Trending Assets

Top investors this month

Trending Assets

Top investors this month

Investing in Green Energy

The investment thesis for green energy is clear: fossil fuels are causing climate change, therefore the world must switch to energy sources that don’t emit greenhouse gasses.

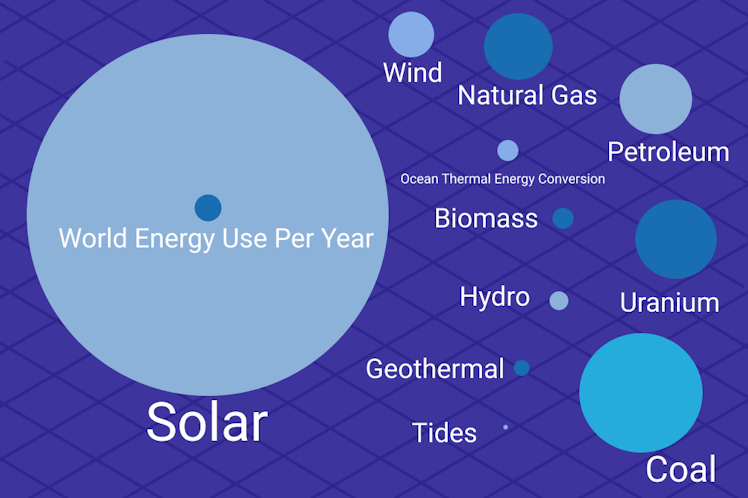

Additionally, our current energy infrastructure draws on finite resources. I made a graphic based off of data from a paper by Richard Perez that compares the current annual energy consumption of the world to 1) The known reserves of finite resources and to 2) the yearly potential of renewable alternatives.

This graphic helps illustrate that the solar resource is orders of magnitude larger than all the others combined. And while there are significant issues with solar power availability being volatile locally (weather can block the sun, no production at night, etc.), it is globally stable and predictable. Such a dynamic suggests battery storage technologies and energy routing infrastructure will be a huge area of growth in the future.

(Note, this was created off of data from 2009).

No one knows the precise future, but when making investment decisions you need to think probabilistically. Exploiting only a very small fraction of the earth’s solar potential could meet the world’s energy demands with considerable room for growth. The odds are that investing in solar will be a fruitful use of your money long term.

Another plus is that this shift towards solar energy is relatively slow-moving compared to the attention spans of Wall Street. Any time you look at a potential investment you should be asking, “Why haven’t all the professionals already capitalized on this opportunity? In this case, the reason is that the profits of solar energy are not imminent within the next 18 months. When accounting for battery storage costs, solar is still a little more expensive than fossil fuels. That is supposed to change by 2023, but in the meantime government subsidies are helping keep solar costs competitive.

As green energy enthusiasts and retail investors, we have an opportunity now to invest on a timeline that Wall Street doesn’t have patience for. Its critical to understand that in order to win this game, you have to invest your money long-term (5-10 years, and the longer the better).

Solar infrastructure will be stronger the farther out into the future we go. The far future holds more unknowns in the details, but directionally speaking, solar dominance appears in the cards.

In the future, I’ll be offering some specific investment ideas within the solar and renewable energy field.

Already have an account?