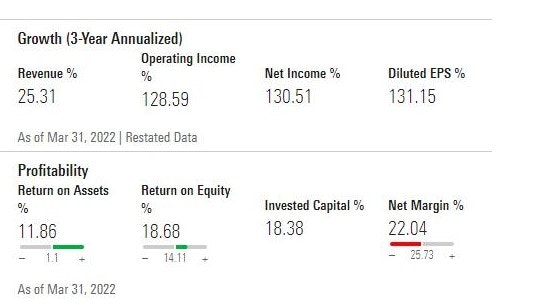

CMC Markets has achieved a top-line revenue growth > 25% (3-year annualised) with a net margin of 22.04% and RoE > 18%.

Source: Morningstar

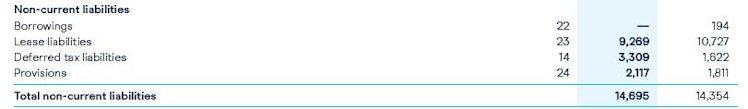

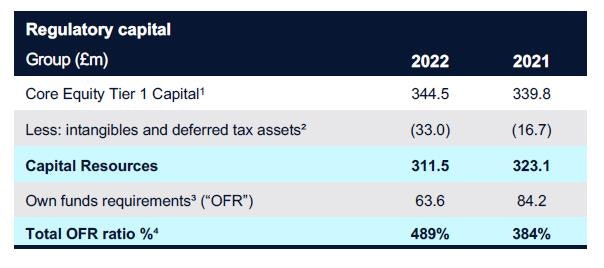

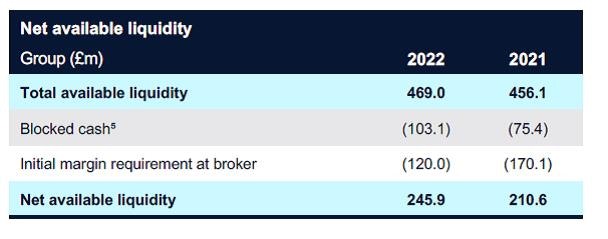

CMC Markets is debt-free and after accounting for the regulator's requirements for equity capital ratio has a net available liquidity of more than £245m.

Source: Annual Report 2022

Source: FY Analyst Presentation 2022

Source: FY Analyst Presentation 2022

Management

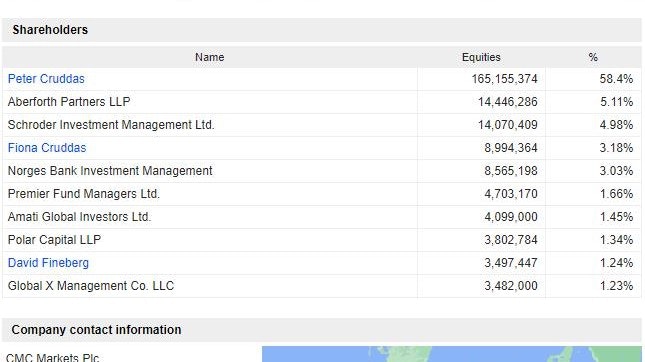

The founder and the current CEO, Lord Peter Cruddas, holds the majority of the company's shares (58.4%).

Source: MarketScreener

Growth Drivers

- Broadening the client base and geography

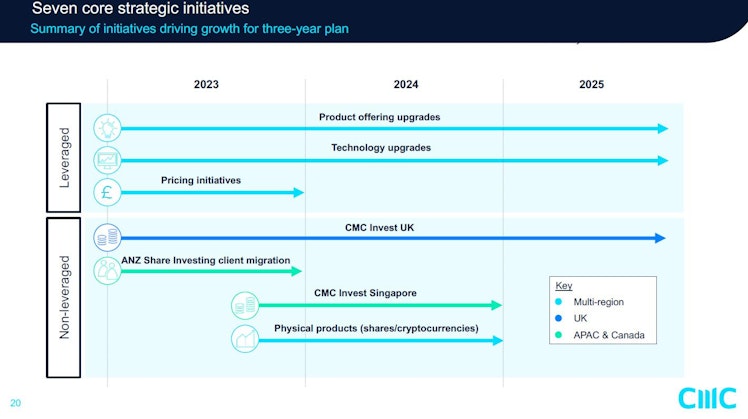

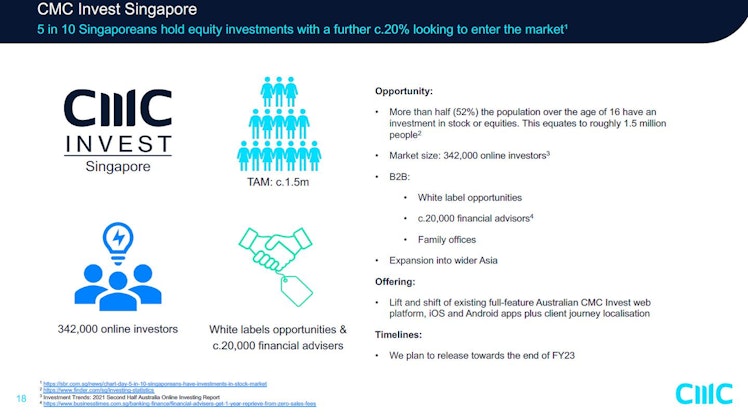

The Company aims to introduce a new investing platform (non-leverage) by the end of 2022 in the UK (and 2023 in Singapore) thus leveraging its in-house technology solutions by broadening the customer base.

Source: FY Analyst Presentation 2022

Source: FY Analyst Presentation 2022

- Diversifying the revenue streams

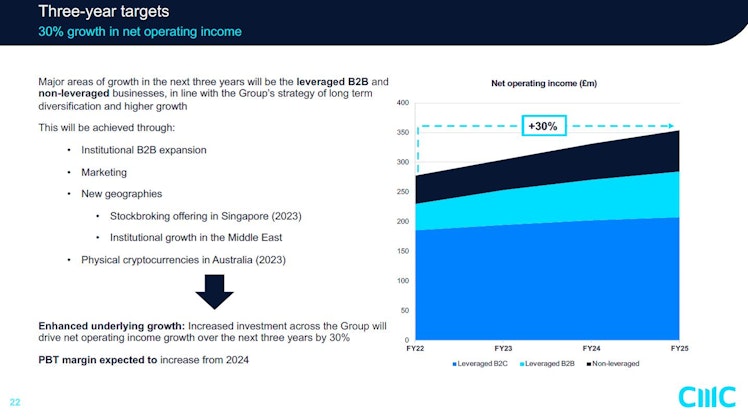

Furthermore, it will be launching physical cryptocurrencies trading in Australia in 2023 targeting 30% growth in net operating income by 2025.

Source: FY Analyst Presentation 2022

Multiples and Valuation

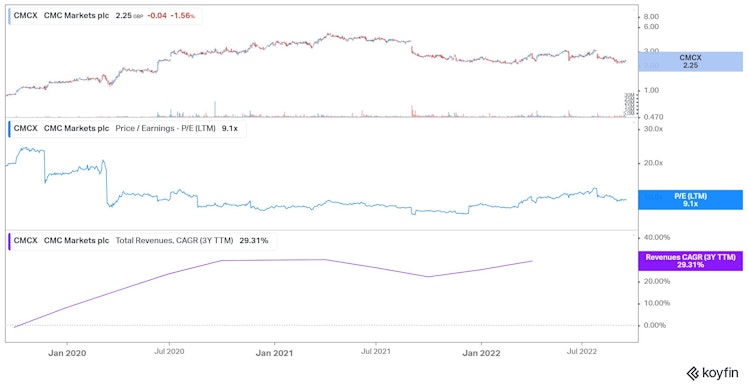

CMC Markets trades at P/E (LTM) ratio of 9.1, quite undemanding considering the revenue growth achieved for the past 3 years - Total Revenue CAGR of 29.31%. Clearly, the broader market is not factoring the new revenue and earnings streams that are expected in 2023 from the non-leveraged products in the UK and Singapore.

Source: Koyfin

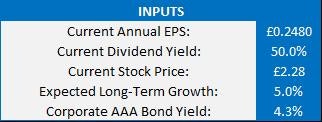

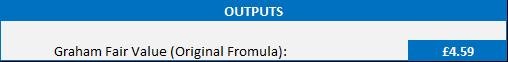

I am using The Graham Intrinsic Value Method (original) with the following inputs:

- Current Annual EPS: £0.248

- Expected Long-Term Growth: 5% (which is very conservative)

- Instrinsic Value Formula: EPS x (8.5+2g)

The current share price of CMC Markets is £2.28. Based on the valuation method used the instrinsic value of the company is at least £4.59 giving it a margin of safety of 50% and a discount to trading price of 101%.

www.cmcmarketsplc.com

CMC Markets Group | Home

CMC Markets is a leading global provider of online trading and investing, with a comprehensive retail, professional and institutional offering.

Already have an account?