Trending Assets

Top investors this month

Trending Assets

Top investors this month

Fiverr: 600 categories to choose from, and I have been an Active Buyer on their Marketplace

I have been invested in Fiverr ($FVRR) since pre-pandemic, but I only started using their services recently, and increasingly so. The first gig I bought on Fiverr was for a fashion sketch. Not quite what people would expect of a content creator on Commonstock, but that was what I did !

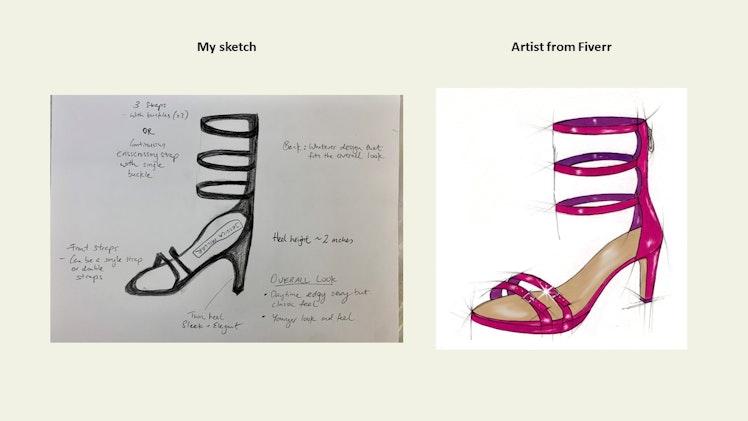

A friend of mine wanted to translate her idea of doing vegan shoes (yeah, welcome to the world of next-gen fashion consumption) so I offered to help sketch out her ideas. I did what I could with pencils, and then sent them over to a Fiverr artist to be reproduced professionally. The pictures shown below are the before (my rudimentary sketch) and after (one of the 3 final designs produced).

The artist was based in Pakistan, and what I paid for the 3 sketches (<$100) was much less than what we would have paid for someone in the US to do it. More importantly, it was fast, convenient, and moderated by Fiverr without needing to share personal information. All I did was take pictures of my sketches, sent them to the artist (chosen from reviews and price points) and all communication was done via the Fiverr platform. When the job was delivered, I made final payment plus tips. Fiverr took cuts from all of them, even tips which had to be grossed up.

The results were good enough for my friend's purposes. It was no Christian Louboutin but it was what she needed. My sketches were free of charge, in case you were wondering, and I paid Fiverr as a gift to her.

Fiverr's platform is broad, and the range of services (at varying price points) that one can find there is pretty wild. Their take rate has been consistently at 30%, mainly due to a combination of additional services utilized by Sellers (including Promoted Gigs) and stature as the go-to platform for small gigs. Fiverr continues to grow, albeit at a slower pace in 2022 as it tapers off pandemic driven demand.

Q4 2022 earnings just came out, and FY 2023 revenue is guided to grow by high single digits. With majority of its Active Buyers being SMEs, recovery is still not apparent and Fiverr is focusing more on cost discipline, which will yield much higher margins going forward. Since SMEs are not inclined to spend in this environment, marketing spend is pulled back. No more Superbowl adds - for now at least.

Below are some highlights from the Q4 2022 report:

- Q4 revenue grew by 4%, partly due to tough comps; Active Buyers were sequentially up, but barely. Still losing pandemic era buyers and gross adds have been weaker due to macro conditions

- Q1 2023 revenue projected to be flat, but growth rate is expected to reach double digits towards Q4 2023 as comps get easier. This does not assume macro recovery but normalization of buyer behaviors

- Adjusted EBITDA margin for FY 2023 guided at 15%, which implies Q4 2023 levels approaching 20%, since Q1 adjusted EBITDA margins are estimated at 12%

- Repeat buyers (myself included) contributed 63% of total revenue, up from 59% from a year ago

- Buyers that spend >$10,000 annually (myself excluded) grew 29%% year-over-year, albeit slower than the 50% in Q3. They are still very small compared to other Active Buyers

- Pace of spend per buyer growth moderated in the second half of 2022 – flat sequentially at $262 as the SMB spending crunch continued

- >$500 per annum Active Buyer cohort contribute to 63% of revenue; the rest are tiny

- >600 categories as of end Q4, up from 550+ from a year ago

Marketplace potential for gigs is pretty massive; Fiverr has the brand name to keep the flywheel moving with better economics as it continues to scale across more categories and countries. Current macro conditions may not be conducive to SME spend for now, but with a leaner organization from recent cost cuts, Fiverr may be positioned for a stronger rebound when SMEs pick up spending again.

I write on a weekly blog called Consume Your Own Tech Investing. Check it out and subscribe - it is free.

www.consumeyourowntechinvesting.com

Consume Your Own Tech Investing | BT Capital Agency LLC | Substack

Covering human psychology in investing, consumer, and tech sectors. It is also about managing a portfolio based on your "personality tech" without copying others. Author is a seasoned investor, ex-ibanker, and grad student in clinical mental health. Click to read Consume Your Own Tech Investing, by BT Capital Agency LLC, a Substack publication with hundreds of subscribers.

Already have an account?