Trending Assets

Top investors this month

Trending Assets

Top investors this month

$GRMN posting "meh" results.

I love Garmin products and I still think that they could fight against $AAPL in the Automotive industry. They are a leader in Aviation and Marine already. I own Garmin since 2019 and interestingly I have it in a bucket with other aerospace/defense names, instead of on a discretionary/fitness bucket.

In the fitness and smartwatch space, they have superior products than the Apple Watch, however, the display user experience is still in my opinion an issue. I was happy to read they are finally launching the next-gen Forerunner watches with a bright AMOLED display.

Highlights for the first quarter 2023 include (From PR Newswire)

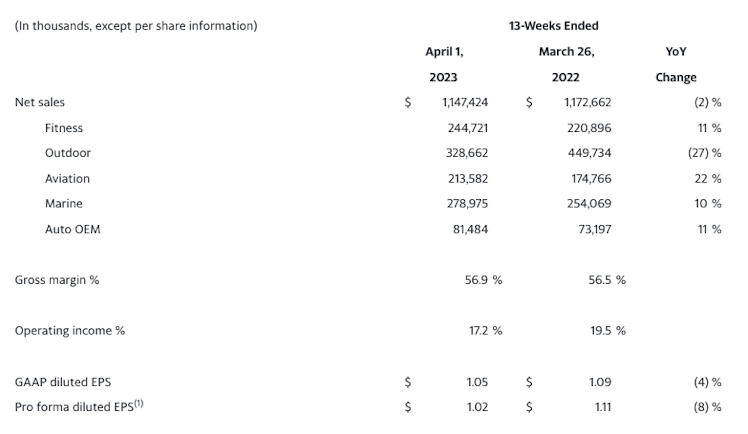

- Consolidated revenue of $1.15 billion, a 2% decrease compared to the prior year quarter

- Gross margin increased to 56.9%, and operating margin was 17.2%

- Operating income was $197 million, a 14% decrease compared to the prior year quarter

- GAAP EPS was $1.05 and pro forma EPS(1) was $1.02

- Announced the fēnix 7 adventure watches will be worn by crew members on the upcoming Polaris Dawn space mission to help scientists understand how space travel affects the human body

- Named the "Best of the Best" supplier to Embraer, and also received two top supplier awards in the categories of Systems as well as Services & Support

What makes it so hard to compete with $AAPL is the ecosystem, which makes the sum of the products (and services) worth more and more beloved than any individual iPhone or Apple Watch. Garmin may well have a superior product. I don't own one so I don't know. But it's the Apple lovers and their fascination with and love for the Apple ecosystem that I think would be Garmin's undoing in that fight.

Already have an account?